Latest Ethereum Price Trends and Predictions: Insights for Investors

As the cryptocurrency market continues to evolve, Ethereum stands at the forefront, capturing the attention of investors and analysts alike. With its innovative smart contract capabilities and a rapidly growing decentralized finance (DeFi) ecosystem, Ethereum has solidified its position as the second-largest cryptocurrency by market capitalization. However, recent price fluctuations have raised questions about its future trajectory. In this article, we delve into the latest price trends of Ethereum, exploring market dynamics, historical performance, and expert predictions. Our aim is to provide investors with valuable insights to navigate the complexities of the Ethereum landscape, enabling informed decisions in an ever-changing market. Whether you’re a seasoned trader or new to the crypto space, understanding these trends is crucial for capitalizing on potential opportunities in the coming weeks and months.

Table of Contents

- Latest Market Analysis: Understanding Current Ethereum Price Dynamics

- Key Indicators Driving Ethereums Market Performance

- Expert Predictions: What to Expect from Ethereum in the Coming Months

- Investment Strategies: Navigating Volatility in Ethereum Trading

- Insights and Conclusions

Latest Market Analysis: Understanding Current Ethereum Price Dynamics

The current landscape for Ethereum prices is characterized by notable volatility, shaped by a combination of macroeconomic factors and blockchain-specific developments. Recently, Ethereum has seen fluctuating trading volumes, indicating a mixed sentiment among investors. Key influences on this price behavior include:

- Global economic uncertainties affecting investor confidence

- Regulatory news from major markets

- Technological advancements and upgrades within the Ethereum network

- Market sentiment driven by major cryptocurrency exchanges

In the short term, analysts predict potential ranges for Ethereum based on these dynamics. A close examination of recent price movements suggests levels of support and resistance that are critical for investors to watch. The current market indicators show:

| Price Indicator | Value |

|---|---|

| Support Level | $1,500 |

| Resistance Level | $1,800 |

| 24-Hour Price Change | +3.5% |

As Ethereum navigates these challenges, understanding these metrics and the broader economic backdrop will be essential for investors looking to make informed decisions in this ever-evolving market.

Key Indicators Driving Ethereums Market Performance

The performance of Ethereum’s market is intricately tied to several key indicators that investors should closely monitor. One of the most significant factors is the Network Activity, represented by metrics such as the number of active addresses and transaction volumes. High transaction volumes can indicate a growing ecosystem and increased use of decentralized applications (dApps) built on Ethereum, thus pushing demand for Ether (ETH). Additionally, the ratio of new addresses to active addresses provides insight into the influx of new users to the network, which can be a bullish sign for Ethereum’s valuation.

Another critical indicator is Smart Contract Utilization. The rise in decentralized finance (DeFi) platforms utilizing Ethereum’s smart contracts can lead to increased capital locked in these protocols. The total value locked (TVL) in DeFi is a statistic that reflects investor confidence and overall network health; higher TVL typically correlates with rising ETH prices. Furthermore, the upcoming blockchain upgrades, such as the transition to Ethereum 2.0, significantly impact market perceptions and can drive speculation, resulting in price volatility. Here’s a brief look at some of these key indicators:

| Indicator | Current Status | Potential Impact |

|---|---|---|

| Active Addresses | 230,000+ | Higher demand for ETH |

| Transaction Volume | $10 billion/week | Increased usage of dApps |

| Total Value Locked in DeFi | $30 billion | Positive market sentiment |

| Upcoming Network Upgrades | Ethereum 2.0 | Speculation and potential price spikes |

Expert Predictions: What to Expect from Ethereum in the Coming Months

As Ethereum continues to evolve post-merge, industry experts are closely monitoring its performance and potential. According to various analysts, the coming months are projected to offer significant developments that could impact Ethereum’s market dynamics. Key predictions include:

- Increased Institutional Investment: As scalability and efficiency improve, more institutions are likely to enter the Ethereum ecosystem, driving demand.

- Regulatory Clarity: Anticipated regulatory frameworks could provide clearer guidelines for Ethereum, attracting conservative investors.

