Mastering Trading Discipline: Essential Strategies for Success

In the fast-paced world of trading, where fortunes can change in the blink of an eye, one factor remains constant: the critical importance of discipline. Aspiring traders often find themselves enamored by the allure of quick profits, yet many overlook the foundational skill that distinguishes successful traders from their less fortunate counterparts. Mastering trading discipline is not merely a suggestion; it is an absolute necessity for anyone serious about achieving long-term success in the markets. In this article, we will delve into essential strategies that can help you cultivate and reinforce your trading discipline, ensuring that you navigate the complexities of the financial landscape with confidence and resilience. Whether you are a novice stepping into the realm of trading or a seasoned trader seeking to refine your approach, these principles will serve as your guiding compass toward sustainable profitability and personal growth. Join us as we explore the transformative power of discipline in trading and equip you with the tools you need to thrive in this challenging yet rewarding environment.

Table of Contents

- Understanding the Psychology of Trading Discipline

- Setting Clear Goals and Developing a Trading Plan

- Implementing Risk Management Techniques for Consistent Success

- Cultivating Patience and Emotional Control in the Trading Process

- Insights and Conclusions

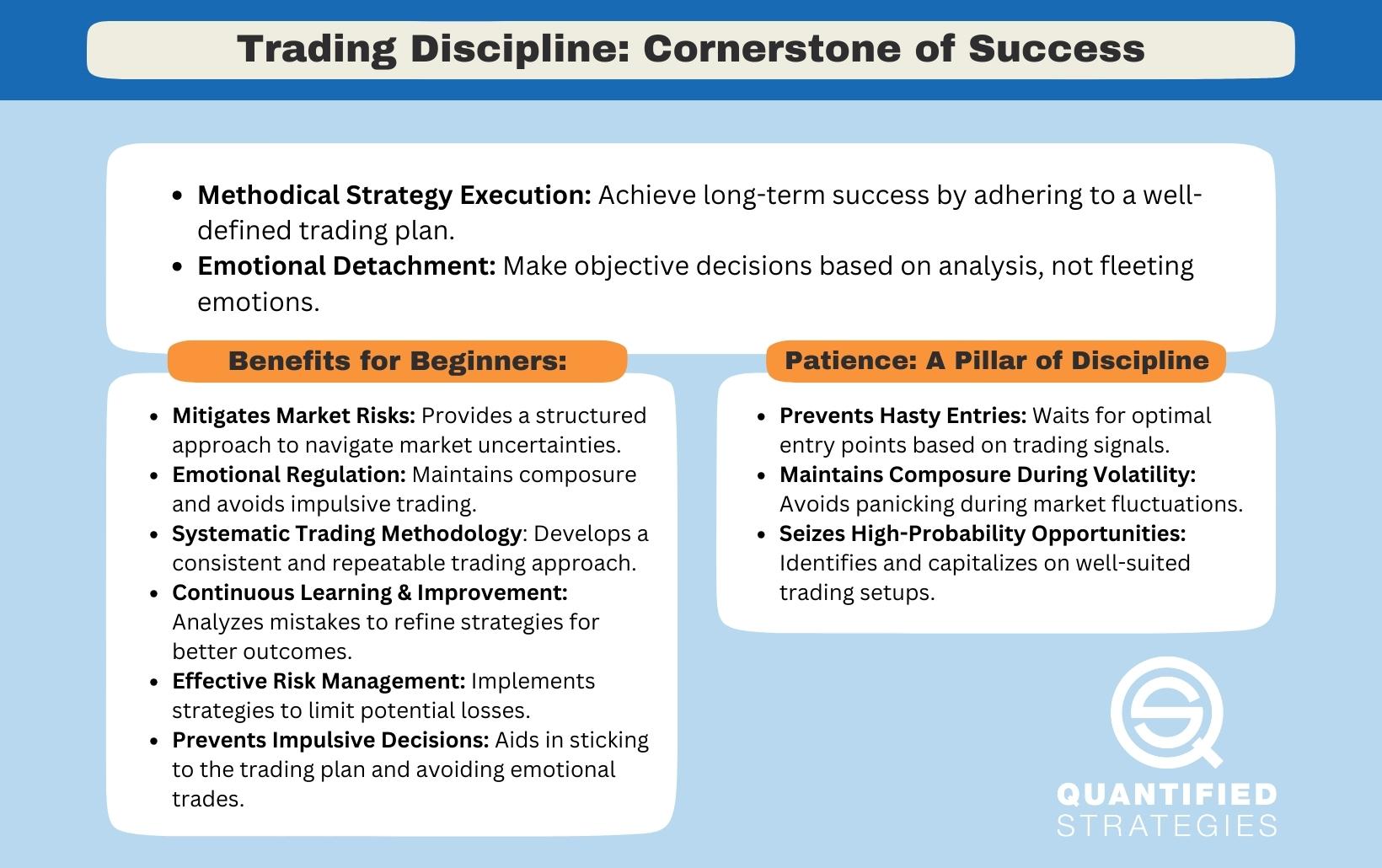

Understanding the Psychology of Trading Discipline

Trading is not merely about numbers and charts; it is fundamentally about understanding human behavior. The complex psychological factors that influence traders’ actions often lead to contradictory decision-making, resulting in unnecessary losses. A solid grasp of these psychological aspects can significantly enhance discipline, shaping a more systematic approach to trading. Key elements such as emotional intelligence, self-awareness, and impulse control play vital roles in sustaining discipline. Traders must cultivate a mindset that allows them to differentiate between rational analysis and emotional reactions. Learning to respond to market signals without the interference of fear or greed is essential.

