Mastering Fibonacci Retracement: A Trader’s Essential Guide

Introduction:

In the ever-evolving landscape of financial markets, traders are continuously on the hunt for reliable tools and strategies that can offer insights into price behavior and potential reversals. Among these, Fibonacci retracement stands out as a powerful and respected technique, rooted in mathematical principles that have been used for centuries. This guide is designed to demystify the intricacies of Fibonacci retracement, providing both novice and seasoned traders with the knowledge needed to integrate this essential tool into their trading arsenal. We will explore the foundational concepts underlying Fibonacci ratios, how to effectively draw and use retracement levels, and the common pitfalls that can undermine your effectiveness. Whether you are looking to enhance your market analyses or improve your risk management strategies, mastering Fibonacci retracement could very well be the key to unlocking more consistent results. Join us on this journey as we equip you with the strategies and insights necessary to navigate the complexities of trading with confidence and precision.

Table of Contents

- Understanding the Fibonacci Sequence and Its Application in Trading

- Identifying Key Fibonacci Levels for Effective Market Analysis

- Practical Strategies for Integrating Fibonacci Retracement in Your Trading Plan

- Common Mistakes to Avoid When Using Fibonacci Tools in Trading

- The Conclusion

Understanding the Fibonacci Sequence and Its Application in Trading

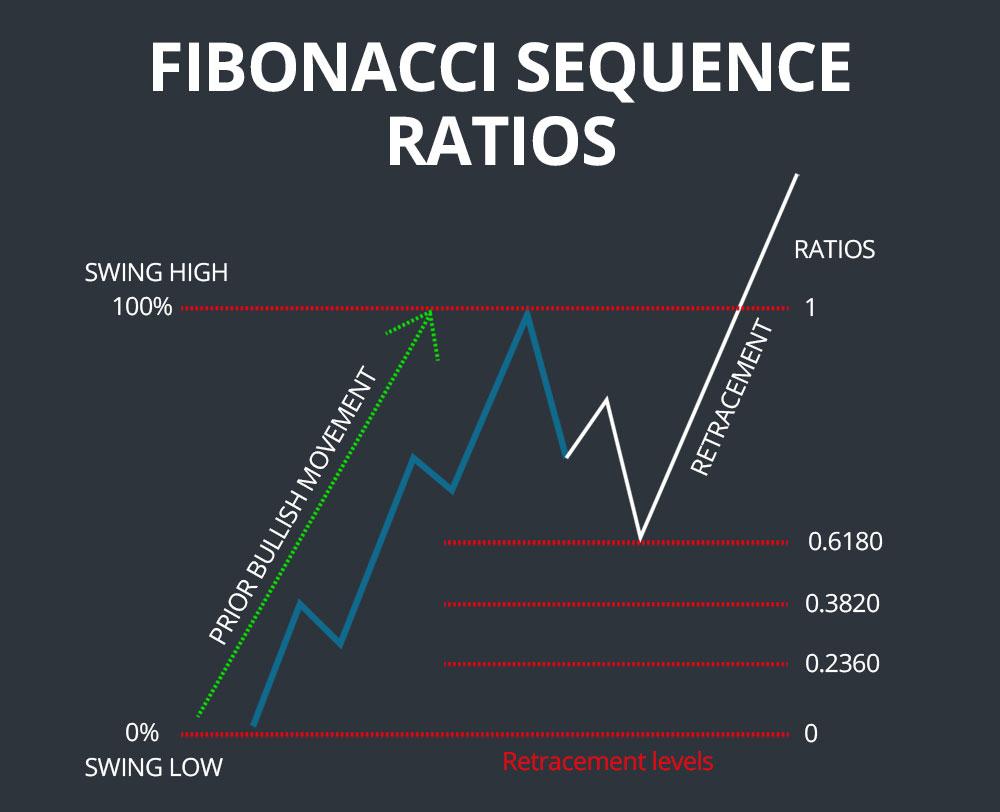

The Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones, has captivated mathematicians and traders alike. Originating from the Italian mathematician Leonardo of Pisa in the 13th century, this intriguing sequence can be represented as: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34…. The significance of Fibonacci in trading lies in its ratios—primarily 23.6%, 38.2%, 50%, 61.8%, and 100%. These levels are derived from the Fibonacci sequence and are believed to identify potential points of reversal in the market, forming the cornerstone of Fibonacci retracement analysis.

Traders utilize these retracement levels to predict retracement in trending markets, offering an edge in identifying actionable trading opportunities. When a price retraces towards these Fibonacci levels, it signals potential zones of support or resistance, providing traders with critical insights. Key applications include:

- Entry and exit points: Determining strategic entry and exit points based on market retracement.

- Stop-loss placements: Setting stop-loss orders just beyond the identified Fibonacci levels to manage risk effectively.

