Global Wealth Redistribution: The Impact of Bitcoin Trends

As the world grapples with widening economic disparities, the rise of digital currencies like Bitcoin is reshaping the conversation around wealth redistribution. Initially hailed as a revolutionary financial tool, Bitcoin has evolved from a niche investment to a potential catalyst for change in global economic dynamics. This article delves into the intricate relationship between Bitcoin trends and wealth redistribution, exploring how decentralized finance is empowering individuals in economically marginalized regions, challenging traditional financial systems, and influencing policy discussions worldwide. With an increasing number of people turning to cryptocurrencies as an alternative to conventional financial mechanisms, understanding the implications of this digital transformation becomes critical for policymakers, investors, and citizens alike. As we navigate this evolving landscape, we will examine the multifaceted effects of Bitcoin on wealth distribution and consider its potential to redefine the financial future for millions.

Table of Contents

- Global Economic Inequalities and the Role of Bitcoin in Wealth Redistribution

- Analyzing Bitcoin Trends: A Catalyst for Financial Inclusion in Developing Nations

- Regulatory Frameworks: Balancing Innovation and Protection in Cryptocurrency Markets

- Strategic Recommendations for Stakeholders to Harness Bitcoin for Equitable Growth

- In Summary

Global Economic Inequalities and the Role of Bitcoin in Wealth Redistribution

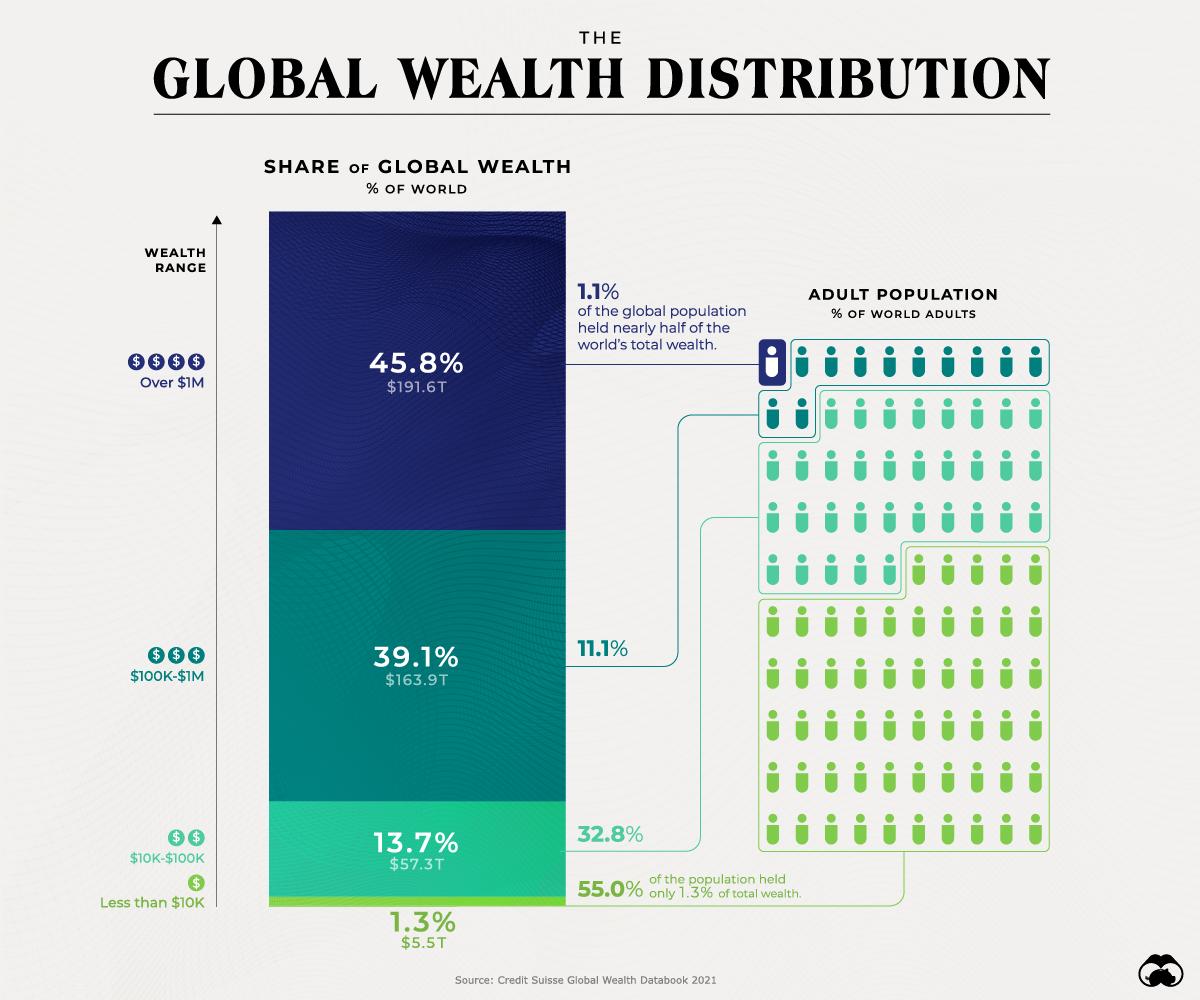

As the gap between the rich and the poor continues to widen globally, traditional economic systems often fail to address the needs of those at the lower end of the wealth spectrum. In this context, Bitcoin emerges as a potential tool for wealth redistribution, offering a glimpse into a decentralized financial future. By providing access to financial systems through blockchain technology, Bitcoin allows individuals in developing countries, often marginalized by traditional banking institutions, to engage in the global economy. As a borderless currency, it challenges the conventional limitations imposed by central banks, enabling users to control their own assets without intermediaries.

