Exploring Token Standards: ERC-20 and ERC-721’s Impact on Crypto

In the rapidly evolving landscape of blockchain technology, token standards play a pivotal role in defining the functionality and interoperability of digital assets. Among the most influential standards are ERC-20 and ERC-721, which have respectively transformed fungible and non-fungible token (NFT) ecosystems. This article delves into the intricacies of these Ethereum token standards, examining their architecture, use cases, and the profound impact they have had on the cryptocurrency space. By analyzing the technical specifications and practical applications of ERC-20 and ERC-721, we aim to elucidate how these frameworks not only facilitate seamless transactions and asset management but also lay the groundwork for innovative decentralized applications (dApps) and digital economies. As we explore the implications and future developments of these token standards, we underscore their significance in shaping the broader narrative of blockchain technology and its potential to disrupt traditional markets.

Table of Contents

- Understanding ERC-20: The Foundation of Fungible Tokens in Cryptocurrency

- Analyzing ERC-721: Non-Fungible Tokens and Their Unique Value Proposition

- Comparative Analysis of ERC-20 and ERC-721: Use Cases and Market Implications

- Future Recommendations for Developers: Leveraging Token Standards for Innovation

- Concluding Remarks

Understanding ERC-20: The Foundation of Fungible Tokens in Cryptocurrency

In the realm of cryptocurrency, the ERC-20 standard plays a crucial role in defining how fungible tokens operate on the Ethereum blockchain. As a technical standard for tokens, it enables developers to create their own assets that adhere to a set of common rules and interfaces, fostering compatibility across various projects and platforms. The significance of ERC-20 lies in its simplicity and flexibility, which have catalyzed the growth of decentralized applications (dApps) and facilitated Initial Coin Offerings (ICOs). With features such as transferability, balance tracking, and allowance mechanisms, ERC-20 tokens can seamlessly interact with wallets, exchanges, and other smart contracts, creating an interconnected ecosystem of digital assets.

Among the notable benefits of utilizing the ERC-20 standard are its standardized functions and events, which help streamline the development process and enhance user experience. Some essential components include:

- transfer() – Facilitates the movement of tokens between accounts.

- approve() – Allows a third party to manage a set amount of tokens on behalf of the token owner.

- transferFrom() - Enables a designated spender to transfer tokens from the owner’s account.

This standardized framework not only promotes security but also simplifies the integration of tokens with existing platforms and wallets. The widespread adoption of ERC-20 has fundamentally changed the way we perceive and utilize digital currencies, establishing a foundation for innovation and collaboration within the blockchain space.

Analyzing ERC-721: Non-Fungible Tokens and Their Unique Value Proposition

Non-fungible tokens (NFTs), represented by the ERC-721 standard, have redefined ownership in the digital landscape by providing each token with unique properties that distinguish them from one another. Unlike ERC-20 tokens, which are fungible and identical, ERC-721 tokens can represent anything from digital art and music to virtual real estate and game assets. This uniqueness allows for a robust framework to establish provenance, ownership, and authenticity of digital assets. As such, the value of each NFT is inherently tied to its rarity and the demand for the specific asset it represents. The implications for creators and collectors are significant, as they are empowered to trade unique digital objects in ways that were previously impossible.

The practical use cases of ERC-721 are expanding rapidly across various industries, fostering a new ecosystem where digital ownership can be monetized effectively. Some notable applications include:

- Digital Art: Artists can tokenize their work, ensuring scarcity and enabling direct sales to consumers.

- Gaming: Players can own and trade in-game items, which can have real-world monetary value.

- Collectibles: Unique collectibles, such as trading cards or virtual pets, can be created and traded among enthusiasts.

- Real Estate: Virtual property ownership in metaverse environments verified through NFTs allows seamless transactions.

This unique value proposition has attracted substantial investment in the NFT space, leading to a thriving market where collectors actively seek out rare items. The ability to establish and verify ownership digitally using blockchain technology opens up new revenue models and creates opportunities for innovation across various sectors.

Comparative Analysis of ERC-20 and ERC-721: Use Cases and Market Implications

ERC-20 and ERC-721 represent two foundational token standards in the Ethereum ecosystem, each serving distinct purposes and catering to different market needs. ERC-20 tokens are fungible, meaning that each token is identical and interchangeable with another of the same kind, similar to currencies. This interchangeability makes them ideal for various applications such as initial coin offerings (ICOs), decentralized finance (DeFi) protocols, and payment systems. In contrast, ERC-721 tokens are non-fungible, meaning each token is unique and cannot be replaced with another. This uniqueness facilitates the creation of digital collectibles, artworks, and gaming assets, revolutionizing how ownership and provenance are tracked in the digital realm.

Market implications of these token standards are profound. For instance, while ERC-20 tokens have become the backbone of many new projects focusing on capital generation and liquidity, resulting in a highly competitive market landscape, ERC-721 tokens have thrived in niche markets, such as art and gaming, creating communities built around scarce digital assets. The surge in popularity of platforms like OpenSea for NFT trading underscores the economic potential of ERC-721 tokens, which has led to new monetization models and enhanced engagement between creators and collectors. Understanding these dynamics is crucial for stakeholders aiming to navigate the intricate web of opportunities presented by both standards.

| Token Standard | Type | Use Cases | Market Impact |

|---|---|---|---|

| ERC-20 | Fungible |

|

High liquidity and widespread adoption |

| ERC-721 | Non-Fungible |

|

Niche markets with strong community engagement |

Future Recommendations for Developers: Leveraging Token Standards for Innovation

As the utility of token standards continues to expand, developers should focus on experimenting with hybrid models and integrating features from both ERC-20 and ERC-721 to create innovative applications. By combining fungible and non-fungible attributes, it is possible to develop unique financial products that capture the advantages of both standards. For example, protocols that allow the issuance of fungible tokens representing shares in an NFT-based asset can pave the way for decentralized finance (DeFi) solutions that enable fractional ownership. This approach not only enhances liquidity but also increases accessibility for a wider range of users.

