Fundamental vs. Technical Analysis: Choosing the Right Trading Strategy

In the ever-evolving landscape of financial markets, investors and traders are constantly seeking the most effective strategies to maximize their returns. Among the myriad approaches available, fundamental and technical analysis stand out as two of the most widely debated methodologies. While fundamental analysis delves into a company’s intrinsic value through economic indicators, earnings reports, and market conditions, technical analysis focuses on price movements and trading volumes to predict future market behavior. For both novice and seasoned investors, choosing between these two analysis methods can significantly impact success in trading. In this article, we will dissect the core principles of fundamental and technical analysis, evaluate their strengths and weaknesses, and provide guidance on how to select the right strategy based on individual goals and risk tolerance. Whether you’re looking to make informed long-term investments or capitalize on short-term market fluctuations, understanding these approaches is key to navigating the complex world of trading.

Table of Contents

- Understanding the Core Principles of Fundamental Analysis

- Navigating Market Trends Through Technical Analysis

- Combining Fundamental and Technical Approaches for Optimal Trading

- Evaluating Your Trading Style: Which Analysis Best Aligns with Your Goals

- Key Takeaways

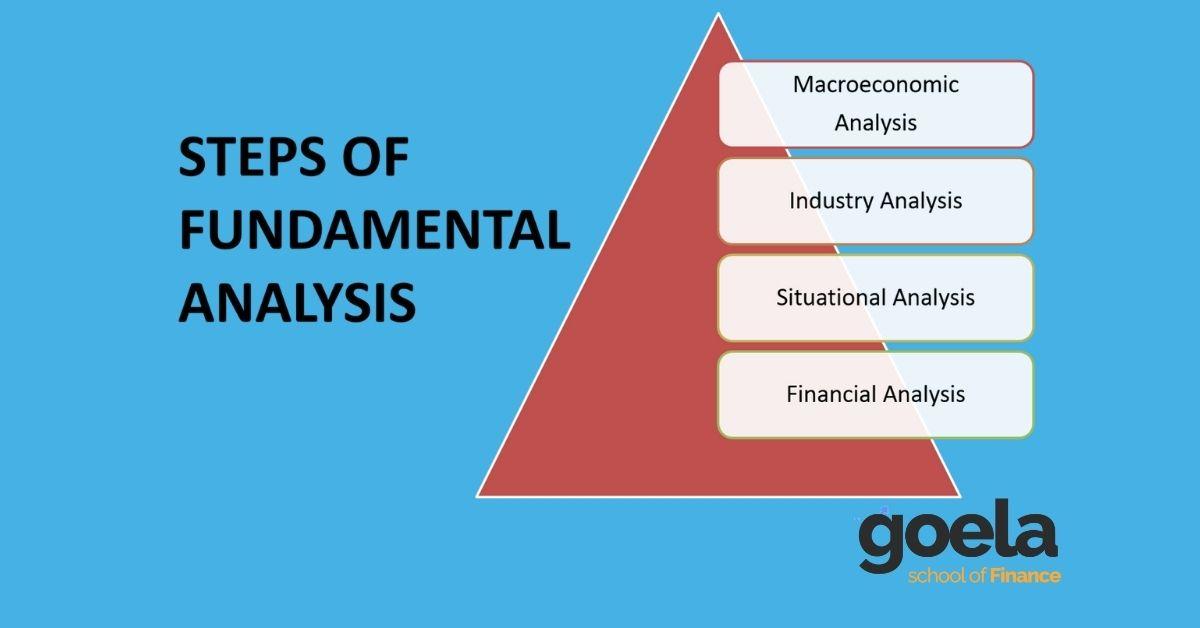

Understanding the Core Principles of Fundamental Analysis

Fundamental analysis serves as a critical approach for investors looking to gauge a security’s intrinsic value by examining various economic and financial factors. This method involves a deep dive into company earnings, revenue, industry conditions, and overall economic indicators. Some key components that analysts often focus on include:

- Financial Statements: These documents, including income statements, balance sheets, and cash flow statements, reveal the company’s financial health.

- Economic Indicators: Data such as GDP growth rates, unemployment figures, and inflation rates can influence market conditions and investment decisions.

- Industry Analysis: Understanding the dynamics of the industry in which a company operates provides context to its performance and potential.

Another critical aspect of fundamental analysis is the assessment of qualitative factors, such as management quality, brand reputation, and competitive positioning within the market. These elements are less tangible but can vastly affect a company’s long-term sustainability and profitability. Investors often rely on a combination of quantitative and qualitative assessments to arrive at a well-rounded valuation. Below is a simplified table to illustrate how these principles might be organized:

| Aspect | Importance |

|---|---|

| Financial Statements | Provides hard data on performance |

| Economic Indicators | Helps forecast market conditions |

| Industry Analysis | Contextualizes company performance |

| Qualitative Factors | Affects long-term viability |

Navigating Market Trends Through Technical Analysis

Utilizing technical analysis enables traders to identify and interpret market trends with precision. By examining historical price movements and utilizing various technical indicators, traders are equipped to make informed decisions about entry and exit points for their trades. Key tools employed in this analysis include:

- Moving Averages: Helps in identifying the direction of the trend.