Moreover, Bitcoin’s programmable nature fosters innovation in wealth distribution mechanisms, such as smart contracts that can automate and secure transactions in a transparent manner. By effectively lowering transaction costs and increasing transaction speed, Bitcoin could redefine charity and remittance channels. The potential to create decentralized platforms for fundraising and wealth transfer highlights how cryptocurrency can empower communities to forge their own economic paths. An exploration of Bitcoin adoption trends shows the growing acceptance in regions experiencing high economic inequality, suggesting that this digital currency might play a pivotal role in rebalancing the scales of wealth:

| Region | Bitcoin Adoption Rate | Economic Inequality Index |

|---|---|---|

| Africa | 33% | 0.45 |

| Southeast Asia | 25% | 0.39 |

| Latin America | 20% | 0.49 |

Analyzing Bitcoin Trends: A Catalyst for Financial Inclusion in Developing Nations

The potential of cryptocurrency, especially Bitcoin, has emerged as a beacon of hope for financial inclusion in developing nations. As traditional banking systems often overlook vast segments of the population, Bitcoin adoption is providing an alternative pathway for individuals to access financial services. By leveraging mobile phones and the Internet, many unbanked individuals are gaining access to global financial markets, enabling them to participate in economic activities that were previously out of reach. This decentralization of finance not only empowers individuals but also encourages economic resilience in regions plagued by political instability and economic disparity.

As Bitcoin trends continue to evolve, they are reshaping the landscape of wealth distribution on a global scale. Key aspects of this revolution include:

- Low Transaction Fees: Compared to traditional remittance systems, Bitcoin transactions offer significant cost savings, which is essential for those in rural areas.

- Borderless Transactions: Individuals can transfer value across borders instantly without the need for intermediaries, reducing reliance on potentially corrupt financial institutions.

- Access to Investment Opportunities: Bitcoin opens new avenues for investment, allowing users in developing nations to access and participate in global markets.

