Mastering the Markets: A Guide to Building Your Trading Strategy

Welcome to “.” In an age where financial markets are more accessible than ever, the allure of trading can be both enticing and overwhelming. With the potential for significant returns comes the reality of risk—a delicate balance that necessitates careful strategy, informed decision-making, and a disciplined approach. Whether you are a novice eager to dip your toes into the world of trading or a seasoned investor looking to refine your methods, having a robust trading strategy is crucial for navigating the turbulent waters of the market. In this guide, we will delve into the essential components of a sound trading strategy, equipping you with the knowledge and tools necessary to make informed decisions and enhance your trading acumen. Join us as we explore the principles of market analysis, risk management, and the psychological aspects of trading, empowering you to take control of your financial journey with confidence.

Table of Contents

- Understanding Market Fundamentals for Successful Trading

- Identifying and Analyzing Trading Opportunities

- Developing a Robust Risk Management Plan

- Evaluating and Adjusting Your Trading Strategy Over Time

- In Retrospect

Understanding Market Fundamentals for Successful Trading

To navigate the complexities of trading successfully, one must grasp the underlying principles that govern market behavior. Knowledge of supply and demand dynamics is crucial, as these forces determine price movements. Traders should also be aware of external factors that can influence market trends, including economic indicators, geopolitical events, and market sentiment. A few key elements to consider include:

- Market Structure: Understanding different market types (bullish, bearish, range-bound) is essential.

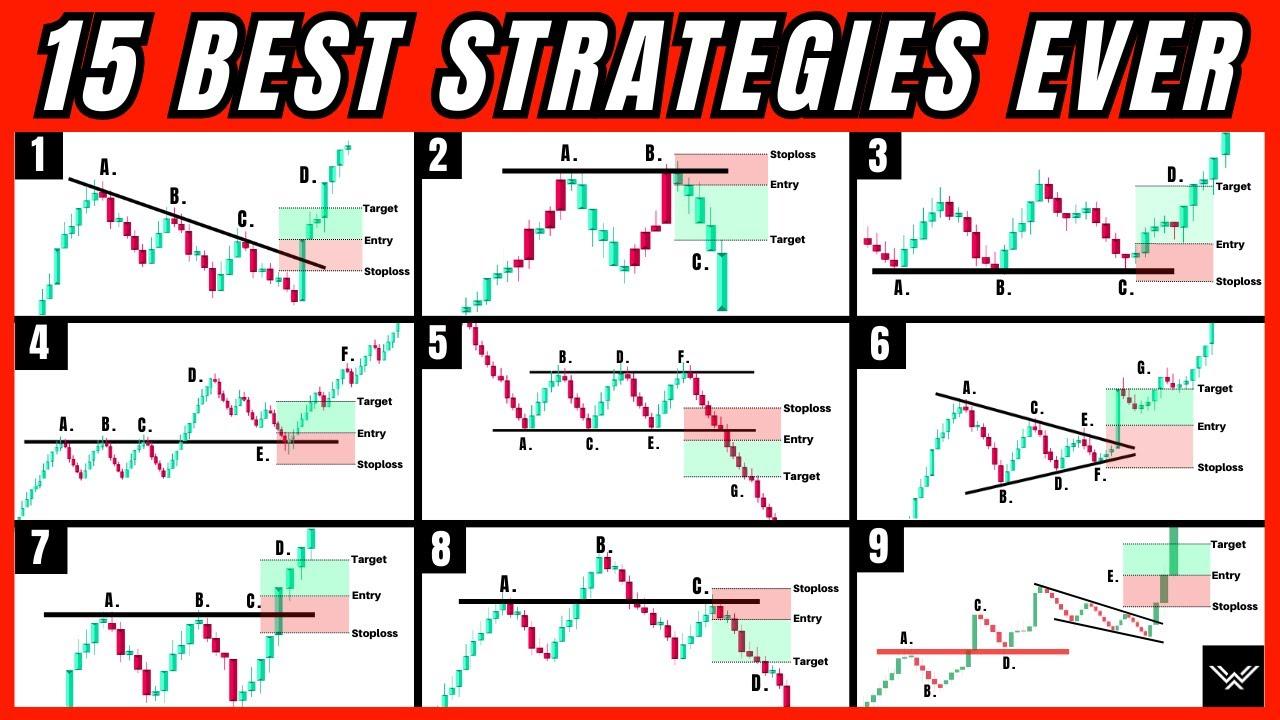

- Technical Analysis: Utilizing charts and patterns helps predict future price movements.

- Fundamental Analysis: Focusing on company performance, earnings reports, and broader economic conditions enhances decision-making.

