Revolutionizing Finance: Blockchain’s Role in Cross-Border Payments

In an era defined by rapid technological advancements, the financial landscape is undergoing a seismic shift driven by the innovative potential of blockchain technology. As globalization accelerates, businesses and individuals alike are increasingly engaging in cross-border transactions, highlighting the urgent need for a more efficient, secure, and cost-effective payment system. Traditional banking methods often prove cumbersome, laden with high fees and delays that stifle economic growth. Enter blockchain, a decentralized ledger technology that promises to revolutionize the way money moves across borders. By streamlining processes and enhancing transparency, blockchain stands poised to not only transform cross-border payments but also redefine our understanding of international finance. This article delves into the pivotal role blockchain is set to play in reshaping the future of cross-border transactions, examining its benefits, challenges, and the potential implications for global commerce.

Table of Contents

- Transforming Traditional Banking with Blockchain Technology

- Enhancing Security and Reducing Fraud in Cross-Border Transactions

- Expediting Payments and Lowering Costs for Global Trade

- Future Considerations: Regulatory Challenges and Technological Integration

- Insights and Conclusions

Transforming Traditional Banking with Blockchain Technology

Blockchain technology is steadily reshaping the landscape of traditional banking, particularly in the realm of cross-border payments. By decentralizing the transaction verification process, institutions are now able to enhance the security, speed, and cost-effectiveness of their services. This shift not only reduces operational complexities but also minimizes the risk of fraud, which has historically plagued international transactions. Moreover, the transparency inherent in blockchain ensures that every transaction is traceable, fostering trust among financial institutions and their clients.

Furthermore, the implementation of smart contracts within blockchain networks opens up new avenues for automating transactions and agreements, thereby cutting down the need for intermediaries. This leads to a streamlined process which can significantly lower transaction fees and processing times. The following table illustrates the evident advantages of integrating blockchain technology in cross-border payments:

| Advantage | Traditional Banking | Blockchain Technology |

|---|---|---|

| Transaction Speed | 3-5 days | Minutes |

| Transaction Fees | High | Lower |

| Security Level | Moderate | High |

| Transparency | Low | High |

Enhancing Security and Reducing Fraud in Cross-Border Transactions

In the rapidly evolving landscape of financial technology, blockchain emerges as a pivotal solution for enhancing security in cross-border transactions. By leveraging distributed ledger technology, blockchain creates an immutable record of every transaction, significantly reducing the risk of fraud. Each transaction is cryptographically secured and validated by a network of participants, thus eliminating the possibility of unauthorized alterations or double-spending. This enhanced transparency not only establishes trust among participants but also ensures that all parties are aware of the transaction details, fostering a more secure cross-border payment environment.

Furthermore, smart contracts can automate and enforce agreements between parties without the need for intermediaries, minimizing human error and potential malfeasance. By streamlining processes, organizations can experience considerable cost savings while maintaining rigorous security standards. The adoption of blockchain technology can also facilitate real-time settlements, reducing the time in which funds are trapped in transit and mitigating risks associated with currency fluctuations. As financial institutions and businesses invest in blockchain infrastructure, they not only bolster their defenses against fraud but also gain a competitive edge in the global market.

