Analyzing the Price Effects of Bitcoin Halving Events

Introduction

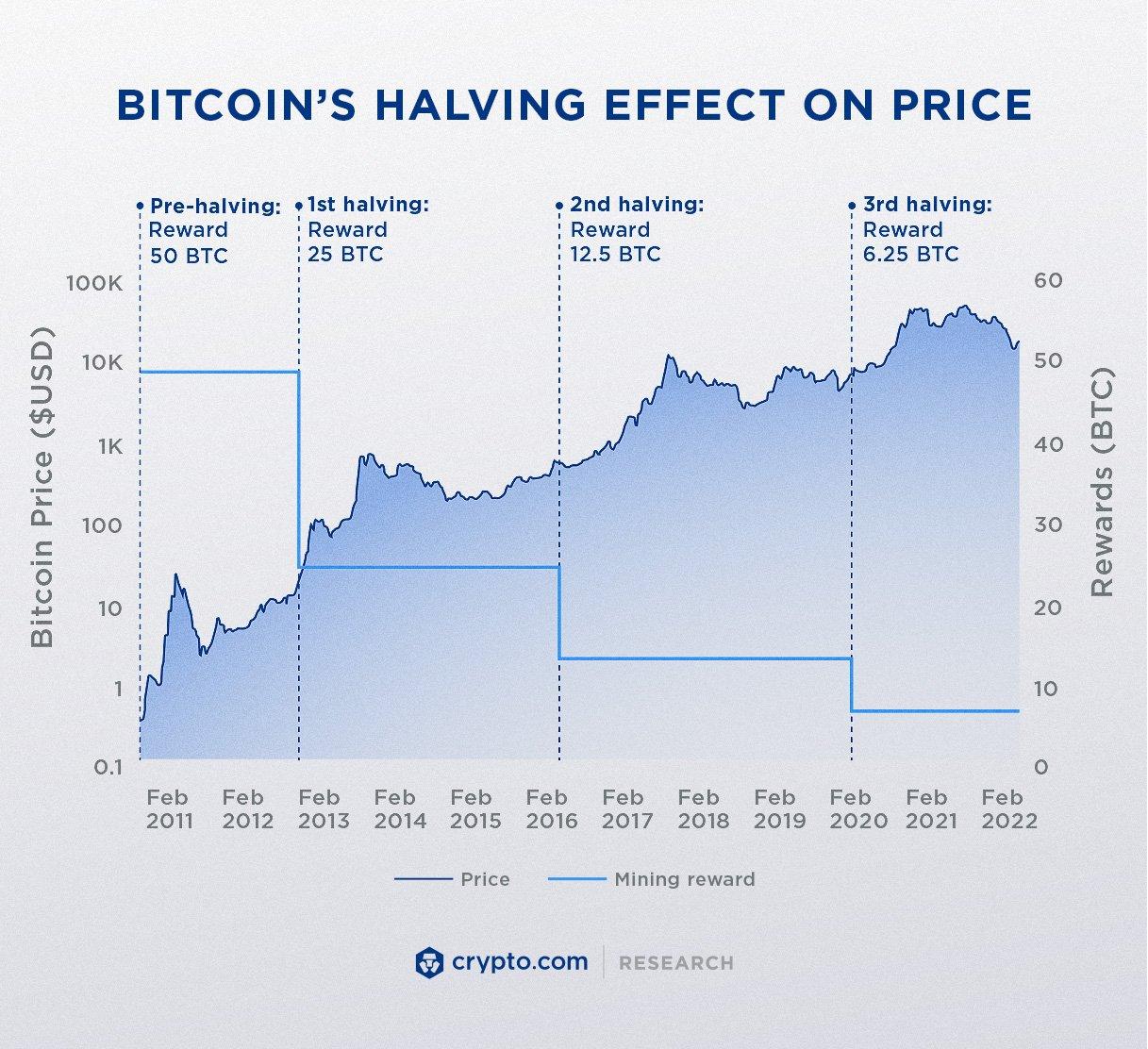

The phenomenon of Bitcoin halving, a critical event embedded in the cryptocurrency’s protocol, has drawn increasing attention from investors, analysts, and economists alike. Occurring approximately every four years, halving reduces the block reward miners receive by half, effectively curbing the rate of new Bitcoin creation and introducing significant implications for supply dynamics. As Bitcoin continues to solidify its position as a leading digital asset, understanding the price repercussions of these halving events becomes essential for informed decision-making in the ever-evolving landscape of cryptocurrency investment. This report endeavors to methodically analyze the historical price effects following each halving event, drawing from empirical data and anecdotal evidence to elucidate patterns, correlations, and the broader market sentiment surrounding these pivotal moments in Bitcoin’s lifecycle. Through this analysis, we aim to equip stakeholders with a comprehensive understanding of how past halvings have influenced Bitcoin’s valuation and what potential implications may arise from future occurrences.

Table of Contents

- Understanding Bitcoin Halving Mechanisms and Their Historical Impact

- Evaluating Price Trends and Market Sentiment Surrounding Halving Events

- Assessing the Relationship Between Supply Dynamics and Bitcoin Valuation

- Strategic Investment Recommendations in Light of Halving Patterns

- In Retrospect

Understanding Bitcoin Halving Mechanisms and Their Historical Impact

The Bitcoin halving mechanism is a crucial aspect of the cryptocurrency’s underlying technology, acting as a built-in economic model designed to control inflation and enhance scarcity over time. When a halving event occurs, the reward that miners receive for validating transactions and adding them to the blockchain is reduced by half. This unique feature creates a predictable schedule for supply reduction that influences market dynamics significantly. Key effects of this mechanism include:

- Scarcity Creation: A decrease in new Bitcoin supply can heighten its perceived value as demand remains steady or increases.