Moreover, the increasing acceptance of Bitcoin by everyday merchants in developing nations highlights a growing trust in digital currencies. The following table illustrates a few examples of country-specific Bitcoin adoption rates and their implications for local economies:

| Country | Bitcoin Adoption Rate (%) | Potential Economic Impact |

|---|---|---|

| Nigeria | 32 | Increased remittances and local business transactions. |

| Philippines | 25 | Boosted access to online jobs and freelance work. |

| Argentina | 21 | Protection against inflation and currency devaluation. |

Regulatory Frameworks: Balancing Innovation and Protection in Cryptocurrency Markets

As cryptocurrency markets continue to evolve, the need for a robust regulatory framework becomes increasingly critical. This balance ensures that innovation can flourish while also providing essential protections for consumers and investors. Governments and regulatory bodies worldwide are exploring various approaches to create an environment conducive to growth yet secure from potential risks such as fraud and market manipulation. Key considerations include:

- Consumer protection: Safeguarding individuals against scams and ensuring their investments are secure.

- Market integrity: Establishing rules to prevent market abuse and enhance transparency.

- Encouraging innovation: Creating a regulatory landscape that promotes technological advancement without stifling creativity.

Countries differ significantly in their approach, leading to a patchwork of regulations that can complicate cross-border activity. Some nations are embracing more permissive regulations to encourage growth and investment, while others take a more cautious stance, prioritizing oversight. This divergence raises questions of competitiveness on the global stage. In assessing regulatory efficiency, it’s crucial to monitor the impact of these frameworks on market dynamics. A comparative analysis can provide insights into effective strategies:

| Country | Regulatory Approach | Market Impact |

|---|---|---|

| United States | Mixed | Growth with stable risks |

| China | Restrictive | Reduction in trading volume |

| Switzerland | Proactive | Increased investment inflow |

Strategic Recommendations for Stakeholders to Harness Bitcoin for Equitable Growth

To maximize the benefits of Bitcoin for equitable growth, stakeholders must adopt a multifaceted approach that involves collaboration, education, and innovation. First and foremost, governments and regulatory bodies should establish clear and constructive policies that encourage the use of Bitcoin while protecting consumers and promoting inclusivity. This can be achieved by:

- Creating favorable tax regimes for cryptocurrency transactions.

- Facilitating access to Bitcoin education programs that target underserved communities.

- Collaborating with financial institutions to develop products that leverage Bitcoin for efficient wealth distribution.

Furthermore, nonprofit organizations and local businesses should engage in grassroots efforts to raise awareness about Bitcoin’s potential for financial inclusion. By fostering partnerships and community-based initiatives, it’s possible to create a network that empowers individuals through direct access to Bitcoin and blockchain technology. Effective strategies may include:

- Establishing local Bitcoin exchanges to allow for peer-to-peer trading.

- Utilizing Bitcoin as a medium for microfinance, enabling entrepreneurs to gain access to capital.

- Implementing educational workshops that focus on understanding cryptocurrencies and their benefits.

| Stakeholder | Recommended Action |

|---|---|

| Governments | Establish supportive policies for Bitcoin adoption |

| Nonprofits | Develop community-focused Bitcoin education |

| Financial Institutions | Create inclusive Bitcoin financial products |

In Summary

the trends surrounding Bitcoin and its growing adoption highlight a pivotal moment in the landscape of global wealth distribution. As cryptocurrency continues to challenge traditional financial systems, it has the potential to democratize access to capital and empower underserved populations worldwide. However, the volatility and regulatory uncertainties associated with Bitcoin underscore the need for thoughtful frameworks that protect investors while fostering innovation. As we move forward, the ongoing dialogue surrounding Bitcoin’s role in wealth redistribution will be crucial in shaping a more equitable financial future. Stakeholders across the globe—from policymakers to investors—must remain vigilant and proactive in addressing the challenges and opportunities presented by this dynamic digital asset. Only through collaborative efforts can we harness the transformational power of Bitcoin to create lasting change in the global economy.