Impact of Cryptocurrency Forks on Blockchain Technology Evolution

Introduction

The evolution of blockchain technology has been a transformative journey marked by innovation, adaptation, and occasional upheaval. Among the pivotal events shaping this trajectory are cryptocurrency forks, which serve as critical mechanisms for altering protocol parameters or creating entirely new digital assets. These forks—both hard and soft—have profound implications not only for the cryptocurrencies involved but also for the broader blockchain ecosystem. They offer insights into governance models, community dynamics, and the underlying economic incentives that drive technological advancement. This article delves into the multifaceted impact of cryptocurrency forks on the evolution of blockchain technology, examining their roles in enhancing scalability, promoting decentralization, and fostering resilience against systemic risks. Through a technical lens, we will analyze case studies of notable forks, discuss their consequences on user behavior and network stability, and explore how they influence future developments in this rapidly evolving field. By understanding the nuances of these events, stakeholders can better navigate the complexities of a technology that continues to redefine financial systems across the globe.

Table of Contents

- Impact of Cryptocurrency Forks on Network Security and Stability

- Evaluating the Influence of Hard Forks on Market Dynamics and User Adoption

- The Role of Governance in Managing Forks and Ensuring Blockchain Integrity

- Strategic Recommendations for Stakeholders to Navigate Fork-Related Challenges

- Insights and Conclusions

Impact of Cryptocurrency Forks on Network Security and Stability

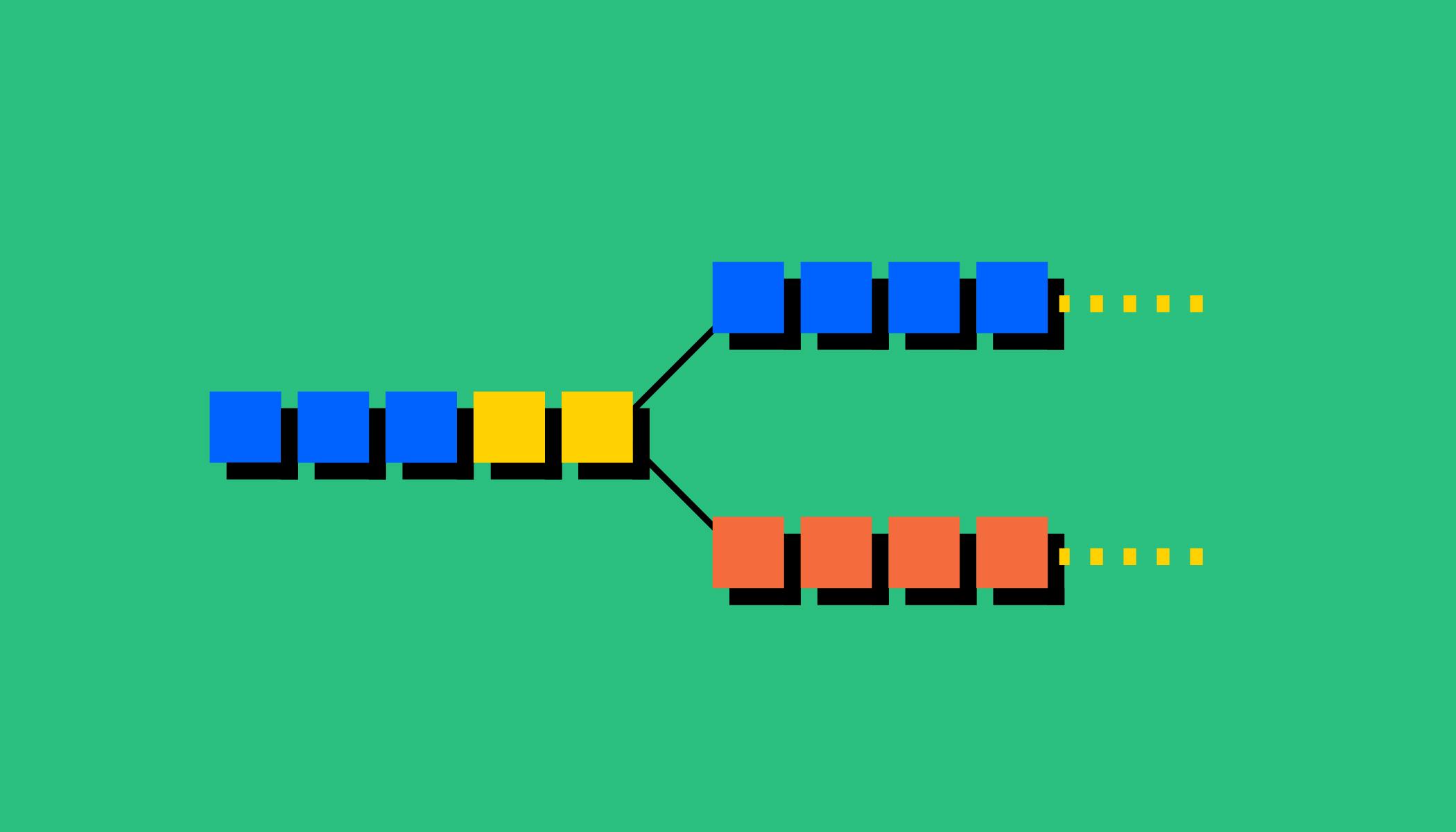

Forks in cryptocurrency networks can significantly influence both security and stability due to the changes they impose on consensus mechanisms and community dynamics. When a fork occurs, especially a contentious one, the original blockchain may split into two or more versions, each with its own distinct set of rules. This bifurcation can create uncertainties regarding which chain will gain the most support, leading to potential vulnerabilities as users and miners redistribute their resources among the competing networks. As a result, the very act of forking can dilute the security model of the original chain, exposing it to increased risks of attacks such as double spending and hash rate manipulation.

Moreover, the repercussions of a fork extend beyond immediate security threats; they also affect the stability of the cryptocurrency ecosystem. Increased fragmentation can lead to lowered market confidence and contribute to price volatility, as investors may be uncertain about which version of a cryptocurrency to support. The underlying technology may also face disruption, as developers might refocus efforts on the new fork rather than improving the original blockchain. To illustrate, consider the following table outlining the potential impacts of various types of forks:

