What Hope Does May Hold For Bitcoin (BTC) Price?

In this article, BeInCrypto shares experts’ Bitcoin (BTC) price forecast for May 2023 and what obstacles the cryptocurrency may face this month

Bitcoin Price Forecast: Expert Opinions

Independent financial expert Alexander Ryabinin believes that “May for Bitcoin, like April, will be difficult and interesting.” In his opinion, the main task on the path of Bitcoin (BTC) will be to maintain the level of $30,000.

The Bitcoin forecast for May from our expert includes two scenarios:

Also, Dmitry Noskov, an expert at StormGain crypto exchange, presented his Bitcoin forecast for May 2023. In his opinion, the road is open for BTC to retake the $30,000 level, with the prospect of its further breakthrough against the backdrop of the market preparing for the upcoming halving of 2024.

At the same time, our expert noted that the coin is under pressure from American regulators. According to Noskov, crypto crackdowns from regulatory authorities can surely become the main obstacle for BTC to trade above $30,000 in May 2023.

Alexey Busov, an entrepreneur and co-founder of the Cryptobaron community, gave May’s most positive Bitcoin forecast.

“In May, Bitcoin’s price will definitely continue to rise and, possibly, reach $35,000-$36,000. This is beneficial primarily for market makers who buy at low values and sell at the peak. A fall in Bitcoin price in the next two to three weeks is not expected: it is important for large players to bring new participants to the market. That was the reason for the sharp increase from $17,000 to $30,000.”

However, Busov believes that another collapse could await the crypto market at the beginning of summer.

Bitcoin Forecast With an Eye on Halving and History

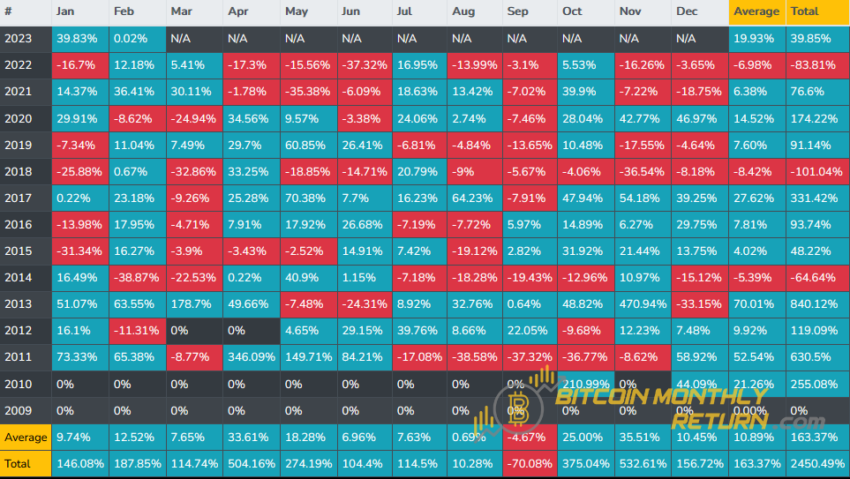

Traditionally, May is not the best month for Bitcoin. Statistics show that since 2011, Bitcoin performs poorly compare to other months.

At the same time, the forecast of the Bitcoin price for May, with an eye to the theory of cyclicity, indicates the growth potential of the coin.

In the cycle after the 2020 halving (green curve), BTC largely followed a similar pattern to the 2016 halving (blue curve). If the cryptocurrency continues to move along the trajectory of the previous cycle, the coin will be able to create a local top.

Crypto Crackdown

The prospects for cryptocurrency largely depend on the actions of American financial regulators. According to Bloomberg, as part of the fight against inflation, the Federal Reserve (Fed) intends to continue raising the key interest rate, despite the growing pressure on the economy.

Against the backdrop of a long rate increase, the U.S. banking system has experienced a series of bankruptcies. Over the weekend, First Republic Bank became the latest victim of the U.S. banking crises.

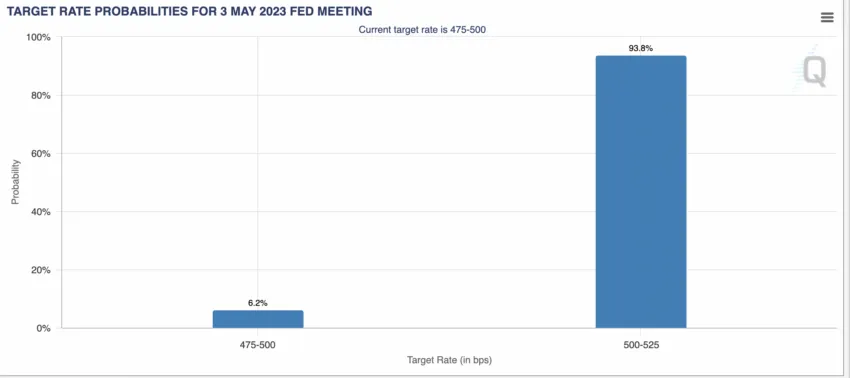

The next meeting of the regulator is scheduled for May 3. Based on its results, the Federal Open Market Committee of the US Federal Reserve (FOMC) will announce the next decision on the key interest rate.

At the time of writing, over 90% of market participants are anticipating a 0.25 basis points rate hike in early May. Increasing pressure on the traditional financial market could negatively affect BTC.

In parallel, the Fed continues to increase the size of its balance sheet. The crypto market is growing as quantitative easing, or money printing, increases.

The March series of bankruptcies in the banking system led to a temporary increase in the balance sheet. BeInCrypto reported that the Fed injected over $300 million to rescue the banking system.

Against the backdrop of the Fed turning on its “printing press,” BTC broke through the $30,000 level.

Bitcoin’s forecast for May largely depends on whether the collapse of First Republic Bank will be the reason for another increase in the Fed’s balance sheet and whether there is a risk of new bankruptcies in the financial market.

Results: Bitcoin forecast for May 2023

Experts interviewed by the editors of BeInCrypto give a moderately optimistic Bitcoin forecast for May 2023. The crypto market is under pressure from the Fed. In particular, we are talking about the key interest rate. The next decision on the metric will be announced on May 3.

The increase in the Fed’s interest rates and the protracted struggle of regulators with inflation put pressure on BTC. Therefore, the possibilities for further growth of the cryptocurrency are limited.

The history of BTC behavior allows us to give a positive forecast for Bitcoin for May 2023. During this period, four years ago – after the 2016 halving – the cryptocurrency was moving towards updating the local maximum.

At the same time, it is important to note that the market situation is different from the previous cycles for the worse. Therefore, it is possible that Bitcoin may spend May 2023 struggling to make further headway.

Got something to say about this article or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content.

Comments are closed.