- Market Sentiment: Historically, halving events have generated significant media coverage and speculation, often leading to increased investor interest.

- Price Volatility: Post-halving, Bitcoin prices have experienced both sharp increases and corrections, influenced by trading behavior and market psychology.

To illustrate the historical impact of halving events, the following table summarizes the price movements and key dates of past halvings:

| Halving Date | Price Before Halving | Price One Year After Halving |

|---|---|---|

| November 28, 2012 | $12.31 | $1,200.00 |

| July 9, 2016 | $650.63 | $2,500.00 |

| May 11, 2020 | $8,566.00 | $64,000.00 |

These events shed light on the potential long-term price dynamics influenced by halving, serving not only as a marker for price expectations but also indicating the underlying structural mechanics of Bitcoin’s economy.

Evaluating Price Trends and Market Sentiment Surrounding Halving Events

Examining the price trends surrounding Bitcoin halving events reveals a notable pattern influenced by market sentiment and investor psychology. Historically, each halving has generated significant anticipation, leading to extended periods of speculative trading. This speculative phase often results in price surges prior to the actual halving date, as traders attempt to capitalize on the expected decrease in supply. Following the halving, there is typically a consolidation period where prices may experience volatility as the market adjusts to the new supply dynamics.

To better understand these trends and sentiments, it is essential to analyze key metrics before and after each halving. Below is a table summarizing the price movement and market sentiment observed during previous halving events:

| Halving Event | Pre-Halving Price (USD) | Post-Halving Price (USD, 6 months later) | Market Sentiment |

|---|---|---|---|

| 1st Halving (2012) | $11 | $1,200 | Bullish |

| 2nd Halving (2016) | $450 | $2,500 | Bullish |

| 3rd Halving (2020) | $8,600 | $60,000 | Extremely Bullish |

the interplay between dwindling supply due to halving and rising demand fueled by market speculation drives Bitcoin’s price volatility. Investors’ emotional responses during these events often contribute to price fluctuations, emphasizing the importance of staying informed and responsive to changing market sentiments. Understanding these cycles is crucial for strategic planning in a market that continues to evolve rapidly.

Assessing the Relationship Between Supply Dynamics and Bitcoin Valuation

The interplay between supply dynamics and Bitcoin valuation is pivotal, particularly during halving events, which systematically alter the rate at which new coins are generated. Each halving reduces the block reward miners receive by 50%, an event encoded in Bitcoin’s protocol that happens approximately every four years. This change not only influences the immediate supply of new Bitcoin entering circulation but also affects market psychology. Investors and speculators often anticipate decreased supply as a bullish signal, leading to increased buying pressure which can accentuate price rallies.

To further illustrate the impact of halving events on Bitcoin’s supply and its corresponding valuation, consider the following key aspects:

- Reduced Inflation Rate: Halving events effectively lower the inflation rate of Bitcoin, making it a deflationary asset over time.

- Market Sentiment: Speculative trading frequently responds to the anticipated impact of halving, often resulting in pre-halving price surges.

- Long-Term Valuation: Historical data suggests that Bitcoin’s price tends to rise significantly in the months following a halving, driven by supply constraints and heightened interest from both retail and institutional investors.

| Halving Event | Date | Price Before ($) | Price After ($) |

|---|---|---|---|

| 1st Halving | November 28, 2012 | 12.31 | 1,142.00 |

| 2nd Halving | July 9, 2016 | 657.61 | 19,497.40 |

| 3rd Halving | May 11, 2020 | 8,566.25 | 64,863.10 |

Strategic Investment Recommendations in Light of Halving Patterns

In examining the historical performance of Bitcoin surrounding halving events, investors should consider implementing a diversified investment strategy that capitalizes on the potential price appreciation that often follows these milestones. Historical analysis suggests that the months leading up to and following a halving can create significant price volatility. Therefore, it is prudent to adopt a strategic approach that includes:

- Incremental Buying: Gradually accumulating Bitcoin can mitigate risks associated with abrupt price fluctuations.

- Staggered Selling: Planning multiple selling points post-halving can help capitalize on price spikes while protecting against downturns.

- Investing in Alternative Assets: Consider diversifying into other cryptocurrencies or blockchain-related stocks to balance exposure and improve overall portfolio resilience.

Moreover, aligning one’s investments with key market trends and technological advancements is vital for long-term success. Tracking metrics such as miner activity, network health, and external market sentiment can provide valuable insights. A strategic investment tableau could include:

| Metric | Significance |

|---|---|

| Miner Revenue | Indicates network profitability and security strength. |

| Hash Rate | Reflects network activity and miner competitiveness. |

| Market Sentiment | Can influence price trends significantly. |

In Retrospect

the analysis of Bitcoin halving events provides significant insights into the intricate dynamics of cryptocurrency markets. Historical data reveals a consistent pattern where these events lead to substantial price adjustments, influenced by factors such as supply constraints and market speculation. While past performance is not indicative of future results, understanding these price effects is crucial for investors, miners, and market analysts alike.

As the cryptocurrency landscape continues to evolve, ongoing research into the implications of Bitcoin halving will be vital for informing investment strategies and shaping market expectations. Recognizing the interplay between halving cycles and market behavior can enhance the decision-making process and mitigate potential risks associated with the inherent volatility of digital assets.

Ultimately, staying informed and adaptable in the face of upcoming halving events will empower stakeholders to navigate the complexities of Bitcoin’s economic ecosystem more effectively. The next halving, poised to occur in 2024, will undoubtedly present new opportunities and challenges, warranting closer scrutiny and evaluation by all participants in the cryptocurrency market.