Transitioning from Centralized to Decentralized Cryptocurrency Exchanges

Title: : Navigating the Future of Digital Trading

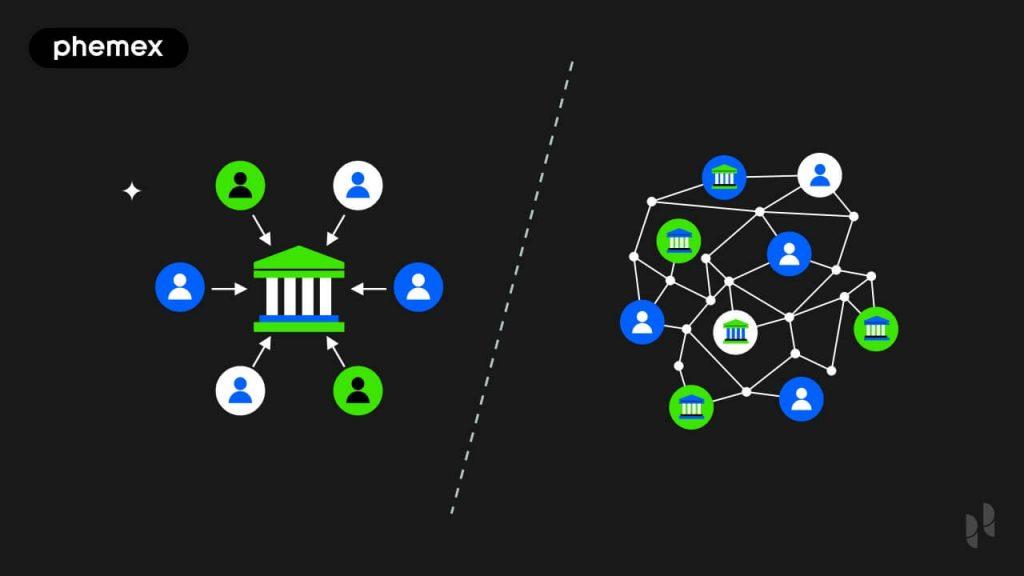

In the rapidly evolving landscape of cryptocurrency trading, the shift from centralized to decentralized exchanges represents a pivotal transformation that is reshaping the entire financial ecosystem. As traditional finance grapples with increasing regulatory pressures and evolving consumer demands, centralized exchanges have come under scrutiny for their inherent vulnerabilities, including potential security breaches, lack of user control over assets, and centralized points of failure. In contrast, decentralized exchanges (DEXs) offer a transformative approach, leveraging blockchain technology to enhance security, transparency, and user sovereignty.

This article delves into the intricacies of this paradigm shift, examining the technological, regulatory, and economic factors driving the migration towards decentralized frameworks. It will provide a comprehensive analysis of the operational mechanics of DEXs, the challenges faced during the transition, and the impact on market dynamics and user behavior. By exploring both the advantages and pitfalls of this transition, we aim to equip stakeholders with the knowledge required to navigate this uncharted territory and harness the full potential of decentralized trading ecosystems. As we stand on the cusp of this new era, it is imperative to understand not only the innovations that DEXs bring but also the implications they hold for the future of cryptocurrency and financial independence.

Table of Contents

- Understanding the Advantages of Decentralized Exchanges Over Centralized Models

- Key Technical Considerations for Successful Migration to Decentralized Platforms

- Mitigating Risks: Security Measures and Compliance in Decentralized Exchange Operations

- Enhancing User Experience: Strategies for Seamless Transition and Adoption

- In Conclusion

Understanding the Advantages of Decentralized Exchanges Over Centralized Models

Decentralized exchanges (DEXs) have gained prominence as a robust alternative to their centralized counterparts. One of the key advantages of this model is enhanced security. In DEXs, users retain control of their private keys, minimizing the risk of hacking incidents that have plagued centralized exchanges, where user funds are often stored in a single location. Furthermore, the implementation of blockchain technology ensures that all transactions are transparent and verifiable, significantly reducing the likelihood of fraud. This trustless environment encourages participation from users who prioritize privacy and security.

Another noteworthy benefit of decentralized exchanges is increased accessibility. Unlike centralized platforms that often require rigorous verification processes, DEXs allow users to trade directly from their wallets without the need for a middleman. This opens up opportunities for individuals who may be excluded from traditional financial systems. Additionally, DEXs operate across global jurisdictions, making them less susceptible to regulatory restrictions. The absence of centralized control means that users can access a wider variety of tokens and trading pairs, further enhancing their trading experience.

