Mastering the Fundamentals: A Deep Dive into Trading Basics

Introduction:

In the ever-evolving world of finance, trading stands as both an art and a science — a realm where opportunity and risk collide in ways that can redefine both fortunes and futures. Yet, behind every seasoned trader’s success lies a foundation built upon a firm grasp of the essentials. For those eager to embark on their trading journey or refine their existing skills, understanding these fundamentals is not just beneficial; it’s imperative.

In this article, we aim to illuminate the critical concepts that form the bedrock of trading — from the intricacies of market mechanics to the psychology that drives decision-making. We will explore the vital tools and strategies that can help pave your path to success while emphasizing the importance of disciplined practice and continuous learning. Whether you’re a novice seeking to grasp the basics or an experienced trader looking to reinforce your knowledge, this deep dive into trading fundamentals will equip you with the insights necessary to navigate the complexities of the financial markets confidently. Join us as we dissect the core principles of trading, empowering you to master the art of making informed and strategic decisions in the pursuit of your financial goals.

Table of Contents

- Understanding Market Dynamics and Asset Classes

- Analyzing Technical Indicators and Chart Patterns

- Developing a Risk Management Strategy

- Building a Disciplined Trading Plan

- In Retrospect

Understanding Market Dynamics and Asset Classes

Understanding market dynamics is crucial for anyone looking to navigate the complexities of trading effectively. It involves recognizing how various factors, such as economic indicators, geopolitical events, and investor sentiment, influence the buying and selling behavior within financial markets. Key elements to consider include:

- Supply and Demand: The fundamental principle where prices adjust based on the availability of an asset and the desire for it.

- Market Sentiment: The overall attitude of investors toward a particular security or financial market.

- Economic Indicators: Statistics that provide insights into the economic performance which can impact asset values.

- Regulatory Changes: New regulations can significantly affect market operations and investor confidence.

Different asset classes respond uniquely to these market dynamics. Each class carries its own characteristics, risks, and behaviors, making it essential for traders to understand their nuances. The primary asset classes typically include:

| Asset Class | Characteristics | Risk Level |

|---|---|---|

| Stocks | Ownership in a company; potential for high returns | High |

| Bonds | Debt securities; regular interest payments | Medium |

| Commodities | Physical goods like oil and gold; influenced by supply/demand | Medium to High |

| Real Estate | Physical property; rental income potential | Medium |

By grasping the fundamental properties of these classes, traders can make more informed decisions, tailor their strategies accordingly, and manage their portfolios effectively amid fluctuating market conditions.

