Evaluating Cryptocurrency Fundamentals Through Fundamental Analysis

Introduction

In the rapidly evolving landscape of finance, the emergence of cryptocurrencies has piqued the interest of investors, policymakers, and financial analysts alike. As digital assets challenge traditional notions of value and investment, understanding the fundamental underpinnings of these cryptocurrencies has become imperative. Unlike conventional securities, cryptocurrencies operate on decentralized platforms, governed by intricate technologies and market dynamics that are not always transparent. This article aims to explore the essential principles of fundamental analysis as applied to cryptocurrencies, providing a framework for evaluating their intrinsic value and potential for long-term success. By examining core elements such as technology, market demand, regulatory environment, and competitive positioning, we seek to equip investors with the analytical tools necessary to navigate the complexities of this burgeoning asset class. The insights garnered from a rigorous fundamental analysis can serve as a foundation for informed investment decisions, ultimately fostering a more prudent approach to engaging with the cryptocurrency market.

Table of Contents

- Understanding the Core Components of Cryptocurrency Fundamentals

- Assessing Market Demand and Supply Dynamics

- Analyzing Technology and Development Roadmaps

- Evaluating Team Credentials and Community Engagement

- Wrapping Up

Understanding the Core Components of Cryptocurrency Fundamentals

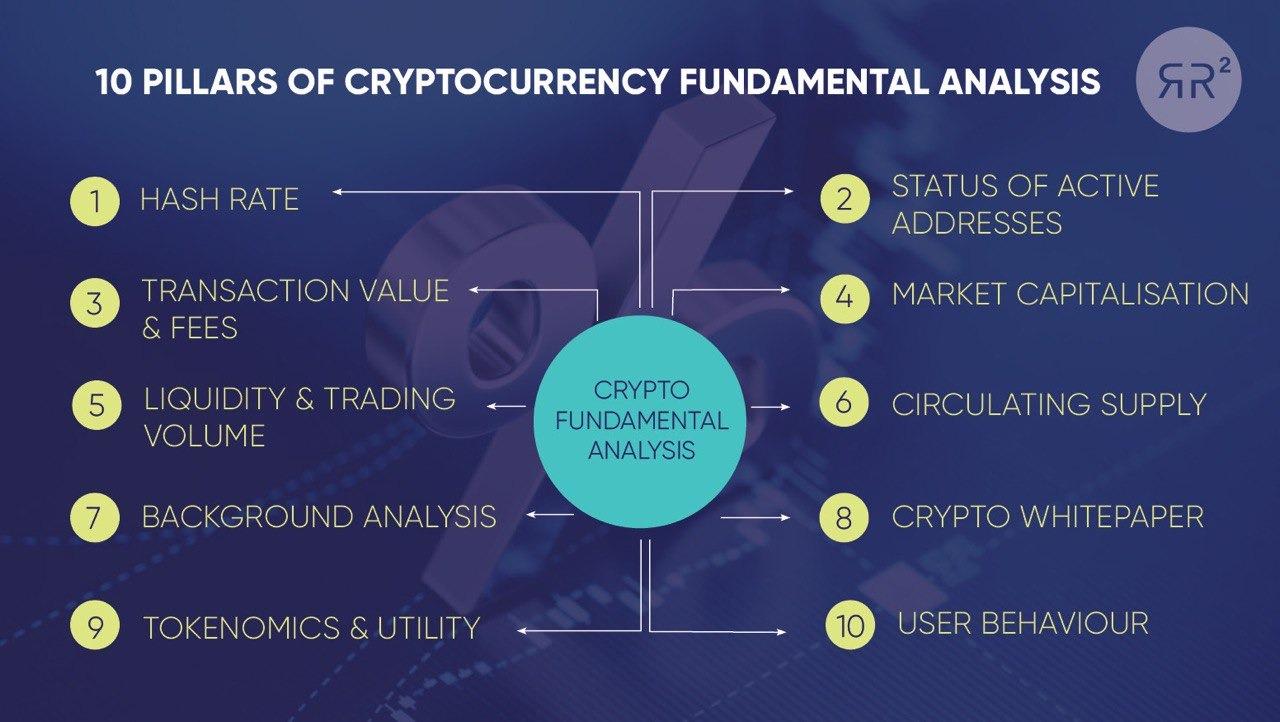

To effectively analyze cryptocurrencies, it’s essential to grasp their core components. Blockchain technology serves as the foundation for most cryptocurrencies, allowing for secure and transparent transactions without the need for intermediaries. In addition to this, understanding the concept of decentralization is crucial, as it signifies a shift in control from central authorities to a distributed network of participants. Furthermore, aspects such as consensus algorithms, which facilitate agreement on the state of the blockchain, and the role of smart contracts in operational automation highlight the complexity of crypto ecosystems.

