Latest Developments in the NFT Market: October 2023 Updates

As the digital landscape continues to evolve, the Non-Fungible Token (NFT) market remains at the forefront of innovation and investment. In October 2023, we observe significant shifts and emerging trends that are reshaping the NFT ecosystem. From heightened regulatory scrutiny to advancements in technology that enhance user experience, the current environment presents both challenges and opportunities for creators, investors, and collectors alike. This article delves into the most recent developments, providing a comprehensive overview of the factors impacting the NFT market today, including evolving marketplace dynamics, shifts in consumer sentiment, and key collaborations that are setting the stage for the future of digital ownership. Join us as we explore the latest insights and analyses that are defining the NFT landscape this month.

Table of Contents

- Current Trends Shaping the NFT Market Landscape in October 2023

- Key Player Innovations and Collaborations Driving NFT Adoption

- Investment Strategies for Navigating the Evolving NFT Ecosystem

- Regulatory Changes Impacting NFT Transactions and Ownership Rights

- Wrapping Up

Current Trends Shaping the NFT Market Landscape in October 2023

As of October 2023, the NFT market is witnessing significant shifts, largely influenced by advancements in technology and evolving consumer behaviors. One of the most notable trends is the growing integration of utility-based NFTs which offer more than just digital ownership. These tokens are being used to unlock exclusive content, access real-world events, and even grant governance rights within decentralized platforms, highlighting a move beyond mere collectibles. Major brands are beginning to recognize this potential, leading to an increased variety of offerings that appeal to a wider audience, thus expanding the market’s reach.

Another trend reshaping the landscape is the rise of cross-chain compatibility, allowing NFTs to be bought, sold, and traded across different blockchain networks. This is expected to enhance liquidity, making it easier for users to navigate various marketplaces. Moreover, the introduction of sustainable practices within the NFT space is gaining traction, with platforms pledging to minimize environmental impact through eco-friendly blockchain solutions. As consumer awareness regarding environmental issues grows, this focus on sustainability could play a crucial role in attracting a more conscientious investor demographic.

Key Player Innovations and Collaborations Driving NFT Adoption

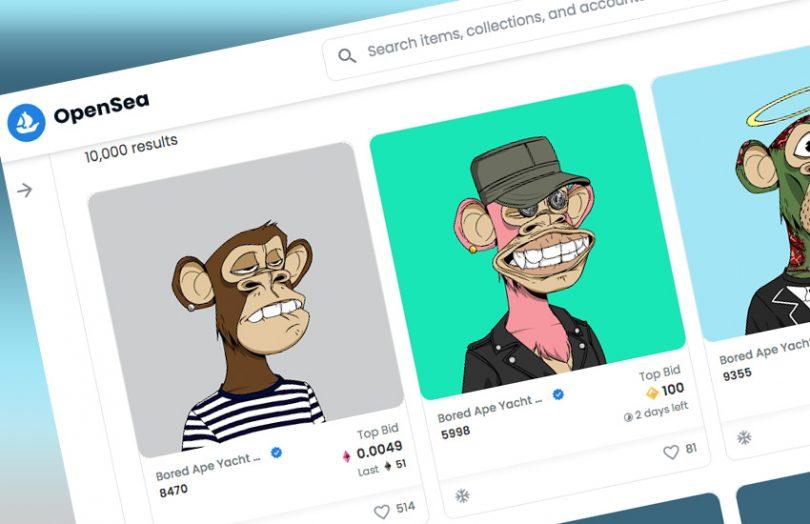

In October 2023, several top players in the NFT space have made significant strides towards enhancing the ecosystem through innovative products and strategic collaborations. Major platforms like OpenSea and Rarible have joined forces to create a shared liquidity pool, making it easier for users to discover and purchase NFTs across both platforms. This collaboration not only boosts accessibility but also helps to unify the marketplace, setting a precedent for future partnerships. Meanwhile, companies like Adobe have integrated NFT minting capabilities directly into their suite, enabling creators to seamlessly produce and sell digital assets, thus democratizing the process of entry into the NFT world.

Furthermore, we are witnessing an influx of brands from diverse sectors embracing NFTs, highlighting their growing versatility. Notable collaborations include:

- Nike teaming up with digital artists to produce exclusive virtual sneakers.

- Ubisoft launching a game that rewards players with unique NFT collectibles.

- Coca-Cola releasing limited edition NFTs tied to special events and promotions.

A recent survey revealed that 63% of brands are planning to invest in NFT technology within the next year, indicating a clear shift towards mainstream adoption. As these key players push boundaries and engage with consumers in innovative ways, the NFT market continues to evolve at a remarkable pace.

Investment Strategies for Navigating the Evolving NFT Ecosystem

As the NFT landscape continues to evolve, investors must adapt their strategies to capitalize on new opportunities while mitigating risks. Acknowledging the shift towards utility-based NFTs, investors should consider focusing on projects that offer real-world applications or unique features that set them apart. This includes supporting creators and platforms that prioritize sustainability, inclusivity, and long-term value rather than mere speculative allure. Additionally, the rise of fractional ownership in NFTs allows for diversification within portfolios, enabling investors to access high-value digital assets with lower capital outlay.

Moreover, as regulatory frameworks begin to take shape, understanding legal implications becomes paramount for navigating the NFT space effectively. Keeping abreast of new compliance requirements will allow investors to make informed decisions and avoid potential pitfalls. Establishing a solid network within the NFT community can also provide critical insights and facilitate collaborations that enhance portfolio performance. To further optimize investment strategies, consider leveraging analytics tools and market research to identify trending sectors within the NFT marketplace:

| Trending NFT Sectors | Description |

|---|---|

| Gaming | Integration of NFTs in gaming for ownership of in-game assets. |

| Art | Digital art collectibles and virtual exhibitions. |

| Music | Unique music experiences and artist royalties through NFTs. |

| Metaverse | Virtual land and assets within immersive digital worlds. |

Regulatory Changes Impacting NFT Transactions and Ownership Rights

The landscape of NFT transactions is undergoing significant regulatory scrutiny, with various jurisdictions introducing frameworks aimed at clarifying ownership rights and transaction protocols. In the United States, discussions within the SEC have intensified regarding the classification of NFTs as securities, which could require platforms to adhere to more stringent compliance measures. This shift is prompting creators and buyers to reassess their understanding of ownership, as essential elements, such as resale rights and licensing agreements, come under the microscope.

Meanwhile, Europe is moving toward a unified approach, with the European Commission proposing comprehensive regulations targeting digital assets, including NFTs. These regulatory changes emphasize consumer protection and transparency in transactions, compelling marketplaces to enhance their verification processes. Some key elements being discussed include:

- Enhanced disclosure requirements for NFT creators and marketplaces.

- Standardized contracts to declare ownership rights and terms of use.

- Consumer rights protections to ensure fair transactions and dispute resolution.

As these regulatory developments unfold, both creators and investors within the NFT space must stay informed to navigate this evolving landscape effectively.

Wrapping Up

the NFT market as of October 2023 showcases a landscape marked by innovation, regulation, and evolving consumer preferences. With major brands and artists continuing to explore the potential of non-fungible tokens, the market is poised for further transformation. Recent trends indicate a growing interest in sustainable practices and community-driven projects, reflecting the changing attitudes of both creators and collectors. As we move forward, staying informed about these developments will be crucial for stakeholders looking to navigate this dynamic space effectively. The NFT market has undoubtedly proven to be a significant player in the broader digital economy, and as we continue to witness advancements and challenges alike, the future remains both promising and unpredictable.