Leveraging Fibonacci Retracement for Cryptocurrency Market Analysis

Introduction

In the rapidly evolving landscape of cryptocurrency trading, market participants are constantly seeking reliable tools and methodologies to enhance their analytical capabilities. One such tool that has gained traction among traders and analysts alike is Fibonacci retracement, a technical analysis strategy rooted in ancient mathematics. Known for its ability to identify potential support and resistance levels, Fibonacci retracement provides insights that can significantly influence trading decisions. As cryptocurrencies display unique volatility patterns and market behaviors, integrating Fibonacci retracement into analyses offers traders a structured approach to navigating market fluctuations. This report delves into the principles of Fibonacci retracement, explores its applicability within the cryptocurrency market, and assesses how traders can leverage this technique to optimize their trading strategies. By examining historical price movements and current market trends, we aim to equip readers with a comprehensive understanding of the potential benefits and limitations of using Fibonacci retracement in cryptocurrency trading.

Table of Contents

- Understanding Fibonacci Retracement and Its Application in Cryptocurrency Trading

- Key Levels of Fibonacci Retracement: Identifying Support and Resistance Zones

- Effective Strategies for Integrating Fibonacci Analysis with Market Trends

- Case Studies: Real-World Examples of Successful Fibonacci Utilization in Crypto Markets

- In Conclusion

Understanding Fibonacci Retracement and Its Application in Cryptocurrency Trading

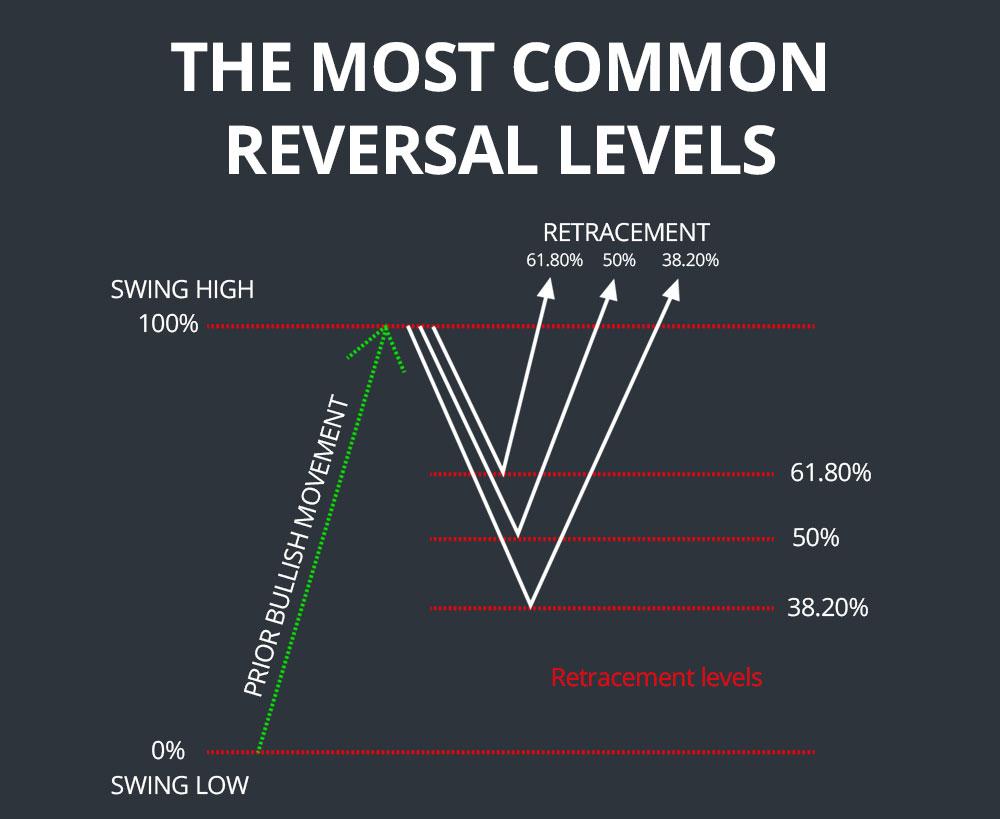

Fibonacci retracement is a technical analysis tool that traders utilize to predict potential reversal levels in asset prices, particularly within the volatile cryptocurrency market. By identifying horizontal lines that correspond to Fibonacci levels, traders can better understand the psychological barriers that buyers and sellers encounter. These retracement levels are derived from the Fibonacci sequence and typically include key percentages such as 23.6%, 38.2%, 50%, 61.8%, and 100%. Traders often look for price action around these levels to gauge possible entry and exit points, making it an essential component of their trading strategy.

To effectively implement Fibonacci retracement in cryptocurrency trading, traders should consider the following key strategies:

- Identify the Trend: Determine whether the market is in an uptrend or downtrend before applying retracement levels.

- Draw Fibonacci Levels: Use the Fibonacci tool to mark significant highs and lows to establish potential support and resistance zones.

