Mastering Candlestick Patterns: A Trader’s Guide to Success

Title:

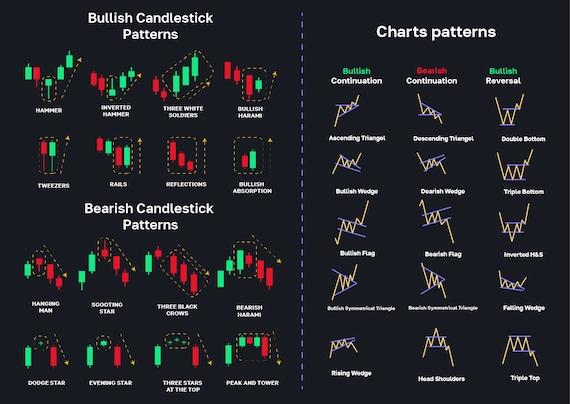

In the world of trading, where the dance of numbers and charts can often feel overwhelming, one of the most powerful tools at a trader’s disposal lies within the intricate world of candlestick patterns. These visual indicators, born from the discipline of technical analysis, offer invaluable insights into market sentiment and potential price movements. Understanding and mastering candlestick patterns is not just an exercise in technical proficiency; it is a foundational skill that can significantly enhance a trader’s decision-making process.

This article delves into the art and science of candlestick patterns, exploring their origins, interpreting various formations, and integrating them into a comprehensive trading strategy. Whether you are a novice eager to learn the ropes or an experienced trader looking to sharpen your skills, mastering these patterns can unlock doors to greater success in the dynamic realm of trading. Join us as we dissect the fundamental concepts and strategies that can elevate your trading game to new heights.

Table of Contents

- Understanding the Anatomy of Candlestick Patterns

- Identifying Key Reversal Signals for Informed Decision Making

- Integrating Candlestick Analysis with Technical Indicators

- Developing a Winning Trading Plan Using Candlestick Strategies

- Concluding Remarks

Understanding the Anatomy of Candlestick Patterns

To effectively interpret candlestick patterns, traders must first understand the basic anatomy of a candlestick. Each candlestick consists of four main price points: open, close, high, and low. The body of the candlestick is formed between the open and close prices, while the wicks (or shadows) extend to the high and low prices of that period. The body can be either filled or hollow, indicating the direction of the price movement:

- Filled Body: Indicates a closing price lower than the opening price, typical of bearish movements.

- Hollow Body: Shows a closing price higher than the opening price, signaling bullish momentum.

Understanding these elements is crucial as they provide insights into market sentiment. A single candlestick may convey essential information, but it is often the combination of multiple candlesticks that reveals true market psychology. Recognizing patterns such as Doji, Engulfing, and Hammer formations can offer traders critical signals for entry or exit points in their trading strategy. Following is a simple guide to these common patterns:

| Pattern | Description | Market Sentiment |

|---|---|---|

| Doji | Open and close are almost equal, indicating indecision. | Neutral |

| Engulfing | A larger body engulfs the previous candlestick, signaling a possible reversal. | Reversal (Bullish/Bearish) |

| Hammer | A candle with a little body and a long lower wick, appearing after a downtrend. | Bullish Reversal |

Identifying Key Reversal Signals for Informed Decision Making

Recognizing key reversal signals is vital for traders aiming to navigate the often turbulent waters of market trends. These signals offer insights that help in identifying potential shifts in market sentiment, providing a crucial edge in decision-making. Among the most prominent candlestick patterns to monitor are:

- Hammer Formation: Found at the bottom of a downtrend, it signifies a potential bullish reversal.

- Inverted Hammer: Similar to the hammer but appears after a downtrend, indicating buyer interest.

- Shooting Star: A bearish reversal pattern that appears after an uptrend, suggesting the potential end of a rally.

- Engulfing Patterns: A two-candle pattern where a small candle is followed by a larger candle with an opposite color, indicating potential reversals.

