Decoding Cryptocurrency Mining: Its Impact on Crypto Economics

In the rapidly evolving sphere of digital finance, cryptocurrency mining stands as a cornerstone of the blockchain ecosystem, fueling the creation of new coins while simultaneously securing the networks they operate on. However, this intricate process goes beyond the technicalities of hashing power and algorithms; it significantly influences the foundational principles of crypto economics. With energy consumption, supply dynamics, and market behaviors interconnected in a complex web, understanding the implications of mining is essential for anyone navigating this digital frontier. In this article, we will unravel the layers of cryptocurrency mining, examining its economic ramifications, the challenges it presents, and the evolving solutions that aim to create a sustainable future for digital currencies. Join us as we decode the mechanics of mining and explore its pivotal role in shaping the landscape of cryptocurrency economics.

Table of Contents

- Understanding the Fundamentals of Cryptocurrency Mining

- Analyzing the Economic Implications of Mining on Cryptocurrency Markets

- The Environmental Cost of Mining and Its Economic Consequences

- Optimizing Mining Practices for Sustainable Profitability in the Crypto Landscape

- The Conclusion

Understanding the Fundamentals of Cryptocurrency Mining

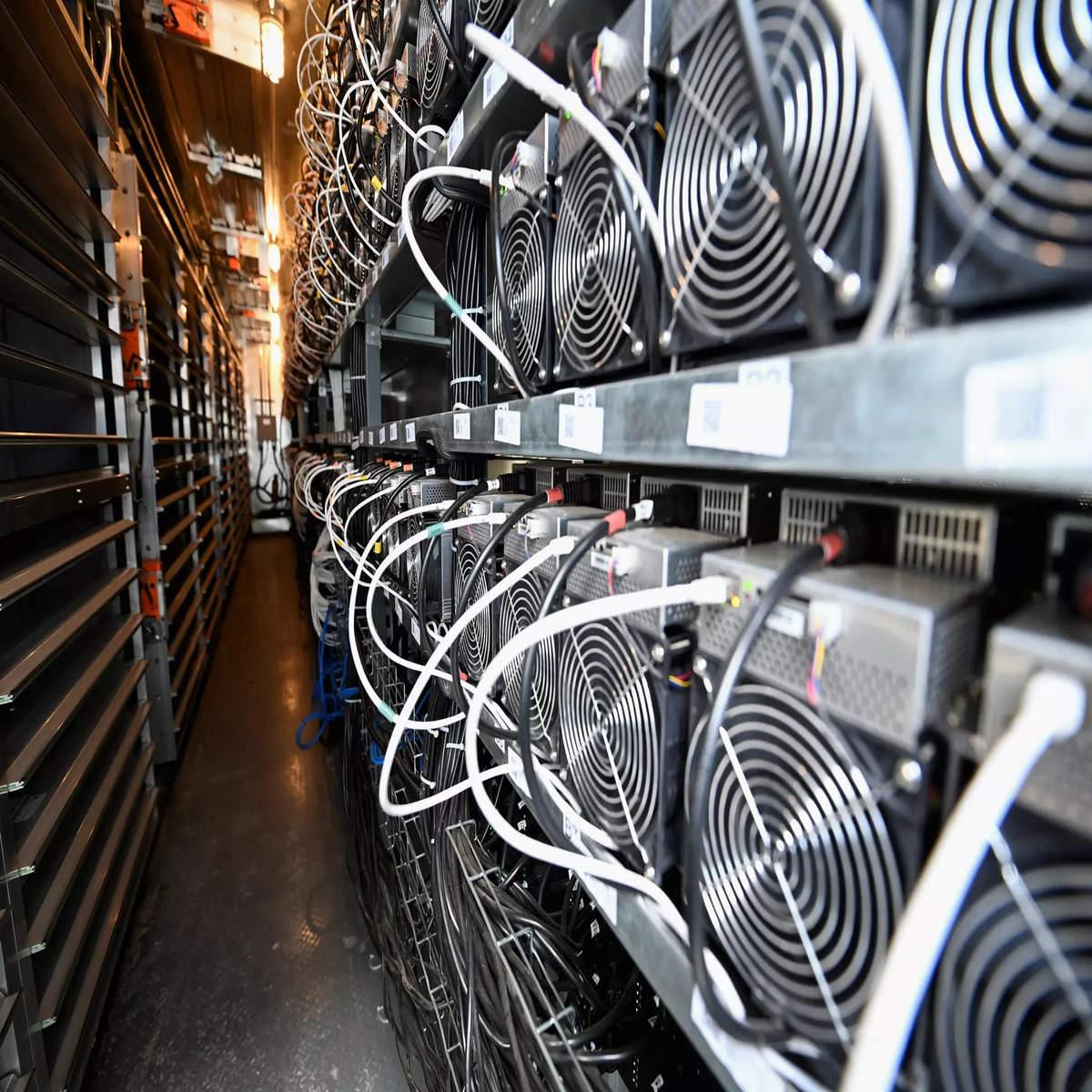

Cryptocurrency mining is the backbone of decentralized networks like Bitcoin and Ethereum, where miners validate transactions and secure the blockchain. This intricate process involves solving complex mathematical puzzles, which in turn confirms transactions and prevents double-spending. The mining process operates on a reward system; miners receive newly minted coins for their efforts, incentivizing them to utilize computational power to maintain the network. The decentralized nature of mining also ensures that no single entity controls the currency, promoting a fair distribution of wealth within the system.

