The Pros and Cons of Automated Trading Systems Explained

In the ever-evolving landscape of financial markets, automated trading systems have emerged as a double-edged sword, promising both unprecedented efficiency and inherent risks. As technology continues to reshape how we invest, understanding the complexities of these systems becomes crucial for both seasoned traders and novices alike. Automated trading—often hailed for its ability to execute trades at lightning speed and analyze vast amounts of data—also comes with its share of drawbacks, including the potential for significant losses and market volatility. In this article, we delve into the pros and cons of automated trading systems, providing a comprehensive overview that equips you with the knowledge to navigate this sophisticated realm. Whether you’re considering adopting such a system or merely seeking to enhance your trading acumen, exploring these facets will empower you to make informed decisions in your trading journey.

Table of Contents

- Understanding Automated Trading Systems and Their Functionality

- Benefits of Automated Trading: Maximizing Efficiency and Reducing Emotional Bias

- Challenges and Risks: Navigating the Downsides of Automation

- Best Practices for Implementing an Automated Trading System in Your Strategy

- Final Thoughts

Understanding Automated Trading Systems and Their Functionality

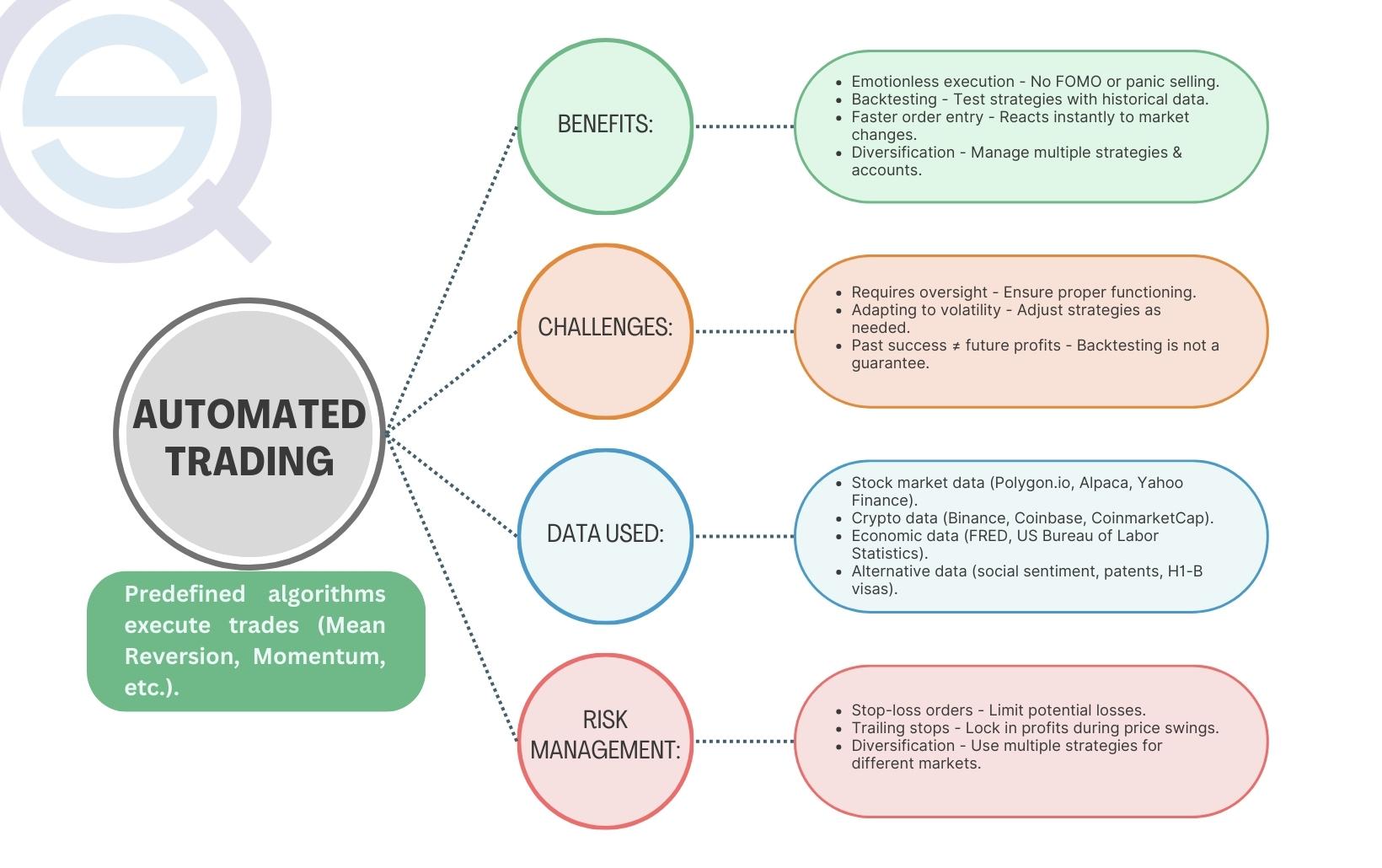

Automated trading systems, often referred to as algorithmic trading or algo-trading, utilize computer algorithms to execute trades in financial markets. These systems are designed to analyze market conditions and make decisions based on pre-defined criteria, such as price movements, volume, and market trends. The primary function of these systems is to enhance trading efficiency and remove emotional bias, allowing traders to capitalize on opportunities swiftly. Key features that characterize these systems include:

- Speed: Automated systems can process vast amounts of data in milliseconds, allowing for rapid decision-making.

