Mastering Stock Evaluation: A Guide for Day Traders

Title:

In the fast-paced world of day trading, where split-second decisions can make or break your portfolio, mastering stock evaluation is not just an asset – it’s a necessity. As more traders flock to the markets with hopes of financial freedom, the ability to accurately assess the value and potential of stocks is paramount. This guide aims to equip both novice and experienced traders with the essential tools and strategies for effective stock evaluation, empowering them to navigate the complexities of the market with confidence. From understanding the fundamentals of technical analysis to constructing a balanced trading strategy, we’ll explore the critical elements that can help you maximize profit while minimizing risk. Whether you’re looking to refine your current approach or seeking a robust framework to guide your trading decisions, this comprehensive exploration will serve as your roadmap to success in the dynamic world of day trading. Let’s dive in and unlock the skills necessary to thrive in today’s competitive market.

Table of Contents

- Understanding Key Financial Metrics for Effective Stock Evaluation

- Technical Analysis Tools Every Day Trader Should Use

- Developing a Disciplined Trading Strategy Based on Stock Evaluation

- Mitigating Risks: Strategies for Protecting Your Investments

- To Conclude

Understanding Key Financial Metrics for Effective Stock Evaluation

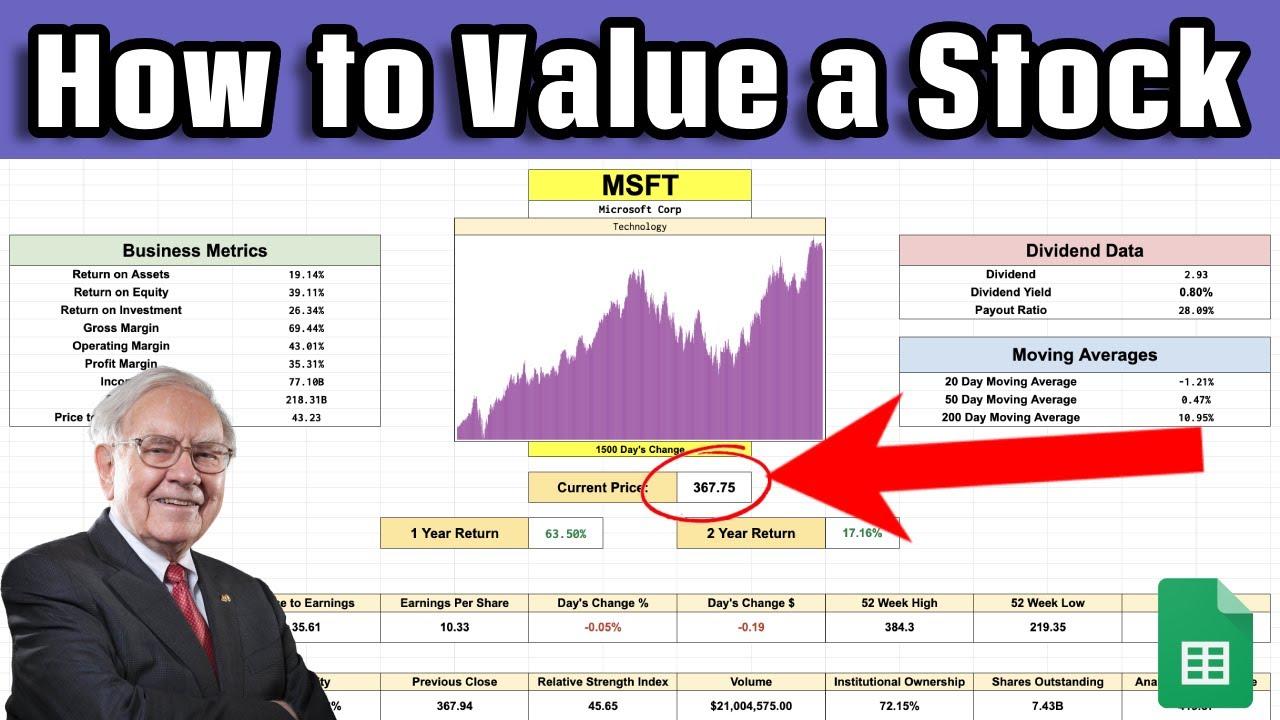

Evaluating stocks effectively requires a solid understanding of key financial metrics that can illuminate a company’s potential for growth and profitability. Earnings Per Share (EPS) is a critical indicator, reflecting the portion of a company’s profit attributed to each outstanding share of common stock. A rising EPS suggests increasing profitability, making it a favorable sign for investors. Similarly, Price-to-Earnings Ratio (P/E) offers insight into how much investors are willing to pay for $1 of earnings, with lower values often indicating a potentially undervalued stock. It’s prudent to compare P/E ratios among industry peers to gauge relative valuation.

