Exploring Options Trading: A Key to Portfolio Diversification

In today’s ever-evolving financial landscape, investors are constantly seeking innovative strategies to enhance their portfolios and manage risk effectively. Amidst the myriad of investment options available, options trading stands out as a powerful tool for diversification. Unlike traditional buying and selling of stocks, options offer unique benefits that can help investors hedge against market volatility, generate additional income, and capitalize on potential price movements. In this article, we will delve into the intricacies of options trading, exploring its fundamental concepts, practical applications, and how embracing this strategy can ultimately bolster your investment portfolio. Whether you’re a seasoned trader or a novice exploring new avenues, understanding options trading can be the key to unlocking greater financial resilience and opportunity in a competitive market. Join us as we embark on this journey to demystify options and discover how they can play a pivotal role in your investment strategy.

Table of Contents

- Understanding the Fundamentals of Options Trading for Diversification

- Strategies for Incorporating Options into Your Investment Portfolio

- Risk Management Techniques When Trading Options

- Evaluating Market Conditions: Timing Your Options Trades for Success

- In Retrospect

Understanding the Fundamentals of Options Trading for Diversification

Options trading is a powerful tool that can bolster your portfolio by providing effective strategies for diversification. Understanding the fundamentals of options is crucial for investors looking to leverage their holdings without solely relying on traditional stocks and bonds. By engaging with options, you can manage risks, hedge against market downturns, and potentially enhance returns. Here are a few key concepts to grasp:

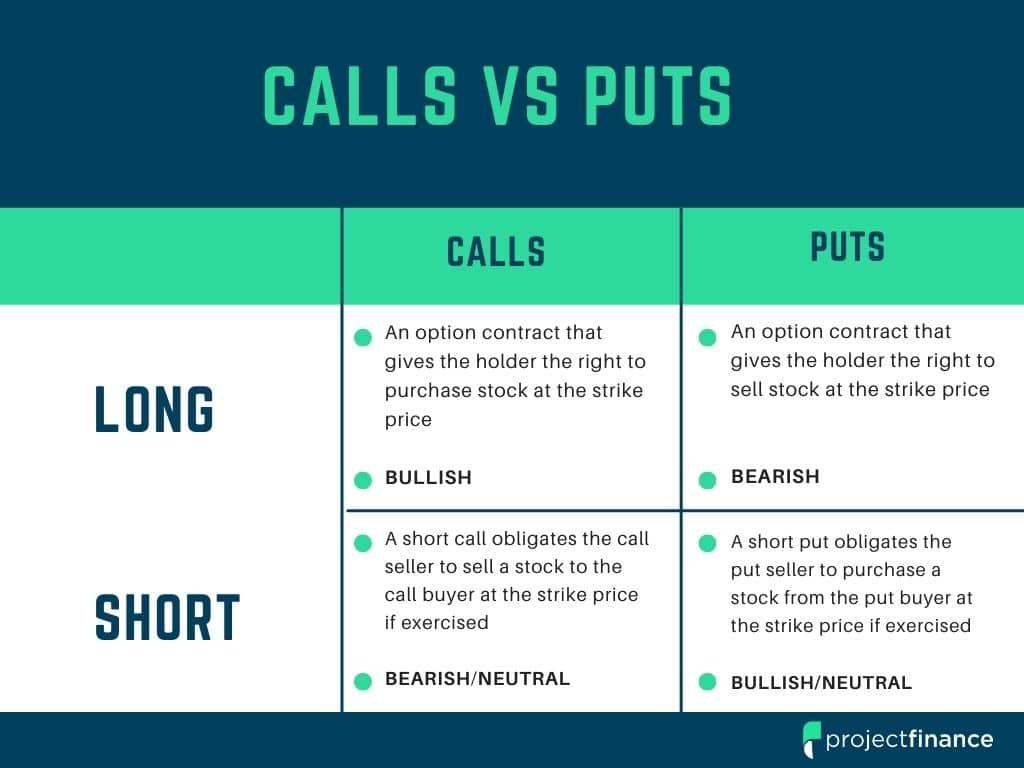

- Call and Put Options: A call option gives you the right to buy an asset at a predetermined price before a specific expiration date, while a put option allows you to sell an asset under similar terms.

- Leverage: Options can provide exposure to larger positions with a smaller capital outlay, which can amplify returns or losses.

- Expiry and Strike Price: Each option has an expiration date and a strike price, which are critical factors in determining its value and potential profitability.