Expediting Payments and Lowering Costs for Global Trade

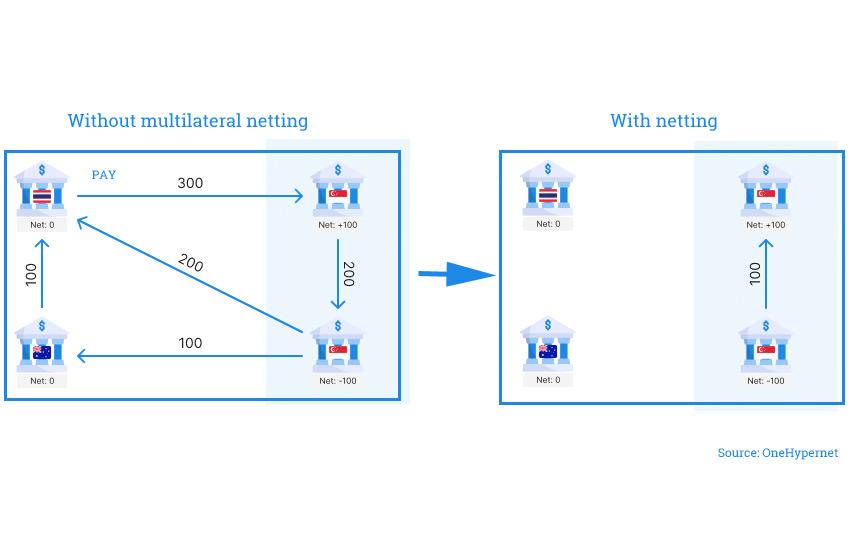

The integration of blockchain technology in global trade has the potential to transform the way businesses handle cross-border payments, providing significant enhancements in speed and efficiency. Traditionally, international transactions are plagued by delays, high fees, and the involvement of multiple intermediaries, often leading to extended processing times and increased costs. By leveraging blockchain’s decentralized ledger system, companies can facilitate near-instant payment settlements, effectively eliminating the bottlenecks associated with traditional banking systems. This innovation not only expedites payments but also offers heightened transparency, as all transactions are recorded on an immutable ledger accessible to all parties involved.

Furthermore, the reduction in transaction costs represents a critical advantage for organizations engaged in global trade. Because blockchain minimizes the need for intermediaries, businesses can benefit from lower fees typically associated with currency conversion and other cross-border transfer charges. The direct peer-to-peer payment capability offered by blockchain further reduces costs, allowing companies to divert resources previously allocated to transaction fees towards growth and innovation. These savings can ultimately enhance competitive positioning in the global market, making it essential for businesses to adopt blockchain solutions to remain viable in an evolving financial landscape.

Future Considerations: Regulatory Challenges and Technological Integration

The integration of blockchain technology in cross-border payments not only promises to enhance efficiency but also poses considerable regulatory challenges. Regulatory bodies worldwide face the task of understanding and governing a system that operates independently of traditional financial institutions. Some of the key challenges include:

- Compliance with AML/KYC Regulations: Ensuring that blockchain solutions comply with anti-money laundering and know-your-customer requirements is crucial, as these are fundamental to maintaining financial integrity.

- Jurisdictional Conflicts: The global nature of blockchain transactions creates complexity in identifying which country’s laws apply, often leading to gaps in enforcement.

- Consumer Protection: As blockchain’s user base expands, regulators must consider how to protect consumers against fraud and errors in a decentralized environment.

Furthermore, the technological integration of blockchain into existing financial systems requires significant groundwork. Financial institutions need to invest in research and development to create compatibility between traditional systems and emerging technologies. They also face the dual challenge of:

- Interoperability: Creating a seamless connection between different blockchains and conventional payment systems is essential for widespread adoption.

- Scalability Issues: As transaction volumes increase, ensuring that blockchain networks can handle high throughput without compromising speed or security remains a priority.

| Aspect | Challenge | Potential Solution |

|---|---|---|

| Regulatory Compliance | Aligning blockchain with AML/KYC | Development of standardized protocols |

| Consumer Protection | Fraud and error management | Implementation of robust smart contracts |

| Technological Integration | Ensuring interoperability | Collaboration between tech innovators and banks |

Insights and Conclusions

As we stand on the brink of a financial revolution, the implications of blockchain technology in cross-border payments cannot be overstated. This transformative innovation is not just a fleeting trend; it is a profound change that promises to enhance efficiency, reduce costs, and foster greater financial inclusion across the globe. Institutions, governments, and individuals alike must adapt to this paradigm shift, embracing the opportunities it brings while remaining vigilant to the challenges ahead. As the landscape of global finance continues to evolve, those who harness the power of blockchain will not only keep pace but thrive in an interconnected world. The future of finance is here, and it is time to embrace the possibilities that lie within.