Expert Insights: Bitcoin Price Predictions for the Next Year

As the cryptocurrency market continues to evolve, the spotlight remains firmly fixed on Bitcoin, the pioneering digital asset that has seen both meteoric rises and dramatic falls. With the end of the year approaching, investors, analysts, and enthusiasts alike are keenly assessing the landscape to formulate their strategies for 2024. In this article, we delve into expert insights and predictions regarding Bitcoin’s price trajectory over the next year. By examining market trends, technological advancements, macroeconomic factors, and regulatory developments, we aim to provide a comprehensive overview of what the future may hold for this influential cryptocurrency. As Bitcoin navigates its path through an increasingly complex financial ecosystem, understanding these expert perspectives will be crucial for anyone looking to make informed decisions in the dynamic world of digital currencies.

Table of Contents

- Market Trends and Economic Factors Influencing Bitcoin Prices

- Technological Developments and Their Impact on Investor Sentiment

- Expert Predictions: Bullish and Bearish Scenarios for 2024

- Strategic Investment Recommendations for Navigating Market Volatility

- In Conclusion

Market Trends and Economic Factors Influencing Bitcoin Prices

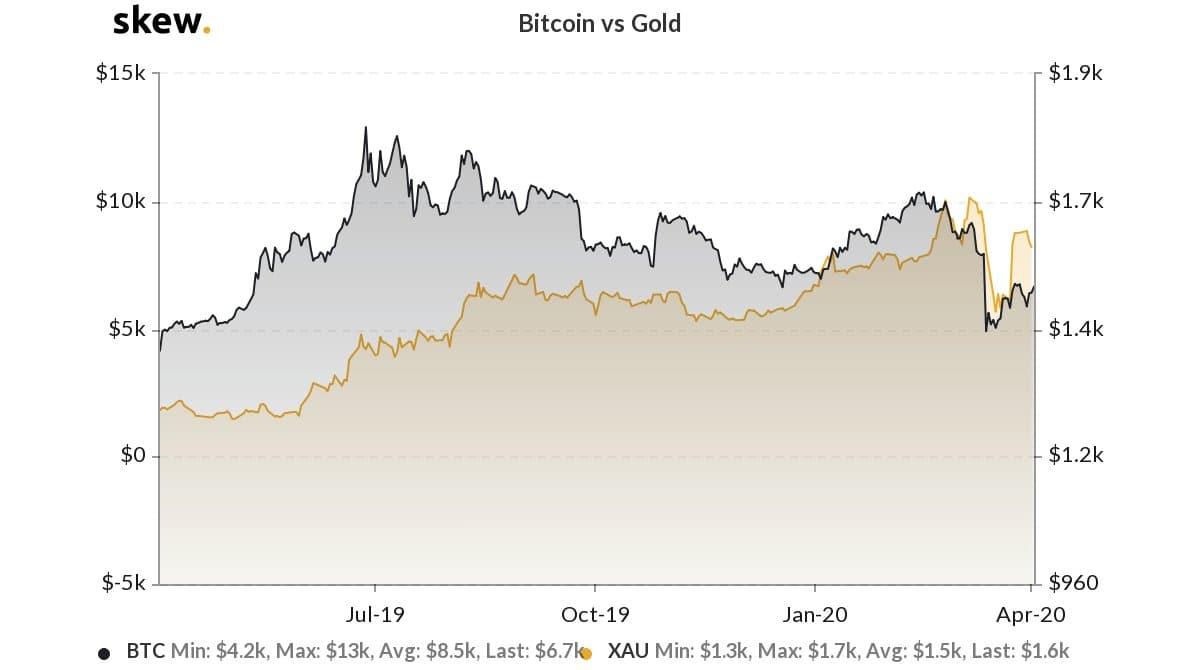

The current landscape for Bitcoin prices is heavily influenced by a multitude of market trends and economic factors. Increased institutional adoption continues to play a pivotal role, as large corporations and investment funds allocate funds to cryptocurrency assets. This trend is often supported by the growing legitimacy of Bitcoin as an asset class, alongside regulatory developments that are becoming more favorable. Additionally, macroeconomic conditions, such as inflation rates and monetary policy shifts, are contributing to investor sentiment surrounding Bitcoin. For many, the digital currency is increasingly viewed as a hedge against inflation, which may drive demand higher as economic uncertainty persists.