- Confirm with Additional Indicators: Combine Fibonacci retracement levels with other technical indicators like volume, moving averages, or RSI to increase reliability.

| Fibonacci Level | Interpretation |

|---|---|

| 0% | Starting point of the trend |

| 23.6% | First potential retracement level |

| 38.2% | Minor support/resistance area |

| 50% | Psychological level often tested |

| 61.8% | Critical level; strong reversal point |

| 100% | End of the retracement |

Key Levels of Fibonacci Retracement: Identifying Support and Resistance Zones

In the volatile realm of cryptocurrency trading, identifying critical price levels is essential for making informed decisions. Fibonacci retracement levels serve as a fundamental tool in this regard, helping traders to discern potential support and resistance zones. By calculating the key Fibonacci levels, specifically 23.6%, 38.2%, 50%, 61.8%, and 76.4%, traders can pinpoint areas where price reversals are likely to occur. Understanding these levels allows traders to set strategic entry and exit points, optimizing their risk-reward ratios during volatile market conditions.

Utilizing historical price data, traders can visually map out Fibonacci retracement levels on charts, creating a framework for market analysis. Commonly, a bullish trend presents the opportunity to buy near the Fibonacci retracement levels, while a bearish trend suggests the possibility of selling or shorting at these zones. The following table summarizes the significance of key Fibonacci levels in trading strategies:

| Fibonacci Level | Market Implication | Action |

|---|---|---|

| 23.6% | Minor Support | Potential Buy |

| 38.2% | Moderate Support | Strong Buy Signal |

| 50% | Key Level | Observe Market Reaction |

| 61.8% | Strong Resistance | Consider Shorting |

| 76.4% | Critical Support | Potential Buy Opportunity |

Effective Strategies for Integrating Fibonacci Analysis with Market Trends

Integrating Fibonacci analysis with market trends can significantly enhance your understanding of cryptocurrency price movements. By identifying key Fibonacci levels, traders can anticipate potential reversal points and price targets. Using Fibonacci retracement alongside other technical indicators, such as moving averages and volume analysis, allows for a more comprehensive view of market dynamics. Consider the following strategies:

- Identify Trend Direction: Before applying Fibonacci levels, determine whether the market is in an uptrend or downtrend to ensure the relevance of your analysis.

- Combine Indicators: Use Fibonacci analysis in conjunction with additional tools like RSI or MACD to confirm entry and exit points.

- Monitor Market Sentiment: Pay attention to news and events in the cryptocurrency space that can affect market trends, ensuring that your Fibonacci levels align with broader market activity.

To visualize potential price action, it’s beneficial to create a table that outlines significant Fibonacci levels alongside the corresponding price movements in recent market trends. Below is an example of how this can be structured:

| Fibonacci Level | Price Level ($) | Market Reaction |

|---|---|---|

| 23.6% | 40,000 | Support |

| 38.2% | 35,000 | Consolidation |

| 61.8% | 30,000 | Resistance |

By continually refining your approach to merging Fibonacci analysis with prevailing market trends, you can develop a more robust trading strategy. This iterative process will enable you to adapt to changing market conditions and seize potential opportunities as they arise.

Case Studies: Real-World Examples of Successful Fibonacci Utilization in Crypto Markets

In the dynamic landscape of cryptocurrency trading, several notable case studies exemplify the success of Fibonacci retracement techniques. One prominent example involved Bitcoin’s price movements during the first quarter of 2021, when traders utilized the 23.6% and 38.2% retracement levels to make informed entry points after periods of significant upward momentum. As Bitcoin surged past its previous all-time high, many traders relied on these Fibonacci levels to identify potential pullbacks and set stop-loss orders, effectively minimizing their risks while maximizing profit potential.

Similarly, in the altcoin market, Ethereum showcased a successful implementation of Fibonacci retracement during its rapid price fluctuations in late 2020. Analysts observed a retracement to the 61.8% level after a strong rally, which prompted investors to re-enter the market with confidence. This strategic move not only helped traders capitalize on the subsequent price rebound but also illustrated the effectiveness of Fibonacci analysis in predicting market movements. The following table highlights key retracement levels and corresponding price reactions observed in these two case studies:

| Crypto Asset | Retracement Level | Market Reaction |

|---|---|---|

| Bitcoin | 23.6% | Support Level for Uptrend |

| Bitcoin | 38.2% | Rebound after Correction |

| Ethereum | 61.8% | Strong Buy Signal Detected |

In Conclusion

the application of Fibonacci retracement levels in cryptocurrency market analysis offers traders a systematic approach to identifying potential support and resistance zones. By understanding the mathematical principles underlying the Fibonacci sequence and its implications for price movement, investors can enhance their decision-making processes and improve their trading strategies.

While no analytical tool guarantees success, incorporating Fibonacci retracement into a broader analytical framework—alongside fundamental analysis and market sentiment—can provide valuable insights. As the cryptocurrency market continues to evolve, keeping abreast of such analytical strategies will be essential for both novice and experienced traders alike.

Ultimately, leveraging Fibonacci retracement not only aids in charting price movements but also fosters a disciplined trading philosophy, which is critical in navigating the often volatile landscape of cryptocurrencies. As with any trading strategy, continuous education and practice will empower investors to adapt to changing market conditions and harness the full potential of Fibonacci analysis in their trading arsenal.