Evaluation of a cryptocurrency’s fundamentals also hinges on its tokenomics, which encompasses the supply, demand, and economic incentives driving the asset’s value. Analyzing the project team, including their expertise and past successes, offers insight into the project’s viability. Moreover, assessing community engagement and partnerships can provide valuable indicators of underlying strength and potential for growth. Implementing a framework to scrutinize these elements can greatly enhance your decision-making process in the volatile crypto landscape.

Assessing Market Demand and Supply Dynamics

In the ever-evolving landscape of cryptocurrency, understanding market demand and supply dynamics is crucial for investors and traders alike. Demand is influenced by various factors such as market sentiment, technological advancements, and regulatory developments. On the other hand, supply is often determined by the mining rates, pre-defined token distribution, and even the psychological thresholds of scarcity. Analyzing trends in both demand and supply can provide insights into price movements, allowing investors to make more informed decisions.

To quantitatively assess these dynamics, market participants commonly utilize data metrics like trading volume, market capitalization, and price elasticity of cryptocurrencies. These metrics help in constructing a clearer picture of the overall market landscape. For example, you can evaluate cryptocurrency projects by considering the following key indicators:

- Trading Volume: Reflects active participation and can indicate increasing demand.

- Market Capitalization: Represents the total value of a cryptocurrency, providing insight into its demand relative to supply.

- Price Trends: Monitoring historical price patterns can signal how supply and demand adjustments might affect future valuations.

| Indicator | Description |

|---|---|

| Trading Volume | Daily trading activity, indicating interest and liquidity. |

| Market Cap | Total value of all circulating coins, indicative of market confidence. |

| Price Trends | Historical analysis to forecast future movements. |

Analyzing Technology and Development Roadmaps

When evaluating cryptocurrency projects, analyzing their technology and development roadmaps is crucial for understanding their potential growth and sustainability. A clear and well-defined roadmap often reflects a project’s commitment to innovation and improvement. Key elements to consider include:

- Milestones Achieved: Assess what milestones the project has reached, such as successful product launches or significant partnerships.

- Future Plans: Examine upcoming features or improvements scheduled for release, which can indicate the project’s long-term vision.

- Development Team: Research the qualifications and track records of the team members, as experienced developers are more likely to execute the roadmap effectively.

Furthermore, the alignment of a project’s technology with market demands can greatly influence its success. A thorough analysis should also include:

- Technological Advancements: Investigate any proprietary technology or unique selling propositions that differentiate the project from competitors.

- Community Engagement: Consider how well the development team communicates with the community, as transparency can demonstrate trust and reliability.

- Scalability and Security: Ensure the technology can handle increased user demand and is fortified against potential threats.

Evaluating Team Credentials and Community Engagement

When assessing the potential of a cryptocurrency, it’s crucial to examine the credentials of its team. A strong, experienced team can significantly impact a project’s credibility and long-term success. Look for information that highlights the following aspects:

- Professional Background: Investigate the previous roles and industry experience of team members.

- Technical Expertise: Ensure the developers possess the necessary skills relevant to the blockchain technology in question.

- Track Record: Evaluate past projects they have worked on and their success rates.

In addition to team credentials, community engagement serves as a barometer for a cryptocurrency’s health and viability. A vibrant and active community can foster innovation, support, and a strong user base. Consider the following indicators when evaluating community involvement:

- Social Media Presence: Active participation on platforms like Twitter, Telegram, and Reddit is a positive sign.

- Community Initiatives: Look out for hackathons, AMAs (Ask Me Anything), and other collaborative activities that promote inclusivity.

- Feedback Mechanisms: Assess how responsive the team is to community suggestions and criticisms.

Wrapping Up

evaluating cryptocurrency fundamentals through fundamental analysis is a critical approach for investors seeking to navigate the complexities of the digital asset landscape. As the market continues to mature, understanding the core components that drive value—such as technology, team capabilities, market demand, and regulatory factors—becomes paramount.

Adopting a rigorous analytical framework allows investors to make informed decisions, identify potential risks, and seize opportunities within this dynamic environment. As the cryptocurrency space evolves, continuous learning and adaptation will be essential for staying ahead of market trends. By leveraging fundamental analysis, investors can enhance their strategies and contribute to the broader understanding of cryptocurrency as a legitimate and transformative asset class.

Ultimately, a well-rounded approach that combines fundamental analysis with insights from market trends and investor sentiment holds the potential to generate significant long-term value in an ever-changing market landscape. As we move forward, the importance of evaluating cryptocurrency fundamentals cannot be overstated, and those who embrace this methodology will be better positioned to thrive in the future of finance.