Another essential metric is the Return on Equity (ROE), which measures how efficiently a company generates profits from its equity. A higher ROE signals efficient management and strong financial health. Debt-to-Equity Ratio (D/E) is equally important, showcasing the proportion of company financing that comes from debt versus shareholder equity. A high D/E ratio might indicate greater risk due to increased debt levels, while a low ratio often signifies stability. Combining these metrics gives traders a multifaceted view of a stock’s financial health, ultimately guiding investment decisions. Furthermore, a comparison table can help visualize these metrics across a portfolio of stocks:

| Company | EPS | P/E Ratio | ROE | D/E Ratio |

|---|---|---|---|---|

| Company A | $3.50 | 15 | 20% | 0.5 |

| Company B | $2.80 | 18 | 15% | 1.2 |

| Company C | $5.00 | 25 | 25% | 0.8 |

Technical Analysis Tools Every Day Trader Should Use

For day traders eager to enhance their market evaluations, a well-equipped toolbox is essential. Technical analysis tools provide vital insights into price movements and trends, enabling traders to make informed decisions quickly. Among the most valuable instruments are charting software, which allow users to visualize historical price data, and trend indicators, such as moving averages, that help identify the market’s direction. Additionally, oscillators like the Relative Strength Index (RSI) and the Stochastic Oscillator can guide traders in spotting overbought or oversold conditions, enhancing entry and exit strategies.

Moreover, incorporating volume analysis tools can significantly bolster a trader’s strategy. Understanding the volume behind price movements helps validate trends and signals, making it easier to discern whether a price change is backed by strong interest or mere fluctuations. Other indispensable tools include candlestick patterns, which provide insights into market sentiment, and support and resistance levels, key areas where prices are likely to reverse or consolidate. By mastering these tools, day traders can refine their tactics and potentially increase profitability in their trading endeavors.

Developing a Disciplined Trading Strategy Based on Stock Evaluation

Creating a disciplined trading strategy hinges on a systematic approach to stock evaluation. By leveraging various financial metrics and tools, traders can gain critical insights into potential investment opportunities. Start by conducting a fundamental analysis, which involves reviewing a company’s financial health through its balance sheets, income statements, and cash flow statements. Key metrics to consider include:

- Price-to-Earnings (P/E) Ratio: Indicates how much investors are willing to pay for each dollar of earnings.

- Return on Equity (ROE): Measures a company’s profitability by revealing how much profit a company generates with shareholders’ equity.

- Debt-to-Equity Ratio: Assesses a company’s financial leverage and overall risk by comparing its total liabilities to shareholders’ equity.

Additionally, integrating technical analysis can provide further clarity for day traders looking to make informed decisions based on market trends and price movements. Use tools like moving averages, Relative Strength Index (RSI), and Bollinger Bands to determine entry and exit points effectively. To visualize your analysis, consider maintaining a trading journal where you can document your trades and evaluate their outcomes against your strategy. This will help you refine your approach over time. Below is a simple template that can guide your evaluation process:

| Evaluation Criteria | Value/Rating | Notes |

|---|---|---|

| P/E Ratio | 15 | Below industry average, potential for growth. |

| ROE | 10% | Stable but could improve. |

| Debt-to-Equity | 0.5 | Healthy balance, low risk. |

Mitigating Risks: Strategies for Protecting Your Investments

When it comes to day trading, risk management is a fundamental aspect that determines long-term success. By employing a variety of strategies, you can effectively shield your portfolio from adverse market movements. Diversification is a well-known tactic; by spreading your investments across different sectors, you can mitigate the impact of poor performance in any single area. Additionally, consider utilizing stop-loss orders to automatically sell your stocks when they reach a predetermined price, protecting your capital from significant losses. Maintaining a disciplined approach to this essential aspect of trading can create a safety net during volatile market conditions.

It’s also crucial to stay informed and prepared for unforeseen events that can dramatically affect stock prices. Incorporating technical analysis into your trading routine can provide insights into market trends and potential turning points. Regularly review your investment thesis and be willing to make swift adjustments if the market dynamics change. Creating a risk management plan that outlines your investment goals, acceptable loss thresholds, and exit strategies will further enhance your potential for success. Below is a simple table outlining these strategies:

| Strategy | Description |

|---|---|

| Diversification | Spreading investments across various sectors. |

| Stop-Loss Orders | Automatic selling of stocks at a set loss limit. |

| Technical Analysis | Analyzing price charts and market trends. |

| Risk Management Plan | Defining goals and acceptable risk levels. |

To Conclude

mastering stock evaluation is an essential cornerstone for any day trader aspiring to achieve consistent success in the fast-paced world of trading. By honing your analytical skills and developing a robust framework for assessing stocks, you can make informed decisions that align with your investment strategies and risk tolerance.

Remember, stock evaluation is not just about crunching numbers—it’s about understanding market trends, underlying business fundamentals, and leveraging available tools to enhance your trading experience. As you navigate this complex landscape, stay disciplined, remain adaptable, and commit to continuous learning.

Whether you’re a novice looking to enter the field or a seasoned trader aiming to sharpen your skills, implementing the techniques outlined in this guide will empower you to approach each trading day with confidence. The journey toward becoming a master of stock evaluation is ongoing, but with patience and dedication, you can elevate your trading game to new heights.

Thank you for reading, and may your trading journey be filled with informed decisions and profitable outcomes. Happy trading!