Mastering Trading Psychology: Keys to a Winning Mindset

In the tumultuous world of trading, where market fluctuations can turn fortunes on a dime, the pivotal role of mindset often goes overlooked. While technical analysis and market research are vital components of a successful trading strategy, it’s the psychological aspect that frequently determines a trader’s long-term success or failure. The discipline of trading psychology delves into the nuances of emotional control, decision-making, and mental resilience. In this article, we will explore the essential principles of mastering trading psychology—the keys to cultivating a winning mindset. By understanding the psychological barriers that can hinder performance and developing strategies to overcome them, traders can enhance their ability to navigate the complex landscape of financial markets with confidence and clarity. Join us as we uncover the mental tools necessary to not only survive but thrive in the high-stakes arena of trading.

Table of Contents

- Understanding the Emotional Landscape of Trading

- Cultivating Discipline: The Backbone of Consistent Success

- Developing Resilience: Overcoming Setbacks with Confidence

- Implementing Mindfulness Techniques to Enhance Decision Making

- In Conclusion

Understanding the Emotional Landscape of Trading

The world of trading is not solely defined by charts and numbers; it is deeply intertwined with human emotions. Traders often navigate a turbulent sea of feelings, ranging from the exhilaration of a successful trade to the despair following a loss. Understanding these emotional shifts is crucial for maintaining focus and discipline. Some of the most common emotions experienced during trading include:

- Fear: Fear of losing money can lead to hasty decisions, often resulting in panic selling.

- Greed: An insatiable desire to maximize profits may cloud judgment and foster overtrading.

- Hope: Holding onto losing positions with the hope they will turn around can be detrimental to a trader’s portfolio.

- Frustration: A string of losses can invalidate a trader’s strategy, leading to impulsive, emotional trades.

Moreover, psychology plays a significant role in how trading strategies are executed and adjusted over time. Each trader must develop a keen self-awareness to recognize their emotional triggers and biases. Maintaining a trading journal can be particularly beneficial, allowing individuals to document their emotional state during trades and reflect on their decision-making processes. An effective approach to mastering trading psychology often includes:

- Routine Practice: Establishing a consistent routine helps to normalize emotional responses.

- Mindfulness Techniques: Practicing mindfulness can enhance emotional regulation and decision-making clarity.

- Setting Realistic Goals: Realistic expectations can mitigate feelings of disappointment and reduce emotional volatility.

Cultivating Discipline: The Backbone of Consistent Success

Discipline is the secret ingredient that transforms sporadic efforts into reliable achievements. In trading, where emotions can sway decisions in an instant, committing to disciplined practices can set traders apart in a highly competitive arena. By establishing clear rules and adhering to them—regardless of market fluctuation—traders create a stable environment that fosters sound decision-making. Incorporating structured routines can help mitigate impulsive behaviors, allowing you to stay aligned with your long-term goals.

To cultivate discipline, consider implementing the following strategies:

- Develop a Trading Plan: Outline your trading strategy, including entry and exit points, risk management, and profitability goals.

- Set Daily Goals: Establish achievable objectives that keep you focused and motivated each day.

- Journal Your Trades: Maintain a record of your trades to analyze success and failure, reinforcing your learning process.

- Limit Screen Time: Avoid becoming overwhelmed by market noise. Set designated times for market observation.

Moreover, embracing a resilient mindset is crucial for fostering discipline. Successful traders view setbacks not as failures but as opportunities for growth. Understanding that losses are an inherent part of trading helps in maintaining composure. By practicing mental fortitude through visualization techniques and mindfulness exercises, you can strengthen your resolve. The following table summarizes common psychological pitfalls and associated counter-strategies that can reinforce mental discipline:

| Psychological Pitfall | Counter-Strategy |

|---|---|

| Fear of Missing Out (FOMO) | Stick to your strategy; remind yourself of your trading plan. |

| Overconfidence | Focus on maintaining a disciplined approach to avoid reckless trades. |

| Loss Aversion | Accept losses as part of trading and maintain a long-term perspective. |

Developing Resilience: Overcoming Setbacks with Confidence

Resilience is a trait that every trader must cultivate, particularly when faced with losses or market volatility. Learning to process setbacks constructively allows traders to analyze their experiences, identify lessons learned, and apply those insights to future trades. The key is to maintain a positive mindset by acknowledging failures as opportunities for growth. By reframing setbacks, traders can enhance their ability to bounce back, ensuring that each obstacle serves as a stepping stone rather than a stumbling block. To foster resilience, consider implementing strategies such as:

- Reflecting on Past Experiences: Analyze previous trades that didn’t go as planned to understand what went wrong and how to improve next time.

- Setting Realistic Goals: Avoid placing excessive pressure on yourself by setting achievable, incremental objectives.

- Practicing Mindfulness: Engage in meditation or deep-breathing exercises to stay centered and focused, reducing anxiety related to trading decisions.