Moreover, learning how to effectively manage risk is a cornerstone of a successful trading strategy. Setting clear entry and exit points, employing stop-loss orders, and maintaining a disciplined approach to position sizing can mitigate potential losses. To visualize these strategies, consider the following table, which outlines common risk management techniques:

| Technique | Description |

|---|---|

| Stop-Loss Orders | Limits losses by automatically selling an asset when it reaches a specified price. |

| Take-Profit Orders | Ensures gains by automatically selling once a target profit level is achieved. |

| Position Sizing | Determines how much capital to invest in a trade based on account risk. |

Identifying and Analyzing Trading Opportunities

In today’s fast-paced markets, the key to successful trading lies in recognizing and capitalizing on potential opportunities before they vanish. Start by leveraging quantitative analysis tools that can provide insights into price movements and volume trends. Additionally, remember to consider both fundamental data and sentiment analysis to paint a complete picture of the market environment. Key elements to focus on include:

- Market Trends: Stay updated with the latest financial news and economic indicators.

- Technical Patterns: Identify recurring price patterns through chart analysis.

- Sector Performance: Monitor how different sectors are reacting to market news and events.

Once a potential opportunity is identified, it’s crucial to conduct a thorough evaluation. Utilizing risk-reward ratios is one effective method to determine if the trade aligns with your overall strategy. A simple yet powerful table can help clarify this analysis:

| Trade Criteria | Potential Risk | Expected Reward | Risk-Reward Ratio |

|---|---|---|---|

| Long Position in Stock A | $2.00 | $6.00 | 1:3 |

| Short Position in Stock B | $1.50 | $4.50 | 1:3 |

| Options Trade on Index C | $1.00 | $5.00 | 1:5 |

This table serves as a quick reference for evaluating different trading opportunities based on their respective risk and reward profiles. A disciplined approach to analysis will ensure that you make informed decisions that enhance your overall trading strategy.

Developing a Robust Risk Management Plan

To navigate the complexities of financial markets, a strategic risk management plan is essential for any trader. This plan should encompass various elements designed to mitigate potential losses while maximizing returns. Key components include:

- Risk Assessment: Identify and evaluate the risks associated with different trading assets.

- Position Sizing: Determine how much of your capital to allocate to a specific trade based on risk tolerance.

- Stop-Loss Orders: Set predefined exit points to minimize potential losses on individual trades.

- Diversification: Spread investments across various assets to reduce exposure to any single economic event.

Implementing these practices can significantly decrease the likelihood of catastrophic losses. Additionally, maintaining a detailed trading journal enables you to analyze past trades and refine your strategies over time. Consider the following table for a quick reference to ideal risk management practices:

| Practice | Description |

|---|---|

| Risk-to-Reward Ratio | Aim for a minimum ratio of 1:2, risking $1 to gain $2. |

| Regular Review | Conduct monthly evaluations of your trades to identify patterns. |

| Emotional Discipline | Stick to your plan and avoid impulsive decisions based on market volatility. |

Evaluating and Adjusting Your Trading Strategy Over Time

To stay competitive in the financial markets, it is crucial to continuously assess the performance of your trading strategy. Start by collecting quantitative data on your trades, such as win-loss ratios, average profit, and maximum drawdown. This information can help you identify patterns and trends that may reveal weaknesses in your current approach. Additionally, qualitative assessments from personal observations or feedback from fellow traders can provide valuable insights. Consider maintaining a trading journal detailing your thought processes during trades, market conditions, and emotional responses, as this can illuminate areas needing improvement.

Once you have gathered sufficient data, it is important to be open to change. Approach your strategy with a critical mindset, asking yourself the following questions:

- Are my entry and exit criteria still effective in current market conditions?

- How does my risk management align with my overall trading goals?

- Am I adhering to my trading plan, or have I begun to deviate due to emotional influences?

Incorporate your findings into actionable adjustments to your strategy. This could mean altering your risk-reward ratio, refining your technical indicators, or even completely overhauling your trading style. Regularly revisiting your strategy not only protects you from stagnation but also keeps you in tune with the ever-evolving market landscape, ensuring you remain equipped to seize the best trading opportunities.

In Retrospect

As we conclude our exploration of mastering the markets, it’s important to remember that building a successful trading strategy is not a one-time event—it’s an ongoing journey. The insights and techniques we’ve discussed serve as your foundational toolkit, but the true test lies in continuous learning, adaptation, and disciplined execution.

In the dynamic world of trading, where market conditions can shift in the blink of an eye, maintaining a steadfast approach will be your greatest ally. Embrace the lessons from both your victories and setbacks, as each experience shapes your growth as a trader. Establish a routine that allows for regular analysis of your strategies, keeping you agile and informed.

Stay curious. The markets are always evolving, and so should your knowledge and techniques. Engage with communities, follow market news, and never hesitate to explore new concepts that could enhance your trading prowess.

Remember, success in trading is not merely about profit; it’s about making informed decisions, managing risk, and being resilient in the face of challenges. As you forge ahead, carry the principles discussed in this guide with you, and commit to refining your craft. With patience, discipline, and a strategic mindset, you have the potential to navigate the complexities of the market with confidence.

Thank you for joining us on this journey to mastering the markets. Here’s to your trading success!