Analyzing Technical Indicators and Chart Patterns

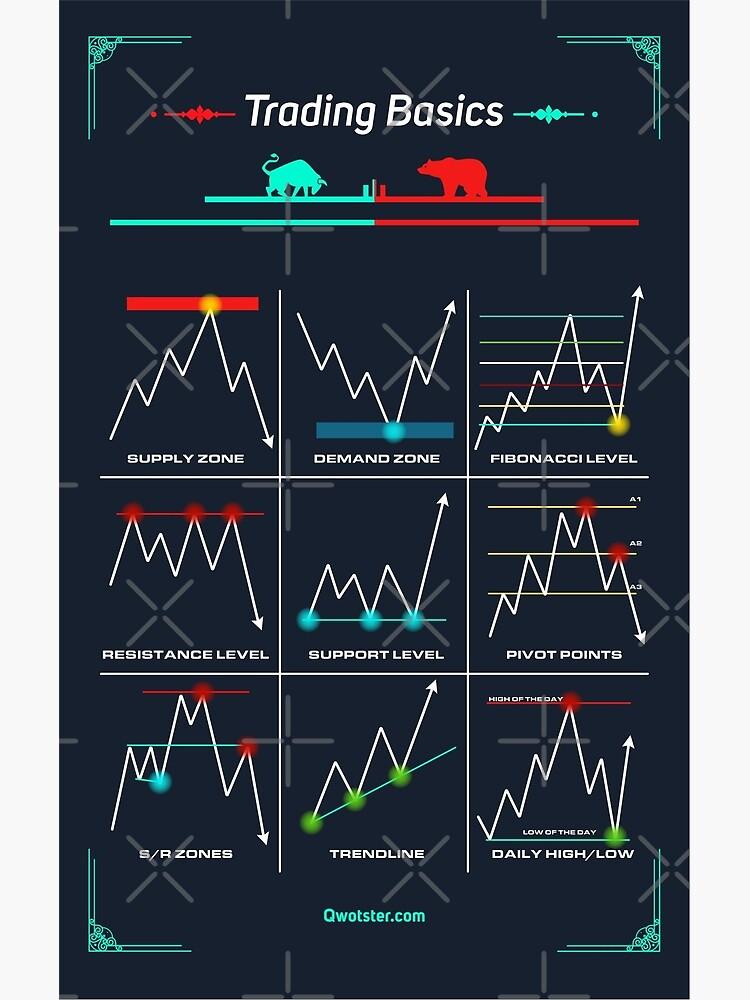

Understanding technical indicators and chart patterns is crucial for traders aiming to navigate financial markets effectively. These tools help traders assess market conditions, identify trends, and make informed decisions based on historical data. Technical indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands can provide valuable insights into market momentum and potential reversals. Incorporating these indicators into your analysis can foster a more nuanced understanding of price movements.

Chart patterns, on the other hand, represent visual formations that occur on price charts, often indicating future movements. Many traders rely on patterns such as head and shoulders, triangles, and flags to signal potential breakout or reversal points. Recognizing these patterns involves a careful analysis of price action over time, leading to strategic entries and exits. To help visualize the relationship between patterns and potential outcomes, consider the following overview:

| Chart Pattern | Implication |

|---|---|

| Head and Shoulders | Trend reversal |

| Ascending Triangle | Possible breakout |

| Flag Pattern | Continuation of trend |

By effectively combining technical indicators with an understanding of chart patterns, traders can enhance their ability to predict price movements and time their trades more effectively. This dual approach not only sharpens analytical skills but also instills a sense of confidence when engaging in market activities.

Developing a Risk Management Strategy

Creating a robust risk management strategy is essential for traders looking to safeguard their investments while maximizing returns. This approach involves identifying potential risks and formulating plans to minimize their impact. One key aspect is setting stop-loss orders, which automatically close a position at a predetermined price, thereby limiting losses. Additionally, traders should consider diversifying their portfolios to spread exposure across different assets and sectors, reducing the potential negative effects of a single poor-performing investment. Here are some fundamental components to include in your strategy:

- Risk Assessment: Evaluate potential market movements and their possible effects on your positions.

- Position Sizing: Determine how much of your capital you are willing to risk on any single trade.

- Continuous Monitoring: Keep an eye on market conditions and adjust your strategy accordingly.

To further illustrate the importance of risk management, consider the following simplified table that outlines various risk levels and their corresponding suggested actions:

| Risk Level | Action |

|---|---|

| Low | Invest in diversified assets, maintain tight stop-loss limits. |

| Medium | Monitor positions; be prepared to adjust strategies. |

| High | Limit exposure, focus on short-term trades. |

Building a Disciplined Trading Plan

Creating a systematic approach to trading is essential for long-term success. A well-structured trading plan serves as a roadmap, providing guidance during unpredictable market conditions. Key components of a disciplined trading strategy include:

- Defined Goals: Identify your short-term and long-term trading objectives.

- Risk Management: Establish clear rules for how much capital you are willing to risk on each trade.

- Entry and Exit Criteria: Specify conditions under which you will buy or sell an asset.

- Performance Review: Set a routine to analyze and assess your trades regularly.

Maintaining discipline is crucial when executing your trading plan. Traders often face emotional challenges, such as fear and greed, that can lead to impulsive decisions. To counteract these factors, it’s important to:

- Stick to Your Plan: Avoid deviating from your established trading rules.

- Keep a Trading Journal: Document each trade with details on strategy and outcome to learn from mistakes.

- Practice Patience: Wait for the perfect setups according to your criteria instead of forcing trades.

| Element | Importance |

|---|---|

| Goals | Guides your trading focus |

| Risk Management | Protects your capital |

| Strategy Execution | Ensures consistency |

In Retrospect

As we conclude our exploration of the essential fundamentals of trading, it’s imperative to recognize that mastering these foundational principles is not merely a stepping stone, but rather a continuous journey. Each concept we’ve covered forms the bedrock of successful trading, equipping you with the knowledge and strategies necessary to navigate the complexities of the financial markets.

While this deep dive illuminates the critical elements, the real learning occurs through practice and experience. Embrace the process—study, analyze, and continually refine your skills. Remember, mastery does not come overnight; it’s the result of dedication, discipline, and a willingness to adapt.

We hope this article has provided you with valuable insights and a clearer understanding of trading basics. As you embark on your trading journey, keep these principles in mind, and let them guide you toward becoming a more informed and confident trader. Stay curious, stay committed, and may your trading endeavors be both profitable and enlightening. Thank you for reading!