Mastering Diversification: Building a Robust Trading Portfolio

In the unpredictable landscape of financial markets, the aphorism “don’t put all your eggs in one basket” carries more weight than ever. As investors seek to navigate the stormy seas of market volatility, diversification emerges as a crucial strategy for safeguarding and enhancing capital. In this article, we will delve into the principles of mastering diversification, exploring how to construct a robust trading portfolio that not only withstands the inevitable ups and downs of the market but also positions you for meaningful growth. Whether you are a seasoned trader or just starting on your investment journey, understanding the nuances of diversification can be the key to unlocking long-term success. Join us as we unravel the strategies and methodologies that can help you spread risk effectively while capitalizing on the myriad opportunities the market has to offer.

Table of Contents

- Understanding the Importance of Diversification in Trading Strategies

- Identifying Key Asset Classes for a Balanced Portfolio

- Implementing Risk Management Techniques to Safeguard Investments

- Evaluating and Rebalancing Your Portfolio for Optimal Performance

- The Conclusion

Understanding the Importance of Diversification in Trading Strategies

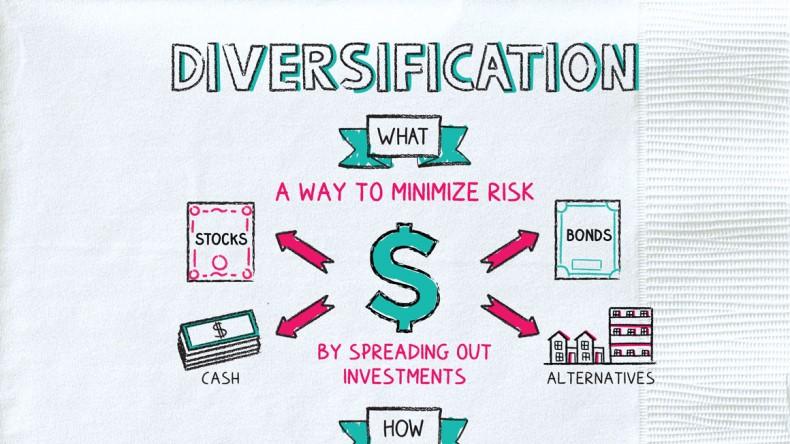

Diversification is a critical principle in trading that helps mitigate risk while maximizing potential returns. By spreading investments across various assets and asset classes, traders can shield their portfolios from the fluctuations typical in any single market. A well-diversified portfolio can reduce the impact of an adverse performance by one asset by offsetting it with gains from another, leading to a more stable overall performance. In this sense, diversification acts as a protective shield, allowing traders to navigate through volatile market conditions with greater confidence.

Implementing a diversified trading strategy entails a thoughtful selection of different trading instruments and sectors. Consider the following factors when crafting a diversified portfolio:

- Asset Classes: Include stocks, bonds, commodities, and currencies to balance exposure.

- Geographical Range: Diversifying across global markets can reduce risks associated with domestically concentrated investments.

- Investment Styles: Combine growth, value, and dividend-paying stocks to create a more adaptive approach.

| Asset Class | Purpose |

|---|---|

| Stocks | Capital appreciation |

| Bonds | Income generation and stability |

| Commodities | Inflation hedge |

| Forex | Leverage and high liquidity |

Identifying Key Asset Classes for a Balanced Portfolio

When constructing a balanced portfolio, it’s vital to identify key asset classes that align with your investment goals and risk tolerance. A well-diversified portfolio typically includes a mix of the following categories:

- Equities: Stocks represent ownership in companies and can offer high returns over time, albeit with higher volatility.

- Fixed Income: Bonds provide stability and income, mitigating the risk of equity fluctuations.

- Real Estate: Real estate investments can diversify your portfolio and provide income through rents while protecting against inflation.

- Commodities: Investing in physical goods, such as gold or oil, adds a layer of protection against currency devaluation.

- Cash Equivalents: Money market funds and other cash-like instruments enable liquidity and risk management.

To better illustrate the potential allocation across these asset classes, consider the following simple table. This table presents a sample portfolio distribution for a moderate risk tolerance:

| Asset Class | Percentage Allocation |

|---|---|

| Equities | 50% |

| Fixed Income | 30% |

| Real Estate | 10% |

| Commodities | 5% |

| Cash Equivalents | 5% |

This allocation can be adjusted depending on individual preferences and market conditions. The key is to routinely assess your portfolio to ensure it remains aligned with your financial objectives, allowing for both growth and protection in the face of changing market landscapes.

Implementing Risk Management Techniques to Safeguard Investments

In today’s volatile market environment, safeguarding investments is paramount. One effective method to mitigate risk is through strategic asset allocation. By spreading your investments across various asset classes such as equities, bonds, and real estate, you can minimize the impact of market fluctuations on your portfolio. The following approaches can be instrumental in building a resilient investment strategy:

- Sector Diversification: Allocate funds across different sectors to avoid concentration risk.

- Geographical Diversification: Invest in domestic and international markets to hedge against local economic downturns.

- Style Diversification: Combine growth and value stocks to balance out potential losses.

Moreover, incorporating tools like stop-loss orders and proper position sizing can further enhance risk management. These techniques create a safety net, ensuring that no single trade significantly impacts your overall financial health. For a clearer understanding, consider the following table that showcases the importance of different risk management techniques:

| Technique | Description | Benefit |

|---|---|---|

| Stop-Loss Orders | Automatically sell an asset at a predetermined price. | Limits potential losses on trades. |

| Position Sizing | Determining the right amount to invest in each trade. | Reduces overall risk exposure. |

| Regular Portfolio Review | Consistently assessing portfolio performance and rebalancing. | Ensures alignment with risk tolerance and goals. |

Evaluating and Rebalancing Your Portfolio for Optimal Performance

To ensure your trading portfolio remains aligned with your investment goals, regular evaluation and rebalancing are essential practices. An effective evaluation involves assessing the performance of your assets within the context of market conditions, economic indicators, and your personal financial objectives. Consider the following factors when reevaluating your portfolio:

- Performance Metrics: Analyze how individual assets have performed against benchmarks.

- Market Trends: Stay informed about macroeconomic trends that could impact your investments.

- Risk Tolerance: Assess whether your current risk exposure still aligns with your financial situation and goals.

Once you have completed your evaluation, rebalancing may be necessary to restore your desired asset allocation. This process typically involves selling over-performing assets and purchasing under-performing ones, which can help mitigate risk and enhance potential returns. Below is a simple table to visualize a potential rebalancing strategy:

| Asset Class | Current Allocation (%) | Target Allocation (%) | Action |

|---|---|---|---|

| Stocks | 70 | 60 | Sell |

| Bonds | 20 | 30 | Buy |

| Cash | 10 | 10 | No Action |

The Conclusion

mastering the art of diversification is not merely an optional strategy; it is essential for building a robust trading portfolio that can weather the storms of market volatility. By thoughtfully allocating your resources across various asset classes, sectors, and geographies, you equip yourself with the tools necessary to navigate uncertainties and seize opportunities.

Remember, diversification is about more than just spreading your investments; it’s about crafting a well-balanced portfolio that aligns with your risk tolerance and financial goals. As you move forward, continuously evaluate your holdings, stay informed about market trends, and be prepared to adapt your strategy as necessary.

As with any discipline, patience and discipline are your greatest allies. Take the time to implement what you’ve learned, and don’t shy away from seeking professional advice if needed. With a diligent approach to diversification, you can enhance your chances of achieving sustained success in the complex world of trading. Thank you for joining us on this journey, and may your trading pursuits be fruitful and fulfilling.