Mastering Moving Averages: A Guide to Effective Trading Signals

In the vast ocean of financial markets, traders are constantly on the lookout for reliable signals to guide their decision-making. Amidst the multitude of technical indicators available, moving averages stand out as one of the most effective tools for identifying trends and potential entry and exit points. This powerful statistical technique smooths out price data over a specified period, helping traders to filter out the noise and focus on the underlying market direction.

Whether you are a novice exploring the intricacies of trading or an experienced trader refining your strategy, understanding how to effectively utilize moving averages can significantly enhance your trading prowess. In this comprehensive guide, we will delve into the various types of moving averages, explore their applications in real-time trading scenarios, and provide actionable insights to help you harness their full potential in your trading endeavors. Join us as we embark on a journey to master moving averages and unlock the robust signals they can provide for a more successful trading experience.

Table of Contents

- Understanding the Fundamentals of Moving Averages in Trading

- Different Types of Moving Averages and Their Unique Applications

- Strategies for Combining Moving Averages with Other Indicators

- Common Mistakes to Avoid When Using Moving Averages for Trading

- Concluding Remarks

Understanding the Fundamentals of Moving Averages in Trading

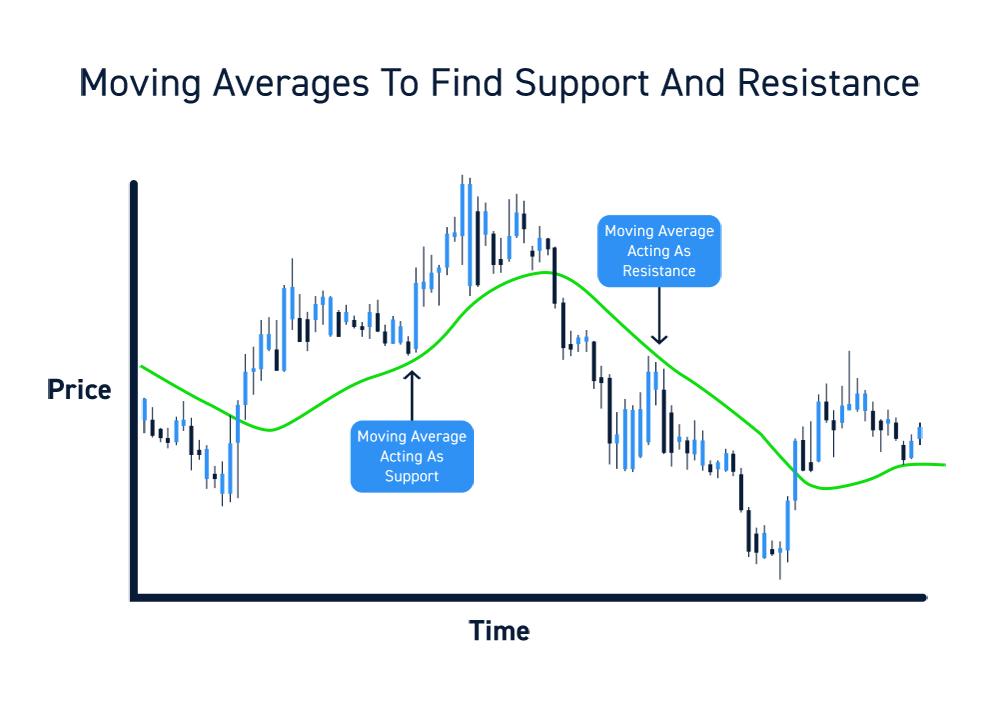

Moving averages are essential tools in technical analysis, providing traders with a clearer understanding of price trends over specific periods. They are particularly valuable because they help to smooth out price fluctuations, making it easier to identify the overall direction of a market. Two main types of moving averages are widely used by traders: Simple Moving Average (SMA) and Exponential Moving Average (EMA). While the SMA calculates the average price over a designated number of periods, the EMA gives more weight to recent prices, making it more responsive to new information. Understanding the distinctions between these two types is crucial in selecting the appropriate one for your trading strategy.