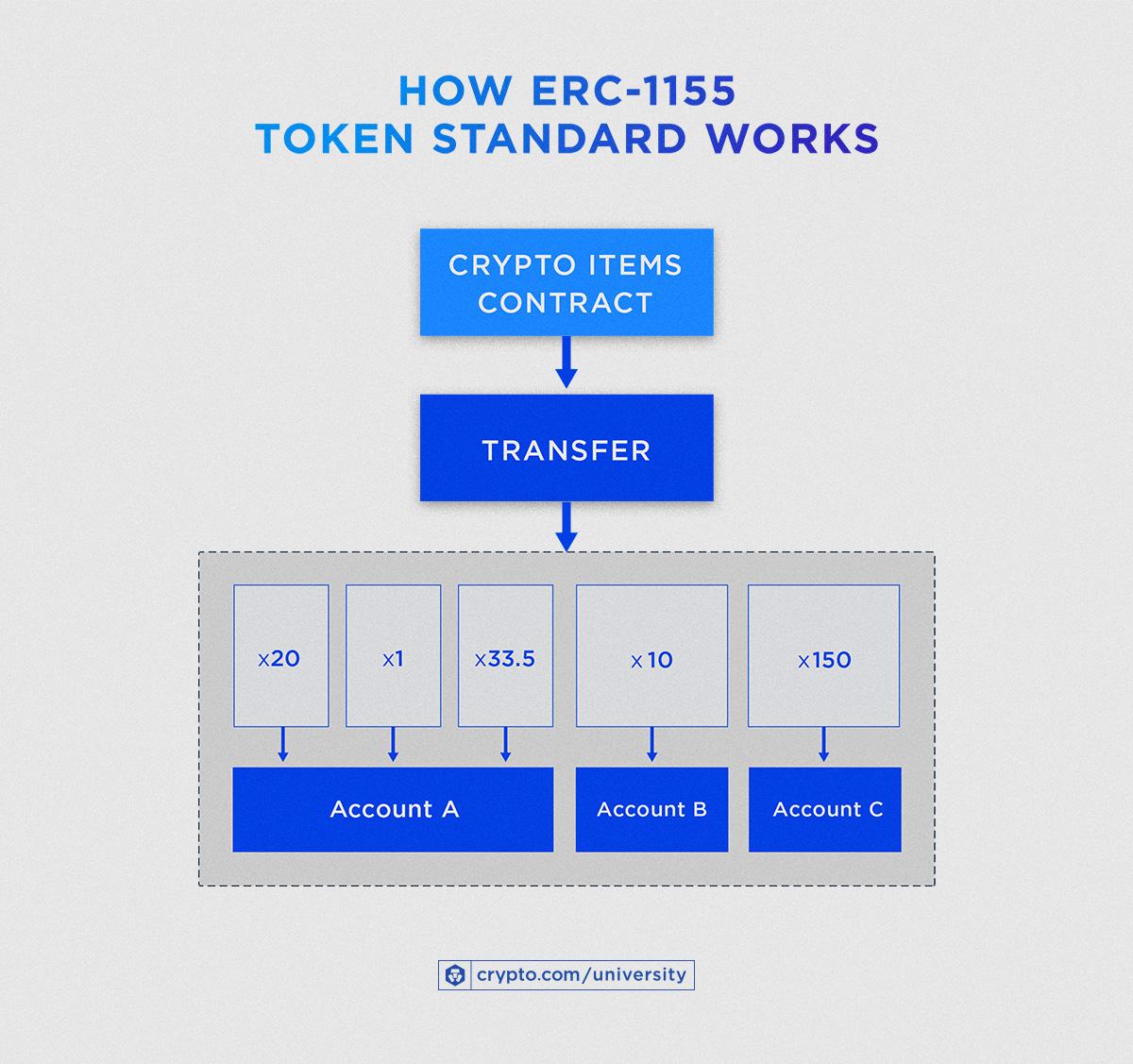

Moreover, developers should prioritize the adoption of interoperability protocols that facilitate seamless interaction among multiple blockchain networks. By leveraging standards such as ERC-1155, which allows for the creation of multi-token contracts, developers can design applications that foster cross-chain functionalities. Implementing features like decentralized marketplaces and cross-platform ecosystems will allow projects to capture diverse user bases and network effects. Additionally, investing in user-friendly interfaces and robust documentation will empower creators to efficiently utilize these standards, encouraging innovation and broadening the developer community.

Concluding Remarks

the exploration of token standards such as ERC-20 and ERC-721 underscores their pivotal roles in shaping the cryptocurrency landscape. As foundational frameworks, these standards not only facilitate the seamless creation and management of digital assets but also enhance interoperability and user engagement across diverse blockchain applications. ERC-20 has become synonymous with fungible tokens, streamlining the issuance of cryptocurrencies and enabling liquidity within decentralized finance (DeFi) ecosystems. Conversely, ERC-721 has paved the way for the emergence of non-fungible tokens (NFTs), unlocking new avenues for digital ownership and creative expression.

The continuous evolution of these token standards, alongside emerging technologies, will undoubtedly influence future innovations within the crypto space. As developers and projects adopt and adapt these standards, the potential for new business models, monetization strategies, and decentralized applications expands exponentially. Ultimately, understanding the implications of ERC-20 and ERC-721 is essential for stakeholders looking to navigate and leverage the complex and dynamic world of blockchain technology efficiently. The impact of these token standards is far-reaching, driving forward the next generation of digital interactions while laying the groundwork for the decentralized economy of tomorrow.