Key Technical Considerations for Successful Migration to Decentralized Platforms

Successful migration to decentralized platforms requires a comprehensive understanding of several key technical aspects. Smart contracts are foundational in ensuring that transactions occur seamlessly without the need for intermediaries. It is critical to meticulously audit these contracts to avoid vulnerabilities that could lead to exploits. Additionally, blockchain interoperability plays a significant role, as the ability to communicate across different blockchain networks can enhance liquidity and broaden user access, thus attracting a more diverse user base.

Another important consideration is the user experience (UX). A smooth onboarding process is essential to minimize friction for new users. Ensuring easy access to private keys, offering intuitive wallet integrations, and providing clear instructions for trading activities can greatly influence user retention rates. Furthermore, scalability must be addressed to handle increased transaction volumes without compromising performance. The selection of appropriate consensus mechanisms, such as Proof of Stake or Layer 2 solutions, can significantly impact the platform’s overall speed and efficiency.

Mitigating Risks: Security Measures and Compliance in Decentralized Exchange Operations

In the shift from centralized to decentralized exchanges, security and compliance remain paramount to protect users and sustain operational integrity. Multi-signature wallets significantly enhance security by requiring multiple approvals for transactions, thereby reducing the risk of unauthorized access. Additionally, smart contract audits conducted by third-party firms can identify vulnerabilities in the code before deployment, ensuring secure transaction execution. Establishing clear communication channels between users and developers can also facilitate swift reporting and resolution of any security incidents, fostering a transparent environment.

Alongside robust security measures, adherence to regulatory standards is critical in maintaining user trust and operational viability. Decentralized exchanges should prioritize Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance to align with legal frameworks without compromising the user’s pseudonymous nature. Implementing automated compliance solutions can streamline these processes, allowing for efficient user verification while minimizing friction. The table below outlines key compliance areas and suggested practices for decentralized exchanges:

| Compliance Area | Recommended Practice |

|---|---|

| Transaction Monitoring | Real-time analytics to flag suspicious activities |

| User Verification | Implement KYC procedures using third-party services |

| Data Protection | Ensure GDPR compliance for user data handling |

Enhancing User Experience: Strategies for Seamless Transition and Adoption

To ensure a smooth transition and enhance user experience during the shift from centralized to decentralized cryptocurrency exchanges, it is vital to implement robust onboarding processes. User education plays a crucial role; providing comprehensive guides, video tutorials, and interactive webinars can empower users with the knowledge they need. Additionally, offering intuitive user interfaces that mirror familiar centralized platforms can reduce the learning curve, making users feel more comfortable navigating the new environment. Consider integrating features such as tooltips and contextual help that offer guidance without overwhelming the user.

Furthermore, seamless wallet integration is essential for encouraging adoption. Users should be able to connect their existing wallets or create new ones without technical hurdles. Implementing multilingual support and region-specific features can cater to a diverse user base, making the platform more inclusive. To track user sentiment and adapt quickly, consider utilizing feedback loops, like surveys and community forums, to gather insights on user experience. Below is a simple table outlining key strategies for enhancing user experience:

| Strategy | Description |

|---|---|

| User Education | Provide guides and tutorials to facilitate learning. |

| Intuitive Interface | Design an interface that is easy to navigate. |

| Wallet Integration | Make wallet connection simple and straightforward. |

| Multilingual Support | Offer multiple languages to reach a broader audience. |

| User Feedback | Implement systems for collecting user insights. |

In Conclusion

the transition from centralized to decentralized cryptocurrency exchanges marks a pivotal evolution in the landscape of digital finance. This shift not only enhances user control and privacy but also mitigates several systemic risks associated with centralized platforms, such as custodial vulnerabilities and liquidity monopolies. As technological advancements continue to proliferate, decentralized exchanges (DEXs) are poised to improve their functionalities—offering better user experiences, enhanced scalability, and increased security.

However, this transition is not without its challenges. Scalability issues, regulatory uncertainties, and liquidity concerns remain significant hurdles that the industry must address. As stakeholders navigate this complex environment, ongoing collaboration among developers, regulators, and investors will be crucial to fostering a robust ecosystem where decentralized exchanges can thrive.

As we move forward, it is imperative for participants in the cryptocurrency space to remain informed and adaptable, recognizing that the future of trading is likely to be a hybrid model that leverages the strengths of both centralized and decentralized platforms. The journey toward a more decentralized financial system is underway, and its success dependency on the collective efforts of the entire cryptocurrency community. Engaging critically with these developments will empower users, drive innovation, and enhance the overall resilience of the digital asset marketplace.