Incorporating these signals into your trading strategy can enhance your ability to make informed decisions. It’s crucial to combine candlestick patterns with other technical indicators, such as support and resistance levels, to increase accuracy. Utilizing a simple table to outline the psychological implications behind each pattern can further streamline the decision-making process:

| Candlestick Pattern | Psychological Implication |

|---|---|

| Hammer | Bulls gaining strength, potential rebound. |

| Shooting Star | Bears starting to take control, potential downtrend. |

| Engulfing Bullish | Strong buyer momentum, shift from selling to buying. |

| Engulfing Bearish | Strong seller momentum, shift from buying to selling. |

Integrating Candlestick Analysis with Technical Indicators

can significantly enhance a trader’s decision-making process. Candlestick patterns provide visual insight into market sentiment, while technical indicators offer quantifiable metrics to confirm or negate trading hypotheses. By using both methods in conjunction, traders can refine their strategies to improve accuracy and effectiveness. Commonly used indicators that harmonize well with candlestick patterns include:

- Moving Averages: Help identify trends and set dynamic support/resistance levels.

- Relative Strength Index (RSI): Assists in determining the potential overbought or oversold conditions.

- MACD: Provides insights into momentum changes and potential reversals.

To create a robust trading strategy, envision a scenario where a bullish engulfing pattern emerges in conjunction with an RSI value below 30. This convergence signals that the asset may be undervalued and a reversal could be imminent. Conversely, if a shooting star candlestick forms at a resistance level with a MACD divergence, it may indicate a high probability of a downward move. Below is a summary table illustrating the synergy between key candlestick patterns and their corresponding indicators:

| Candlestick Pattern | Preferred Indicator | Signals Confirmation |

|---|---|---|

| Bullish Engulfing | RSI | Potential reversal from oversold |

| Bearish Engulfing | MACD | Confirmation of downward momentum |

| Hammer | Moving Average | Support level validation |

| Shooting Star | Bollinger Bands | Resistance level touch and potential drop |

Developing a Winning Trading Plan Using Candlestick Strategies

Creating an effective trading plan is essential for anyone looking to succeed in the markets, and utilizing candlestick strategies can provide a significant advantage. A well-defined plan should outline your trading goals, risk tolerance, and specific criteria based on candlestick patterns that trigger your buy and sell signals. Consider including the following components in your plan:

- Market Selection: Identify which financial markets resonate with your trading style.

- Candlestick Patterns: Focus on key formations like dojis, hammers, and engulfing patterns.

- Risk Management: Set your stop-loss and take-profit levels based on historical volatility.

- Trade Execution: Define entry and exit strategies with precision to minimize emotional decision-making.

To enhance your trading strategy, keep a detailed journal documenting your trades based on candlestick analyses. This practice helps refine your approach by illuminating what patterns yield success and which do not. Additionally, consider incorporating a simple table to track pivotal candlestick patterns, their meanings, and the suggested actions you can take:

| Candlestick Pattern | Meaning | Action |

|---|---|---|

| Doji | Indecision in the market | Wait for confirmation |

| Hammer | Bullish reversal signal | Consider buying |

| Engulfing | Strong reversal signal | Take position accordingly |

Concluding Remarks

mastering candlestick patterns is not merely a skill but an essential component of becoming a successful trader. As you delve deeper into this powerful technical analysis tool, remember that understanding the nuances of each pattern can significantly enhance your decision-making process in the markets. The insights gained from these visual cues allow traders to interpret market sentiment, identify potential reversals, and establish entry and exit points with greater confidence.

However, it’s crucial to not rely solely on candlestick patterns in isolation. Integrating them with other technical indicators and fundamental analysis will provide a more comprehensive view of market dynamics. Practice is key—the more you familiarize yourself with these patterns and their implications, the more instinctively you will be able to read the market.

As you embark on your trading journey armed with this knowledge, stay disciplined, remain patient, and continuously educate yourself. The world of trading is ever-evolving, and your success hinges on adaptability and a commitment to lifelong learning. Remember, every successful trader started where you are now. With perseverance and the right strategies, you too can navigate the complexities of the market and achieve your trading goals. Happy trading!