Moreover, investing in options opens up a myriad of strategies that cater to varying risk tolerances and market outlooks. For example, using covered calls involves holding a long position in an asset while selling a call option on that same asset, generating additional income from the premium received. Another approach is the protective put, where an investor buys a put option to hedge against a decline in the value of a stock they own. Here’s a simple table illustrating these strategies:

| Strategy | Purpose | Risk/Reward |

|---|---|---|

| Covered Call | Generate income from premiums | Limited upside, but some downside protection |

| Protective Put | Insure against downside risk | Limited loss if stock drops, reduced gain potential |

By incorporating these options trading strategies, you can craft a portfolio that is not only diversified but also more resilient to market fluctuations. This allows for a sophisticated approach to investing that transcends traditional methods, paving the way for steady growth and risk management.

Strategies for Incorporating Options into Your Investment Portfolio

Incorporating options into your investment portfolio can enhance flexibility and protect against market volatility. One effective strategy is hedging, which allows you to safeguard your investments by purchasing put options. This means if the market takes a downturn, the gains from your put options can offset losses in your stock holdings. Additionally, consider using covered calls. This tactic involves selling call options on stocks you already own. By doing this, you can generate extra income through the premiums received, effectively lowering your overall cost basis on the investment while agreeing to sell at a predetermined price.

Another valuable approach is the use of spreads, which can help limit risk while maintaining the potential for profits. For instance, a bull call spread involves buying a call option at a lower strike price and selling another call at a higher strike price. This can create a situation where you benefit from upward price movements, but your potential losses are capped. Furthermore, investors might explore strategies like straddles and strangles, which enable you to capitalize on significant market movement in either direction. By setting specific entry and exit points, you can effectively manage risk while seeking to diversify your portfolio.

| Strategy | Purpose | Risk Level |

|---|---|---|

| Hedging | Protect against losses | Moderate |

| Covered Calls | Generate income | Low |

| Bull Call Spread | Profit from upward movement | Moderate |

| Straddles | Capitalize on volatility | High |

Risk Management Techniques When Trading Options

Managing risk is an essential element for success in options trading, as market volatility can introduce significant challenges. One effective technique is to set stop-loss orders, which automatically sell your options if they fall below a specified price. This limits potential losses and protects your capital. Another method is to utilize diversification within your options strategy. By spreading your investments across different sectors or underlying assets, you can reduce the risk associated with any single trade. Moreover, employing a risk-reward ratio approach helps traders evaluate the potential return on their investment compared to the risk taken, guiding more informed and deliberate trading decisions.

In addition to these strategies, keeping a close watch on implied volatility is crucial. Understanding how volatility impacts options pricing can help you time your trades more effectively. Moreover, utilizing position sizing can further enhance risk management; by allocating a small percentage of your total capital to each trade, you can minimize the impact of any one trade on your overall portfolio. Below is a simple table illustrating effective risk management techniques:

| Technique | Description |

|---|---|

| Stop-Loss Orders | Automated selling of options at a predetermined price to limit losses. |

| Diversification | Investing in various sectors or assets to mitigate risk. |

| Risk-Reward Ratio | Assessment of potential profit versus risk for informed trading. |

| Implied Volatility | Monitoring volatility to gauge trading opportunities. |

| Position Sizing | Limiting investment in any trade to a small percentage of total capital. |

Evaluating Market Conditions: Timing Your Options Trades for Success

Successfully navigating options trading hinges on your understanding of market conditions. Key indicators can help you identify the right moment to enter or exit a trade. Consider these factors:

- Market Volatility: High volatility can create opportunities but also increases risk. Assess the VIX (Volatility Index) for insights.

- Economic Indicators: Monitor reports like GDP growth, unemployment rates, and inflation that signal market shifts.

- Technical Analysis: Utilize charts and patterns to predict future price movements. Look for support and resistance levels.

Timing your trades requires both strategy and intuition. Traders often rely on a mix of fundamental and technical analyses to bolster their decision-making. To illustrate this, refer to the following table showcasing essential economic indicators:

| Indicator | Frequency | Market Impact |

|---|---|---|

| GDP Growth Rate | Quarterly | High |

| Unemployment Rate | Monthly | High |

| Consumer Price Index (CPI) | Monthly | Medium |

In Retrospect

exploring options trading presents an invaluable opportunity for investors looking to diversify their portfolios and mitigate risk. While it offers flexibility and the potential for enhanced returns, options trading also requires a thorough understanding of the mechanics involved and a cautious approach to strategy implementation. As with any investment, education is paramount; by taking the time to grasp the fundamentals of options, you can unlock a powerful tool that complements your existing investment strategies.

As you venture into the world of options trading, remember that successful diversification is not merely about expanding the number of assets in your portfolio, but rather about strategically balancing risk and return. Engage with educational resources, consider leveraging demo accounts, and possibly consult professionals who can guide you through the complexities of the options market.

With this knowledge at your disposal, you can navigate the intricate landscape of options trading with confidence, ultimately fortifying your investment approach and paving the way for sustainable growth. Embrace this dynamic segment of financial strategy, and watch as your portfolio evolves into a more resilient and adaptable investment vehicle. Happy trading!