- Trend confirmation: Confirming ongoing trends as prices respect Fibonacci levels, reinforcing the trader’s strategy.

Identifying Key Fibonacci Levels for Effective Market Analysis

To effectively leverage Fibonacci retracement levels in your market analysis, it’s crucial to first identify the significant swing high and swing low points on the price chart. These pivotal points will serve as a foundation upon which the key Fibonacci levels will be calculated. Once established, apply the Fibonacci retracement tool and observe the following essential levels, which typically serve as potential support and resistance:

- 23.6% – Often considered a shallow retracement, indicating potential continuation of the trend.

- 38.2% – This level is frequently watched by traders for possible reversal points.

- 50.0% – Though not a Fibonacci number, it tends to act as a significant psychological level.

- 61.8% – Known as the “Golden Ratio,” this level is a key focus for many traders.

- 78.6% – Penultimate in importance, often indicating the last push before a trend reversal occurs.

After pinpointing these levels, it’s essential to validate them with other technical indicators. Consider the integration of moving averages, trend lines, or momentum oscillators, as these can provide confirmation for potential breakouts or reversals at the Fibonacci levels. Additionally, it’s common to monitor multiple time frames to ensure a comprehensive view, as key levels may vary significantly between them. The following table summarizes the combination of Fibonacci levels with complementary indicators:

| Fibonacci Level | Complementary Indicator | Potential Market Action |

|---|---|---|

| 23.6% | 50-Day Moving Average | Trend Continuation |

| 38.2% | Relative Strength Index (RSI) | Reversal Signal |

| 61.8% | Volume Support | Confirmation of Reversal |

Practical Strategies for Integrating Fibonacci Retracement in Your Trading Plan

Integrating Fibonacci retracement into your trading plan requires a systematic approach. First, ensure that you are familiar with the key Fibonacci levels, especially the 23.6%, 38.2%, 50%, 61.8%, and 100%. Utilize these levels to identify potential reversal points in trends. To make the most of this tool, consider implementing the following strategies:

- Use multiple time frames: Analyze Fibonacci retracement levels across different time frames to confirm significant levels of support or resistance.

- Combine with other indicators: Enhance the reliability of your analysis by using Fibonacci levels in conjunction with other technical indicators such as moving averages or RSI.

- Establish clear entry and exit points: Set your trade entries near the retracement levels and define stop-loss orders just beyond these levels to manage risk effectively.

To visualize Fibonacci retracement levels in a more structured manner, consider using a table to map out potential trades based on these levels:

| Fibonacci Level | Potential Action | Comments |

|---|---|---|

| 23.6% | Entry | Possible price reversal; confirm with other indicators. |

| 38.2% | Monitor | Watch for bullish or bearish signals. |

| 61.8% | Exit/Take Profit | Strong level; assess market conditions before exiting. |

Common Mistakes to Avoid When Using Fibonacci Tools in Trading

When utilizing Fibonacci tools in trading, several common pitfalls can derail your analysis and lead to costly mistakes. One frequent error is the misalignment of your Fibonacci levels. Traders often set their retracement or extension levels incorrectly, either by misplacing the starting point or measuring the wrong swing high and low. It is crucial to ensure that you are using the correct anchor points—without accurate levels, your trades may be based on faulty data, leading to misguided decisions. Additionally, be wary of placing too much emphasis on Fibonacci levels without considering other indicators or market context. Using these tools in isolation can provide a false sense of security.

Another mistake is failing to adapt to changing market conditions. Fibonacci levels can be dynamic, and what worked in one trend may not apply in another. It’s important to remain flexible and observant. Incorporating other technical analysis tools, such as moving averages or momentum indicators, can create a more rounded strategy and enhance the effectiveness of your Fibonacci analysis. keeping a trading journal to track your trades and review your decisions in relation to Fibonacci levels can provide valuable insight and help you avoid repeating past errors. With practice, you will refine your ability to interpret and apply Fibonacci tools in your trading strategy more effectively.

The Conclusion

mastering Fibonacci retracement is an essential skill for any trader aspiring to navigate the complexities of financial markets effectively. By understanding the foundational concepts and applying the Fibonacci tool judiciously, traders can gain valuable insights into potential support and resistance levels, thereby enhancing their decision-making process.

Remember, while Fibonacci retracement can offer a window into market psychology and price movements, it is not a standalone solution. Always use it in conjunction with other technical analysis tools and risk management strategies to cultivate a holistic trading approach. As you continue to refine your skills and expand your knowledge, let the Fibonacci levels guide your strategies, but never lose sight of the broader market dynamics.

Thank you for joining us on this journey into the world of Fibonacci retracement. We hope this guide serves as a valuable resource in your trading toolkit. Here’s to informed trading and successful strategies ahead!