| Type of Fork | Potential Impact on Security | Potential Impact on Stability |

|---|---|---|

| Hard Fork | Increased Risk of attacks due to network split | Price Volatility due to uncertainty |

| Soft Fork | Generally Stable if consensus is achieved | Less Disruption to market confidence |

| Contentious Fork | Higher Vulnerability as communities diverge | Instability as investors choose sides |

Evaluating the Influence of Hard Forks on Market Dynamics and User Adoption

The occurrence of hard forks in cryptocurrency networks often brings a wave of excitement and volatility, significantly influencing both market dynamics and user behavior. These forks can lead to the creation of new tokens, which may attract speculative investment as traders react to the perceived value of the new assets. Users may adopt a forked version of a cryptocurrency for several reasons, including enhanced features, improved governance, or better scalability. The following factors contribute to the overall impact on the market:

- Price Volatility: Hard forks frequently trigger sharp price fluctuations, driven by market speculation and investor sentiment.

- User Segmentation: Different communities may emerge around divergent blockchain protocols, affecting network utility.

- Adoption Rates: The rate of user adoption for the forked version can vary significantly, impacting long-term viability.

In terms of technological progress, hard forks serve as a testing ground for innovation within the blockchain ecosystem. They often lead to enhanced functionalities which can be appealing to users and developers alike. The differentiation of applications post-fork allows for comparative analysis and provides insights into user preferences that can further refine development efforts. Below is a summarization of notable hard forks and their implications:

| Fork Name | Initial Release | Key Features |

|---|---|---|

| Bitcoin Cash | 2017 | Increased block size for faster transaction speeds |

| Ethereum Classic | 2016 | Staying true to the original Ethereum protocol post-Da DAO hack |

| Litecoin Cash | 2018 | Enhanced ASIC resistant algorithm and faster block generation |

The Role of Governance in Managing Forks and Ensuring Blockchain Integrity

Effective governance structures play a pivotal role in managing forks within blockchain networks, ensuring that the integrity and continuity of the technological framework remain intact. The governance process often involves stakeholder engagement, which allows for a variety of opinions to be considered when making decisions about protocol changes or upgrades. This collaborative approach helps to minimize resistance and potential fragmentation that can arise from unexpected forks. Key elements of governance in this context include:

- Consensus Mechanisms: Facilitating agreement across nodes to prevent uncontrolled bifurcations.