- Ecosystem Expansion: Continued growth in decentralized finance (DeFi) and non-fungible tokens (NFTs) is expected to bolster Ethereum’s utility and value.

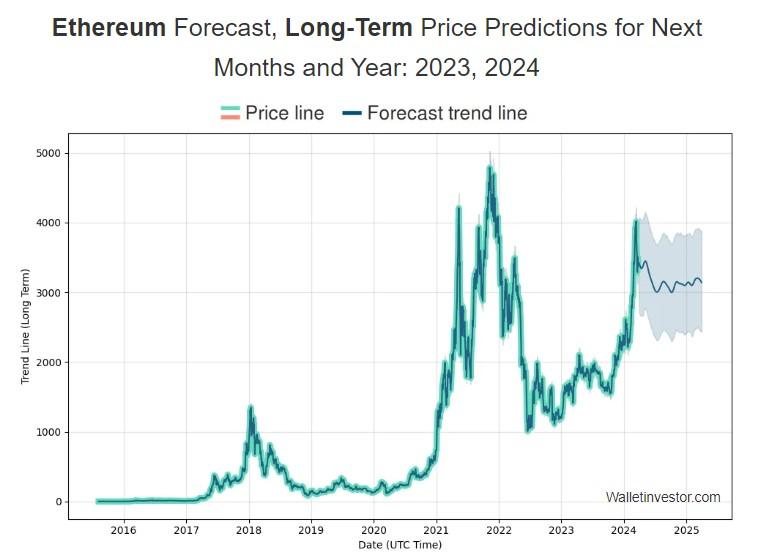

Financial forecasts suggest that Ethereum could see notable price fluctuations influenced by the broader cryptocurrency market trends and macroeconomic factors. Price analysts have set various targets ranging from $2,500 to $4,000 within the next quarter, based on the historical performance and market sentiment. The potential breakout levels are as follows:

| Price Level | Market Sentiment |

|---|---|

| Above $3,000 | Optimistic |

| $2,500 – $2,800 | Neutral |

| Below $2,500 | Pessimistic |

Investment Strategies: Navigating Volatility in Ethereum Trading

In the unpredictable world of Ethereum trading, implementing robust investment strategies is crucial to weathering the storm of price fluctuations. As seasoned traders know, volatility can present both risks and opportunities. By diversifying their portfolios and adopting a balanced approach, investors can mitigate potential losses while still capitalizing on upward trends. Key strategies include:

- Dollar-Cost Averaging: Regularly investing a fixed amount regardless of the price can reduce the impact of volatility.

- Utilizing Stop-Loss Orders: Setting predetermined sell orders helps lock in profits and limit losses during sudden price dips.

- Staying Informed: Keeping abreast of market news and developments significantly aids in making timely decisions.

Analyzing Ethereum’s historical price movements can also reveal patterns that inform trading strategies. For instance, understanding support and resistance levels can provide crucial insights into market behavior. Below is a recent summary of price dynamics reflected in a simple table:

| Date | Opening Price (USD) | Closing Price (USD) | Price Change (%) |

|---|---|---|---|

| October 1, 2023 | $1,650 | $1,700 | +3.03% |

| October 10, 2023 | $1,700 | $1,650 | -2.94% |

| October 20, 2023 | $1,650 | $1,800 | +9.09% |

By carefully monitoring these trends and employing calculated strategies, investors can navigate the often turbulent waters of Ethereum trading with greater confidence and precision.

Insights and Conclusions

as investors navigate the complex landscape of Ethereum, understanding the latest price trends and future predictions is essential for making informed decisions. The market remains highly dynamic, influenced by a multitude of factors including technological advancements, regulatory changes, and macroeconomic conditions. While recent fluctuations in Ethereum’s price have prompted both caution and optimism among stakeholders, the overall sentiment points towards potential growth opportunities. As always, investors should conduct thorough research and consider their risk tolerance before engaging in Ethereum transactions. Staying informed about market developments will be crucial in leveraging Ethereum’s capabilities and positioning oneself strategically in the ever-evolving cryptocurrency market.