- Relative Strength Index (RSI): Indicates overbought or oversold conditions.

- Bollinger Bands: Measures market volatility and price levels.

Understanding these tools allows traders to gauge market sentiment and make calculated moves. For instance, a trader might observe a bullish trend through a series of higher highs and higher lows, reinforced by an RSI reading below 30 suggesting potential growth. Conversely, they might act defensively if the price touches the upper Bollinger Band, signaling possible resistive forces. It’s crucial for traders to remain adaptable and continuously refine their approaches as new patterns and signals emerge.

| Indicator | Purpose | Signal |

|---|---|---|

| Moving Averages | Trend Direction | Crossovers |

| RSI | Market Condition | Above 70 (sell), Below 30 (buy) |

| Bollinger Bands | Volatility | Price Touching Bands |

Combining Fundamental and Technical Approaches for Optimal Trading

For traders seeking a comprehensive strategy, the integration of both fundamental and technical analysis offers a more robust framework. By utilizing fundamental analysis, traders can assess the intrinsic value of an asset, focusing on economic indicators, earnings reports, and industry trends. This approach enables them to make informed decisions based on the broader market context and the long-term viability of their chosen instruments. Meanwhile, technical analysis allows them to examine price movements and market sentiment through charts and indicators, helping to identify timing and entry points for trades. Together, these methodologies provide a balanced perspective, reducing the risk of making decisions based solely on superficial market fluctuations.

Adopting a hybrid trading strategy involves leveraging the strengths of each approach to maximize potential gains. Consider the following key advantages of combining these analyses:

- Improved Decision-Making: Fusing quantitative data with qualitative insights helps to validate trading signals.

- Risk Mitigation: A well-rounded strategy can limit exposure to volatility by aligning fundamental value with technical timing.

- Enhanced Market Understanding: Analyzing economic indicators alongside chart patterns provides a clearer picture of market dynamics.

To illustrate this integrated approach, the table below summarizes potential trade scenarios:

| Scenario | Fundamental Insight | Technical Indicator | Action |

|---|---|---|---|

| Stock A – Earnings Surge | Positive earnings report indicates strong growth. | Breakout above resistance level confirmed. | Buy |

| Currency B – Economic Slowdown | Lower GDP growth forecast negatively impacts the currency. | Bearish trend on the moving average. | Sell |

| Commodity C – Supply Disruption | Planned reduction in supply due to geopolitical issues. | RSI indicates oversold conditions, potential reversal. | Hold |

Evaluating Your Trading Style: Which Analysis Best Aligns with Your Goals

Understanding your trading style is crucial to ensuring you align your strategies with your financial objectives. Each trader has unique goals, time commitments, and risk tolerances, which can influence whether fundamental or technical analysis serves them better. Fundamental analysis digs deep into a company’s performance indicators, such as earnings reports, industry trends, and economic conditions, making it ideal for long-term investors who prefer a holistic approach. On the other hand, technical analysis focuses on price movements and chart patterns, catering to those who seek to capitalize on short-term fluctuations and make quick trades based on market sentiment. Assessing your trading aims can help you pick the right analysis method to maximize your potential for profit.

Another aspect to consider is the time frame in which you plan to operate. For instance, if you are inclined to hold positions over several months or years, fundamental analysis can provide insights into the sustainability of an investment. Conversely, if you prefer a more hands-on approach with daily or weekly trades, mastering technical analysis can equip you with the tools to identify entry and exit points effectively. To help clarify these differences, here’s a summary of key factors:

| Factor | Fundamental Analysis | Technical Analysis |

|---|---|---|

| Time Horizon | Long-term | Short-term |

| Focus | Company metrics and economic indicators | Price patterns and market trends |

| Investment Style | Buy and hold | Day trading and swing trading |

| Risk Appetite | Lower risk tolerance | Higher risk tolerance |

Key Takeaways

the choice between fundamental and technical analysis is not just a matter of preference; it is a critical decision that can significantly impact your trading success. Both approaches offer valuable insights, but they cater to different trading styles and goals. Fundamental analysis provides a broader perspective by evaluating economic indicators, company performance, and market conditions, making it ideal for long-term investors. Conversely, technical analysis focuses on price movements and patterns, offering traders the tools to capitalize on short-term market fluctuations.

Ultimately, the best strategy will depend on your personal investment goals, risk tolerance, and trading style. Many successful traders find that a hybrid approach—balancing both fundamental and technical analysis—enhances their understanding of the market and informs better decision-making.

As you navigate your trading journey, take the time to explore both methodologies. Experiment with each approach, adapt your strategy as needed, and stay informed about market trends and developments. With diligence and practice, you can forge a trading strategy that aligns with your unique vision and objectives, leading you toward greater success in the markets. Happy trading!