- Community Input: Engaging users, developers, and miners to ensure diverse perspectives are evaluated.

- Transparent Communication: Keeping stakeholders informed about proposed changes fosters trust and reduces conflicts.

Furthermore, the establishment of clear guidelines for when and how forks should occur is essential in maintaining the blockchain’s reliability and security. Governance frameworks often delineate the types of forks—such as soft forks, which are backward compatible, and hard forks, which result in a split—and their potential ramifications. By delineating these processes, stakeholders can navigate forks with a clearer understanding of their impact. For example, the table below illustrates various types of forks along with their characteristics:

| Type of Fork | Compatibility | Impact on Users |

|---|---|---|

| Soft Fork | Backward Compatible | Minimal disruption |

| Hard Fork | Not Backward Compatible | Potential split in community |

Strategic Recommendations for Stakeholders to Navigate Fork-Related Challenges

In light of the complexities introduced by cryptocurrency forks, stakeholders must adopt a proactive approach to mitigate associated risks and harness potential opportunities. Developing a robust communication strategy is paramount, allowing stakeholders to articulate their vision and maintain clarity amidst the confusion that often surrounds fork announcements. Engaging with the community through forums and social media can build trust and preemptively address potential conflicts. Additionally, stakeholders should conduct rigorous risk assessments that cover various scenarios linked to forks, enabling them to prepare for price volatility and shifts in user adoption. By investing in educational initiatives, key players can inform users about the implications and benefits of different forks, helping to create a more informed ecosystem.

Furthermore, it is crucial for stakeholders to forge strategic partnerships with developers and blockchain experts to stay ahead of technological advancements and regulatory changes. Creating a flexible technical infrastructure can aid in adapting to sudden shifts that may arise from forks, such as changes to consensus protocols or governance models. Combined with a diversified investment strategy, stakeholders can better navigate the uncertainties posed by forks. Regularly attending industry conferences and participating in working groups can also facilitate knowledge-sharing, ensuring stakeholders remain at the forefront of effective fork management. Below is a summary table illustrating key recommendations:

| Strategic Focus | Description |

|---|---|

| Communication Strategy | Maintain transparency and clarity about fork implications. |

| Community Engagement | Build trust through active participation in discussions. |

| Risk Assessment | Evaluate various scenarios associated with forks. |

| Educational Initiatives | Inform the community about forks and their impact. |

| Technical Partnerships | Collaborate with experts to adapt to changes. |

Insights and Conclusions

the impact of cryptocurrency forks on the evolution of blockchain technology is both profound and multifaceted. As we have explored, forks serve as catalysts for innovation, enabling developers to experiment with new features, enhance security protocols, and address scalability challenges. Each fork not only reflects the divergent philosophies and priorities within the cryptocurrency ecosystem but also contributes to a richer tapestry of blockchain applications.

While hard forks can lead to fragmentation and potential market confusion, they also provide opportunities for communities to realign, adapt, and solidify their vision for decentralized networks. Conversely, soft forks exemplify the collaborative spirit intrinsic to open-source development, allowing for incremental improvements without disrupting the existing consensus.

As the blockchain landscape continues to mature, understanding the role of forks will be crucial for stakeholders ranging from developers and investors to regulators and academics. By appreciating the historical context and technical implications of these bifurcations, we can better navigate the evolving digital economy. Ultimately, the ability of blockchain technology to adapt and innovate in response to these forks will determine its sustainability and relevance in the rapidly changing technological landscape. As we look ahead, it is imperative to anticipate further developments and engage in thoughtful dialogue about the future of blockchain and its myriad applications.