Furthermore, the technological advancements in blockchain technology and Bitcoin’s scalability solutions are essential in shaping market perceptions and investment behaviors. Innovations such as the Lightning Network are enabling faster transactions and lower fees, which can boost Bitcoin’s utility as a method of payment. Moreover, geopolitical tensions often lead investors to seek alternative assets, further propelling Bitcoin’s attractiveness. Below is a summary of key economic indicators that are likely to impact Bitcoin prices in the coming year:

| Economic Indicator | Impact on Bitcoin |

|---|---|

| Inflation Rates | Higher inflation can drive investors to Bitcoin as a store of value. |

| Interest Rates | Lower interest rates tend to boost asset prices, including cryptocurrencies. |

| Regulatory Changes | Positive regulations can enhance institutional confidence and investment. |

| Market Sentiment | Growing interest and optimism can lead to price appreciation. |

Technological Developments and Their Impact on Investor Sentiment

Recent advancements in technology have significantly influenced investor sentiment in the cryptocurrency market, especially regarding Bitcoin. Tools like AI-driven analytics, blockchain integration, and real-time data tracking have provided investors with unprecedented insights into market trends and price movements. As these technologies evolve, they contribute to a more informed investor base, enabling individuals and institutions to make better-informed decisions. Moreover, the growing use of social media and sentiment analysis platforms plays a critical role in shaping public perception, as investors increasingly rely on community-driven insights to guide their investment strategies.

In addition, the rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) is reinforcing the appeal of Bitcoin within the broader cryptocurrency ecosystem. These innovations not only amplify Bitcoin’s utility but also create new avenues for investment, stimulating interest from both retail and institutional investors. It’s essential to recognize how these technological developments contribute to investor confidence and stability in a traditionally volatile market. The table below outlines key technological trends and their potential impacts on Bitcoin’s market trajectory:

| Technological Trend | Impact on Investor Sentiment |

|---|---|

| AI-Driven Analytics | Enhanced decision-making capabilities. |

| Blockchain Integration | Increased trust in transactions. |

| Social Media Trends | Real-time sentiment tracking. |

| Decentralized Finance (DeFi) | Greater investment diversification. |

Expert Predictions: Bullish and Bearish Scenarios for 2024

The cryptocurrency market is known for its volatility, and as we head into 2024, experts are divided on what the future holds for Bitcoin. Bullish analysts argue that the increasing adoption of Bitcoin by institutions and a potential ETF approval could catalyze a strong price recovery. They point to several factors, including enhanced regulatory clarity and continued economic uncertainty, as reasons to believe Bitcoin may reach $100,000 or higher by the end of 2024. Key arguments for this bullish outlook include:

- Institutional appetite: Major companies are incorporating Bitcoin into their balance sheets.

- Macroeconomic headwinds: Inflation concerns may drive more investors towards Bitcoin as a hedge.

- Technological advancements: Improvements in the Bitcoin network could enhance transaction efficiency.

Conversely, the bearish perspective emphasizes the potential for regulatory crackdowns and market manipulation to negatively impact Bitcoin’s price. Such risks could keep Bitcoin below $30,000 throughout 2024, with experts warning of possible market corrections driven by global economic conditions. Factors contributing to this cautious stance include:

- Regulatory scrutiny: Heightened regulations from governments worldwide may stifle market growth.

- Market saturation: An oversupply of Bitcoin could lead to reduced demand.

- Technological vulnerabilities: Concerns regarding network security could deter new investors.

Strategic Investment Recommendations for Navigating Market Volatility

In the current landscape of fluctuating cryptocurrency values, particularly Bitcoin, investors must employ a proactive approach to navigate potential market turbulence. One effective strategy is to focus on diversification across various asset classes, which can help mitigate risk while still capturing growth opportunities. Additionally, consider reallocating a portion of your portfolio to stablecoins or other digital currencies with established track records to buffer against extreme volatility. Engaging in risk management tactics, such as setting stop-loss orders or using options to hedge positions, will be crucial in protecting your investments during market downdrafts.

Investment directives for the coming year could also include engaging more deeply with decentralized finance (DeFi) solutions. Both yield farming and lending protocols may yield lucrative returns while adding an innovative dimension to your portfolio. Furthermore, maintaining a close watch on regulatory changes affecting the cryptocurrency landscape will be essential. Understanding how emerging regulations, tax implications, and technological advancements could reshape market dynamics will position investors favorably. A focus on long-term fundamentals, such as Bitcoin’s supply cap and adoption rate, can also provide a clearer picture of its resilience against market shocks.

In Conclusion

As we approach the forthcoming year, the landscape of Bitcoin and the broader cryptocurrency market continues to evolve at an unprecedented pace. With insights from leading experts in finance and technology, it’s clear that while Bitcoin’s price remains volatile, there are multiple factors at play that could influence its trajectory.

predictions for Bitcoin’s price in the next year vary widely, reflecting a range of sentiments from optimism to caution. As institutional interest grows and regulatory frameworks become more defined, investors must remain vigilant, staying informed about market trends and external influences. The insights shared by our panel of experts highlight the necessity of both strategic foresight and adaptability in navigating this dynamic environment.

Ultimately, whether Bitcoin will reach new historical highs or face significant challenges remains uncertain. What is clear, however, is that the cryptocurrency market is a space ripe with opportunity for those well-prepared to engage with it. We encourage readers to consider these expert predictions thoughtfully and to conduct their own research as they move forward in their investment journeys.