The effectiveness of moving averages is enhanced when used in conjunction with other technical indicators. Traders often look for crossover signals, where a shorter moving average crosses above or below a longer moving average. This can signal potential buying or selling opportunities. To further illustrate this relationship, consider the following table that highlights different moving average combinations and their significance:

| Moving Average Pair | Signal |

|---|---|

| 50-day SMA & 200-day SMA | Golden Cross (Bullish Signal) |

| 50-day SMA & 200-day SMA | Death Cross (Bearish Signal) |

| 9-day EMA & 21-day EMA | Short-term Momentum Shift |

| 20-day SMA & 50-day SMA | Trend Continuation |

Different Types of Moving Averages and Their Unique Applications

Moving averages are crucial for traders seeking to identify trends and enhance their market strategies. Each type of moving average serves specific purposes, and using them effectively can provide unique insights. Simple Moving Average (SMA) is one of the most common types, calculated by averaging a set of prices over a specific number of periods. This type is particularly useful for identifying overall trends and supports resistance levels. Conversely, the Exponential Moving Average (EMA) gives more weight to recent prices, making it more responsive to recent price movements. Traders often utilize EMA for short-term trading strategies since it reacts quickly to sudden market changes.

In addition to SMA and EMA, Weighted Moving Average (WMA) is another valuable tool that assigns a heavier weighting to more recent prices than older ones, thus providing a balance between the two approaches. Traders looking to smooth out short-term fluctuations might adopt the Smoothed Moving Average, which combines the properties of both SMA and WMA. Moreover, the Triple Exponential Moving Average (TEMA) aims to reduce lag further, making it effective for fast-paced trading environments. Understanding these different moving averages and their unique applications can empower traders to make informed decisions based on clear market signals.

Strategies for Combining Moving Averages with Other Indicators

Combining moving averages with other indicators can significantly enhance trading strategies and improve decision-making processes. One effective approach is to use moving averages alongside Relative Strength Index (RSI). By doing so, traders can identify overbought or oversold conditions while confirming the trend’s strength. For instance, when the price is above the moving average and the RSI is below 30, it could indicate a potential buying opportunity. Conversely, if the price is below the moving average and the RSI is above 70, it may signal a sell point. This combination provides a layered approach, ensuring that traders do not solely rely on one type of indicator for their trades.

Another popular method involves integrating moving averages with Bollinger Bands. Moving averages serve as a baseline, while Bollinger Bands help visualize the price volatility surrounding that average. When the price touches the upper band while above the moving average, it may suggest a potential reversal or retracement. Similarly, if the price touches the lower band below the moving average, traders might consider this an opportunity to enter long positions. By employing these tools together, traders can create a more comprehensive trading strategy that accommodates various market conditions.

Common Mistakes to Avoid When Using Moving Averages for Trading

When incorporating moving averages into trading strategies, it is essential to steer clear of several common pitfalls that can undermine your decision-making process. One major mistake is relying solely on a single moving average without considering the overall market context. Traders often fail to account for the correlation between different averages and the price action itself, which can lead to false signals. To mitigate this risk, it is advisable to use multiple moving averages (e.g., a combination of short-term and long-term) to gain a more comprehensive view of market trends. Additionally, ignoring the significance of volume when interpreting moving averages can result in misleading conclusions. Volume analysis provides critical insight into price movements and can enhance the reliability of moving average signals.

Another common error is misinterpreting moving average crossovers as definitive buy or sell signals. While these crossovers can indicate potential trend changes, they are not foolproof and require further confirmation. Traders should be wary of whipsaw patterns where frequent crossovers can lead to unnecessary trades, often resulting in losses. Incorporating additional tools, such as oscillators or trend analysis, can help validate these signals. Lastly, neglecting to adjust moving average parameters to suit different market conditions can diminish their effectiveness. Using dynamic settings that adapt to market volatility and trends will provide a more robust framework for decision-making, ensuring that moving averages serve as a reliable component of your trading strategy.

Concluding Remarks

mastering moving averages is not just about understanding a technical indicator; it’s about integrating these powerful tools into a broader trading strategy. As we’ve explored throughout this guide, moving averages can provide you with critical insights into market trends, helping you identify potential entry and exit points with heightened accuracy.

However, remember that no trading strategy is foolproof. It’s essential to combine moving averages with other indicators and analysis methods to create a well-rounded approach to trading. Practicing your skills in a demo account, staying updated on market conditions, and continually educating yourself will give you the edge you need in this dynamic landscape.

As you move forward, keep experimenting and refining your strategies, ensuring that you remain flexible and responsive to changing market dynamics. The world of trading is ever-evolving, and those who adapt will find the most success. Equip yourself with knowledge, maintain discipline, and you’ll be on your way to mastering not only moving averages but the market itself. Happy trading!