Examining the Centralization vs. Decentralization of Altcoins

: A Comparative Analysis

As the cryptocurrency landscape continually evolves, altcoins—alternative digital currencies beyond Bitcoin—are gaining increasing attention from investors, developers, and regulators alike. Central to the discourse surrounding these assets is the fundamental debate of centralization versus decentralization, a key attribute that can significantly influence their functionality, security, and adoption. While some altcoins tout their decentralized frameworks as a means to democratize finance and empower users, others operate within more centralized structures, often promising enhanced efficiency and regulatory compliance. This article delves into the intricate dynamics of centralization and decentralization in the altcoin ecosystem, exploring the implications for innovation, governance, and market resilience, and seeking to provide clarity in a space marked by both enthusiasm and skepticism.

Table of Contents

- Understanding the Centralization Debate in Altcoin Ecosystems

- Evaluating the Impact of Centralization on Security and Scalability

- Analyzing Governance Structures: The Role of Decentralization in Altcoin Success

- Recommendations for Investors: Navigating the Centralization vs. Decentralization Landscape in Cryptocurrencies

- Concluding Remarks

Understanding the Centralization Debate in Altcoin Ecosystems

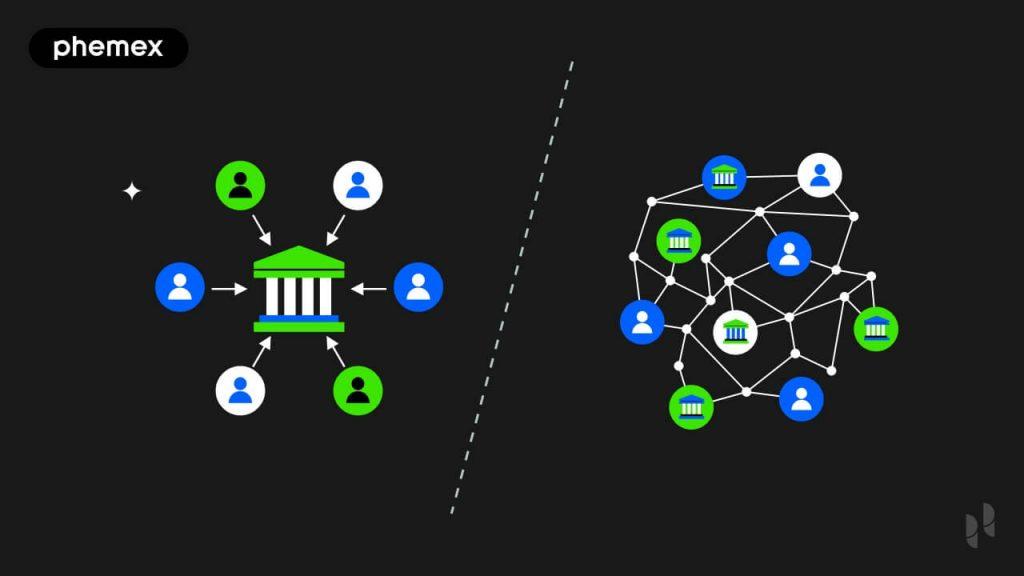

The centralization debate in altcoin ecosystems is crucial as it directly impacts their functionality, governance, and long-term sustainability. While centralization can enhance efficiency and ease of use, it raises concerns about the lack of transparency and the potential for abuse of power by a select group of individuals or organizations. Critics argue that this concentration of control undermines the foundational ethos of cryptocurrencies, which is rooted in decentralization and democratization of financial systems. The implications of centralization are vast, affecting everything from transaction validation to community engagement and innovation.

Key factors influencing the centralization versus decentralization debate in altcoin ecosystems include:

- Governance Models: Varying approaches define how decisions are made within the community, determining the degree of central authority.

- Token Distribution: Centralized distribution creates a power dynamic that can skew benefits towards early investors or developers.

- Development Control: A limited set of developers maintaining code can lead to a lack of diversity in perspectives and innovation.

| Aspect | Centralized Altcoin | Decentralized Altcoin |

|---|---|---|

| Control | Limited to specific participants | Widespread among users |

| Transparency | Restricted access to information | Open auditability |

| Governance | Top-down decision making | Community-driven |

Evaluating the Impact of Centralization on Security and Scalability

In the realm of altcoins, the extent of centralization often plays a pivotal role in determining both security and scalability. Centralized systems tend to have more streamlined governance structures, allowing for swift decision-making processes. This can lead to faster implementation of updates and improvements, providing a robust defense against security vulnerabilities. However, such centralization may also create potential risks, including susceptibility to single points of failure and vulnerability to malicious attacks. Additionally, central entities might face pressure to prioritize their interests over that of the community, leading to erosion of trust among users.