Understanding the economics of mining is essential for grasping the broader implications of cryptocurrency. As more miners join the network, the difficulty of puzzles increases, which in turn affects the profitability and sustainability of mining operations. Key factors influencing the mining landscape include:

- Energy Costs: Mining demands significant energy resources, which can determine a miner’s operational viability.

- Market Value: The price of cryptocurrency directly impacts miners’ revenues and strategies.

- Mining Pools: Collaboration among miners can increase chances of earning rewards, making mining more accessible to individuals.

The balance of these elements shapes the economic health of cryptocurrencies at large.

Analyzing the Economic Implications of Mining on Cryptocurrency Markets

The economic implications of mining on cryptocurrency markets are profound and multifaceted. Mining serves as the backbone of proof-of-work networks, validating transactions and adding new blocks to the blockchain. As miners invest significant resources, including high-powered hardware and substantial electricity consumption, they inadvertently influence the overall supply and demand dynamics of various cryptocurrencies. Key points include:

- Supply Regulation: Mining determines the rate at which new coins enter circulation, thus affecting scarcity and price stability.

- Market Volatility: Fluctuations in mining difficulty and electricity costs can lead to sudden changes in supply, often causing price spikes or drops.

- Geographic Concentration: Regions with lower energy costs attract more miners, which can create market disparities between geographic areas.

Furthermore, the operational costs associated with mining have wider economic ramifications. As mining operations scale, economies of scale emerge, allowing larger entities to dominate, thereby raising concerns regarding centralization and market manipulation. The impact on local economies can also be significant, with mining operations creating jobs and fostering infrastructure development. However, there are also risks and trade-offs to consider:

- Environmental Impact: The substantial energy consumption of mining operations raises concerns regarding sustainability and carbon footprints.

- Investment Risks: Market dependency on mining profitability can expose investors to high volatility risks, leading to potential financial instability.

- Innovation Drive: The competition among miners has led to technological advancements in hardware efficiency and alternative energy sources.

The Environmental Cost of Mining and Its Economic Consequences

The extraction processes inherent in mining operations yield significant environmental repercussions that ripple throughout the economy. Critical resources are often obtained at the expense of ecological degradation, leading to deforestation, loss of biodiversity, and contamination of water supplies. Notably, the high-energy requirements of cryptocurrency mining contribute to a broader carbon footprint, as traditional energy sources are frequently employed to power mining hardware. The negative impacts extend beyond local environments, influencing global climate change and prompting regulatory responses that can stifle industry growth and innovation.

Furthermore, the economic consequences manifest through increased costs associated with environmental remediation and regulation compliance. Mining companies may face financial penalties, heightened operational costs, and challenges in securing future investments as stakeholders become more environmentally conscious. Below is a brief overview of the economic implications:

| Economic Impact | Description |

|---|---|

| Investment Risk | Increased scrutiny may deter investors. |

| Operational Costs | Higher costs for compliance and clean-up efforts. |

| Market Volatility | Environmental issues can lead to price fluctuations. |

Ultimately, the push for more sustainable practices in the mining sector is not merely an ethical imperative, but a necessity for long-term economic viability. This paradigm shift could redefine profitability—encouraging investments in renewable energy sources and more efficient mining technologies, shaping a path towards a more sustainable future for the cryptocurrency economy.

Optimizing Mining Practices for Sustainable Profitability in the Crypto Landscape

In the rapidly evolving world of cryptocurrency mining, the drive for profitability has led to the adoption of various strategies aimed at enhancing operational efficiency while minimizing environmental impact. To achieve a sustainable balance, miners can explore innovative technologies such as renewable energy sources, advanced cooling solutions, and energy-efficient hardware. The integration of these practices not only optimizes power consumption but also significantly reduces the carbon footprint associated with mining operations, thereby aligning with global sustainability goals.

Moreover, understanding market fluctuations and adjusting mining intensity can substantially affect profitability. Miners can leverage data analytics and real-time monitoring systems to determine the ideal periods for mining, maximizing rewards while minimizing operational costs. Key factors to consider include:

- Hash Rate Variability: Analyzing trends helps identify the most lucrative times for mining.

- Energy Costs: Opting for regions with lower electricity rates can enhance profit margins.

- Equipment Upgrades: Investing in next-generation mining rigs can yield significant energy savings.

| Strategy | Benefit |

|---|---|

| Renewable Energy | Lower operational costs and reduced emissions |

| Real-Time Analytics | Optimized mining times and increased profitability |

| Efficient Hardware | Increased hash power with lower energy consumption |

The Conclusion

understanding the intricacies of cryptocurrency mining is essential for anyone looking to navigate the complex landscape of crypto economics. As the backbone of blockchain networks, mining not only secures transactions but also plays a pivotal role in determining the value and sustainability of various cryptocurrencies. By decoding the impacts of mining on supply dynamics, energy consumption, and market behavior, we gain a clearer perspective on how these factors intertwine to shape the overarching economic framework of digital currencies.

As the industry continues to evolve, staying informed about technological advancements and regulatory changes will be crucial for both miners and investors alike. Whether you’re a seasoned crypto enthusiast or just beginning your journey, fostering a comprehensive knowledge of mining practices can empower you to make more informed decisions in this rapidly changing environment.

We hope this article has provided you with valuable insights and a deeper understanding of cryptocurrency mining’s significance in the world of crypto economics. As always, we encourage you to continue exploring, learning, and engaging with this fascinating domain. Thank you for joining us on this exploration, and stay tuned for more articles as we delve deeper into the ever-evolving world of cryptocurrency.