- Accuracy: By adhering to set parameters, these systems reduce the likelihood of human errors common in manual trading.

- Backtesting: Traders can simulate strategies against historical data to evaluate potential performance before using real funds.

Moreover, the functionality of these systems can vary widely, tailored to different trading strategies and market conditions. Traders may choose between fully automated solutions and semi-automated ones, where human oversight is still involved. It’s important to understand potential limitations as well, such as:

- Technical Failures: Dependence on technology means that system failures can lead to significant losses.

- Market Conditions: Automated systems may struggle to adapt to unexpected market events, leading to suboptimal trades.

- Over-Optimization: Traders may inadvertently create strategies that work well on historical data but fail in real-time conditions.

Benefits of Automated Trading: Maximizing Efficiency and Reducing Emotional Bias

Automated trading systems present a revolutionary approach to engaging with financial markets, significantly enhancing efficiency for traders. By deploying algorithms to execute trades based on pre-set criteria, these systems can process vast amounts of data at lightning speed, enabling transactions that would take human traders much longer to execute. This rapid response capability allows traders to capitalize on fleeting market opportunities, reducing the risk of missing out on profitable trades. Moreover, automated trading minimizes the necessity of constant market monitoring, freeing up time for traders to focus on strategy development and analysis.

One of the most significant advantages of automated trading is its ability to eliminate emotional bias, a common challenge in trading. Emotional decision-making often leads to impulsive trades driven by fear or greed, which can jeopardize trading success. With a systematic approach dictated by algorithms, traders can stick to their defined strategies without the influence of emotional reactions. This leads to more disciplined risk management and consistent performance. The following points outline how automated trading systems can help mitigate emotional biases:

- Consistency: Trades are executed based on logic rather than emotion.

- Pre-Defined Strategies: Strategies are defined in advance, allowing for better adherence to trading plans.

- Statistics Over Sentiment: Decisions are made based on data, minimizing subjective interpretations.

Challenges and Risks: Navigating the Downsides of Automation

While automated trading systems offer significant advantages, they also present notable challenges and risks that traders must navigate carefully. One of the primary concerns is systemic risk; as algorithms operate based on certain pre-set conditions, they may react similarly in volatile markets, potentially exacerbating market downturns. The flash crash of 2010 serves as a prime example, where automated trading led to a rapid decline in stock prices. This phenomenon raises questions about the stability of financial markets influenced by machines that may lack the nuanced understanding of human traders.

Additionally, traders may experience technical vulnerabilities. Automated systems can face issues like software bugs, connectivity problems, or failures in market data feeds. Such malfunctions can lead to unintended trades or the complete halt of trading strategies, resulting in significant financial losses. Furthermore, an over-reliance on algorithms may result in a lack of market insight, with traders becoming less engaged in understanding market dynamics. This disconnection can hinder their ability to respond effectively in situations where human judgment is essential.

Best Practices for Implementing an Automated Trading System in Your Strategy

Implementing an automated trading system into your investment strategy requires a careful blend of technical know-how and strategic planning. To begin with, it’s crucial to define clear trading objectives. This will not only help in selecting the right algorithms but also in setting the appropriate risk management parameters. Integrating your trading system with a secure and reliable broker is essential, as it ensures efficient trade execution. Additionally, testing your system in a simulated environment can help identify potential shortcomings before deploying it in the live market. Key considerations include:

- Choose Reliable Software: Ensure that the platform you select is trusted and offers adequate support.

- Risk Management Tools: Implement strict limits to protect your capital.

- Regular Performance Review: Continuously analyze the system’s performance metrics to make necessary adjustments.

Moreover, embracing a modular approach when developing or selecting your trading system can enhance flexibility and adaptability to market changes. For instance, focusing on individual components such as market analysis, signal generation, and execution makes it easier to upgrade specific segments without overhauling the entire system. Collaborating with experienced developers and market analysts can also provide invaluable insights into optimizing your trading strategy. Consider this table summarizing the essential components of an effective automated trading system:

| Component | Description |

|---|---|

| Market Analysis | Utilizes indicators to assess market conditions. |

| Signal Generation | Creates actionable trading signals based on analysis. |

| Execution | Automates the placing of trades on your behalf. |

| Risk Management | Protects against major losses through various techniques. |

Final Thoughts

As we’ve explored in this analysis of automated trading systems, the landscape of trading is continually evolving, presenting both exciting opportunities and notable challenges. On one hand, automated systems offer the promise of efficiency, speed, and the potential for reduced emotional bias. These advantages can lead to improved market timing and higher returns if utilized correctly. On the other hand, the reliance on technology brings with it risks such as system malfunctions, over-optimization, and a lack of understanding of market dynamics that can result in significant losses.

Ultimately, whether you choose to embrace automated trading systems or prefer a more hands-on approach, it’s essential to fully understand both sides of the equation. For those considering automation, thorough research, proper risk management, and continuous learning are vital components for success. By weighing the pros and cons carefully, you can make informed decisions that align with your trading goals and preferences.

As technology continues to advance, staying informed and adaptable will be key in navigating the complexities of trading in this digital age. Whether you are a seasoned trader or just starting, let the insights gained from this exploration guide your journey in the dynamic world of trading. Thank you for reading, and may your trading endeavors be fruitful and informed!