To achieve a disciplined trading mentality, traders can adopt a few strategies that help in maintaining focus and composure. Consider implementing the following practices:

- Journaling: Keep a detailed record of trades to reflect on past decisions and emotions.

- Setting Clear Goals: Define realistic and specific trading objectives to steer actions.

- Creating a Trading Plan: Develop a structured approach that outlines entry and exit strategies.

- Meditation and Mindfulness: Incorporate relaxation techniques to manage stress and stay grounded.

Adopting these methods helps foster an environment of discipline that can significantly improve trading performance. The ability to remain focused during market fluctuations hinges on a trader’s psychological resilience. A well-structured trading routine serves not only to enhance discipline but also acts as a reinforcement mechanism for positive trading habits. Below is a simple outline of a potential trading routine:

| Activity | Frequency |

|---|---|

| Market Analysis | Daily |

| Updating Trading Journal | After Each Trade |

| Reviewing Goals | Weekly |

| Meditation | Daily |

By adhering to a disciplined approach and routine, traders can navigate the psychological barriers that often lead to erratic trading behavior. This discipline not only enhances performance but builds a more resilient trading mindset capable of enduring the volatility of the market.

Setting Clear Goals and Developing a Trading Plan

Establishing clear and achievable goals is the cornerstone of any successful trading journey. Without a defined purpose, traders often find themselves drifting aimlessly through the markets, which can lead to impulsive decisions and losses. To combat this, it’s essential to outline specific, measurable, attainable, relevant, and time-bound (SMART) objectives. Consider the following elements when setting your trading goals:

- Profit Targets: Define how much profit you aim to make monthly or annually.

- Risk Tolerance: Determine the maximum loss you are willing to accept on each trade.

- Skill Development: Set goals for improving your trading knowledge and strategies.

- Consistency: Aim for a specific number of trades per week to develop discipline.