Developing a resilient mindset is also about building a supportive environment where you can thrive. Surround yourself with like-minded individuals who share the same passion for trading and understand the challenges involved. Connecting with a community can provide encouragement and foster accountability. Moreover, consider maintaining a trading journal to document your emotional responses to different scenarios. Here’s a simple table to illustrate the benefits of journaling:

| Benefits of Trading Journals | Description |

|---|---|

| Self-Reflection | Helps identify recurring mistakes and emotional triggers. |

| Trend Analysis | Tracks performance over time for better decision-making. |

| Emotional Management | Encourages emotional awareness, leading to improved resilience. |

Implementing Mindfulness Techniques to Enhance Decision Making

In the fast-paced world of trading, the ability to pause and reflect can be your greatest asset. By incorporating mindfulness practices into your daily routine, you can cultivate a state of mental clarity that is essential for effective decision-making. Start with short meditation sessions or breathing exercises that help ground you before engaging in trading activities. Even a few moments of focused breathing can significantly reduce anxiety, allowing you to assess market conditions with a clear mind. Consider setting a designated time for these practices, and keep in mind the benefits of being present in the moment:

- Improved Emotional Regulation: Mindfulness helps in recognizing feelings of fear or greed without being overwhelmed by them.

- Enhanced Focus: Sustained attention on the task at hand prevents distractions that could lead to hasty decisions.

- Increased Self-Awareness: Mindful practices encourage traders to be aware of their thought patterns and biases, fostering better decision-making.

Furthermore, integrating mindfulness into your trading strategy can also allow you to clearly identify trading patterns and signals without the clutter of stress or impulsive reactions. One effective technique is the practice of journaling, where you document not only your trades but your thoughts and emotions before and after each decision. This reflective process not only helps in learning from past experiences but creates a roadmap for improved decision-making. Here’s a simple structure to consider for your trading journal:

| Journal Entry Components | Description |

|---|---|

| Date | Record the date of the trade. |

| Market Conditions | Briefly describe the market environment. |

| Thoughts/Feelings | Note down your emotions before and after the trade. |

| Outcome | Reflect on the results and any lessons learned. |

In Conclusion

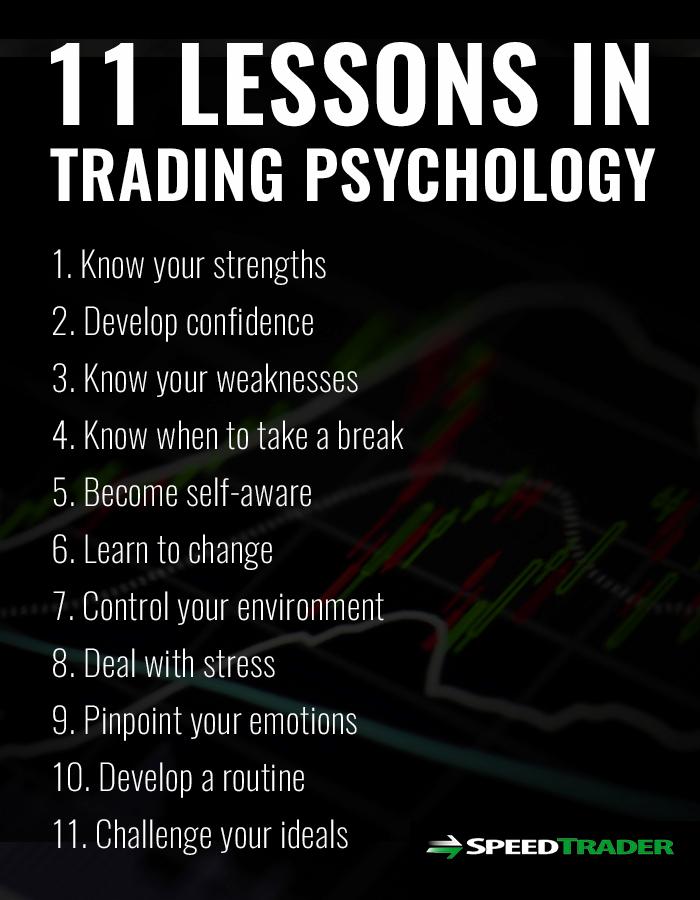

mastering trading psychology is not merely a supplementary skill; it is an essential pillar that underpins every successful trading endeavor. As we’ve explored throughout this article, cultivating a winning mindset involves a combination of self-awareness, discipline, emotional regulation, and continuous learning. By understanding your strengths and weaknesses, embracing the inevitable challenges, and fostering a resilient attitude, you can navigate the tumultuous waters of financial markets with confidence and composure.

Remember, trading is as much about mental fortitude as it is about strategy and analysis. By prioritizing your psychological well-being and implementing the keys we’ve discussed, you will not only enhance your trading performance but also develop a deeper connection with your overall strategy. As you embark on your trading journey, keep these insights close at heart, and commit to fostering a mindful approach in every aspect of your trading career.

Ultimately, the difference between a successful trader and one who struggles often lies in the mindset. Embrace the process of psychological mastery, remain patient with yourself, and watch as your trading evolves into a skillful blend of both science and art. Here’s to your success in the markets—may you trade with clarity, purpose, and unwavering resolve.