On the other hand, decentralized altcoins boast an inherent resilience that comes from spreading control among numerous participants. This distribution can significantly enhance security, as the consensus mechanism requires compromise and collaboration among diverse stakeholders. However, this decentralized nature often leads to challenges in scalability, as bottlenecks can occur when the network must process a high volume of transactions. Understanding the trade-offs involved is crucial for developers and investors alike, as they navigate the complex landscape of altcoin potentials:

| Aspect | Centralized | Decentralized |

|---|---|---|

| Governance | Streamlined | Distributed |

| Security | Single Point of Failure | Resilient |

| Scalability | High | Variable |

| Trust | Central Authority | Community-based |

Analyzing Governance Structures: The Role of Decentralization in Altcoin Success

Decentralization plays a pivotal role in the governance structures of altcoins, often distinguishing successful projects from others that falter. By distributing power among a broader base of stakeholders rather than central authorities, decentralized altcoins promote greater transparency, community engagement, and innovation. Investors are increasingly drawn to projects that empower users through mechanisms such as decentralized autonomous organizations (DAOs) or community governance models, allowing holders to participate in decision-making processes. This participatory approach not only enhances trust but also fosters resilience, as the network remains operational even when faced with challenges or crises.

The effectiveness of a decentralized governance structure can often be measured by the community’s involvement in crucial decisions. Here are some key factors that contribute to the potential success of decentralized altcoins:

- Inclusive Voting Mechanisms: Implementing fair and direct voting processes can ensure all stakeholders have a voice.

- Adaptive Governance Frameworks: Flexibility in governance models to adapt to technological advancements and user needs.

- Active Community Engagement: Encouraging participation through forums, social media, and development initiatives.

- Transparent Decision-Making: Publicly accessible records of decisions and the rationale behind them boost accountability.

Assessing various altcoins reveals a spectrum of decentralization efforts and their impact on performance. The table below summarizes the governance qualities of several prominent altcoins:

| Altcoin | Decentralization Level | Governance Features |

|---|---|---|

| Cardano | High | Staking, community votes |

| Ripple | Medium | Centralized validators, limited community input |

| Tezos | High | On-chain governance, proposal system |

| Ethereum | Medium-High | Community proposals, EIP process |

Recommendations for Investors: Navigating the Centralization vs. Decentralization Landscape in Cryptocurrencies

In today’s evolving landscape of cryptocurrencies, the tension between centralization and decentralization presents both challenges and opportunities for investors. Those looking to enter this market should prioritize understanding the governance structures of various altcoins, as this directly impacts their investment’s long-term viability. Factors to consider include the extent of community involvement in decision-making, development transparency, and the token’s voting mechanisms. A few recommendations for investors are:

- Research Consensus Mechanisms: Grasp the differences between Proof of Work, Proof of Stake, and other emerging protocols.

- Evaluate Founders and Teams: Investigate the backgrounds and reputations of the teams behind the coins.

- Monitor Regulatory Developments: Pay attention to how changing regulations may affect centralized vs. decentralized platforms.

Additionally, it is crucial to analyze the trading volumes and liquidity of altcoins, as these factors often reveal underlying market support. Investors may also want to create a diversified portfolio that balances centralized assets with decentralized ones, which can mitigate risks associated with sudden market shifts. Below is a comparison table of selected altcoins, showcasing various key attributes to help guide your investment decisions:

| Altcoin | Centralization Level | Market Cap | Consensus Mechanism |

|---|---|---|---|

| Ethereum (ETH) | Moderate | $200B+ | Proof of Stake |

| Cardano (ADA) | Low | $80B+ | Proof of Stake |

| Ripple (XRP) | High | $30B+ | RPCA |

| Uniswap (UNI) | Low | $10B+ | Ethereum-based |

Concluding Remarks

the ongoing debate over centralization versus decentralization in the altcoin space underscores the complexities and varying philosophies underpinning digital currencies. As investors and developers assess the implications of these distinct approaches, it becomes essential to recognize how centralization can enhance scalability and user experience, while decentralization promotes security, transparency, and community governance. With new technologies and regulatory developments emerging, the landscape of altcoins will continue to evolve, demanding a careful evaluation of the benefits and challenges associated with each model. As we move forward, understanding these dynamics will be crucial for stakeholders looking to navigate the rapidly changing world of cryptocurrency. Whether proponents of centralized solutions or advocates for decentralized networks, the choices made in the coming years will shape the future of the financial ecosystem.