Developing a comprehensive trading plan is equally vital. This plan serves as a roadmap, guiding your decisions and helping you stay focused amid the volatility of the markets. A robust trading plan should include not only your strategies and methodologies but also a detailed risk management approach. Here’s a simple layout for your trading plan:

| Component | Description |

|---|---|

| Trading Strategy | Identify the approach you’ll use—technical analysis, fundamental analysis, or a combination. |

| Entry Criteria | Define specific technical indicators or conditions that trigger your trades. |

| Exit Strategy | Outline your exit points, including stop-loss and take-profit levels. |

| Review Process | Schedule regular reviews to assess your performance and adjust your plan accordingly. |

Implementing Risk Management Techniques for Consistent Success

In the dynamic world of trading, effectively identifying and managing risk can be the difference between consistent profits and substantial losses. Traders should adopt a robust risk management strategy that aligns with their individual trading style and goals. Key techniques include setting stop-loss orders to limit potential losses, defining risk-reward ratios to assess the viability of trades, and maintaining adequate position sizing to ensure no single trade can significantly impact the trading capital. By integrating pre-defined parameters into each transaction, traders create a disciplined approach that safeguards their investments.

A crucial aspect of risk management involves continuous monitoring and adjusting strategies based on market conditions. Traders should regularly evaluate their performance and identify areas for improvement. This can be achieved through the following methods:

- Performing weekly reviews of all trades to pinpoint successful strategies and missteps.

- Utilizing trading journals to document decisions and emotions associated with each trade.

- Engaging in scenario analysis to prepare for different market trends and volatility.

The table below illustrates a simple risk management framework:

| Risk Management Technique | Description | Benefits |

|---|---|---|

| Stop-Loss Orders | Automatic order to sell a security when it reaches a certain price. | Limits potential losses on trades. |

| Position Sizing | Determining the amount of capital to risk on a trade. | Enhances control over risk exposure. |

| Trailing Stops | Allows a trade to remain open and continue to profit as long as the market price is moving in a favorable direction. | Locks in profits while managing risk. |

Cultivating Patience and Emotional Control in the Trading Process

In the high-stakes world of trading, impatience can often lead to impulsive decisions that sully even the most carefully executed strategies. Cultivating a mindset that fosters patience is paramount for traders looking to navigate the volatile landscape effectively. Key practices for developing this virtue include:

- Setting Realistic Goals: Break down your trading objectives into manageable milestones that allow for gradual progress.

- Establishing a Trading Plan: Your plan should detail entry and exit signals, risk management protocols, and rules for emotional regulation.

- Embracing Delays: Recognize that waiting for the perfect trade is an investment in itself; practice sitting on your hands until conditions align with your strategy.

Emotional control is equally essential. Volatility can trigger reactions that disrupt rational thinking and lead to significant losses. Implementing techniques to manage emotions can enhance trading decisions. Consider the following strategies:

- Mindfulness Practices: Engage in meditation or deep-breathing exercises to remain grounded and focused during turbulent market conditions.

- Journaling Trades: Maintain a record of your trades and the emotions you experienced; this reflection can help identify patterns and emotional triggers.

- Limiting Information Overload: Curate your news and social media sources to avoid distractions that may skew your perspective.

Insights and Conclusions

mastering trading discipline is not just a skill; it’s an ongoing commitment to your growth as a trader. The strategies we’ve discussed—setting clear goals, creating and sticking to a trading plan, managing your emotions, and maintaining a continuous learning mindset—are essential pillars that will support your journey toward success. Remember, the market is unpredictable, but your response to it doesn’t have to be. By cultivating discipline, you not only enhance your trading performance but also build the resilience needed to navigate the inevitable ups and downs of the financial landscape.

As you embark on this path, take the time to reflect on your progress and adapt your strategies as necessary. Success in trading isn’t just about the profits; it’s about developing a disciplined approach that allows you to face challenges with confidence and clarity. Stay focused, stay disciplined, and most importantly, stay committed to your personal trading development. The market can be a relentless teacher, and those who embrace discipline are the ones who will emerge victorious in the long run. Thank you for reading, and may your trading journey be both prosperous and enlightening.