Analyzing the Centralization vs. Decentralization of Ripple

: A Critical Examination of Blockchain Governance

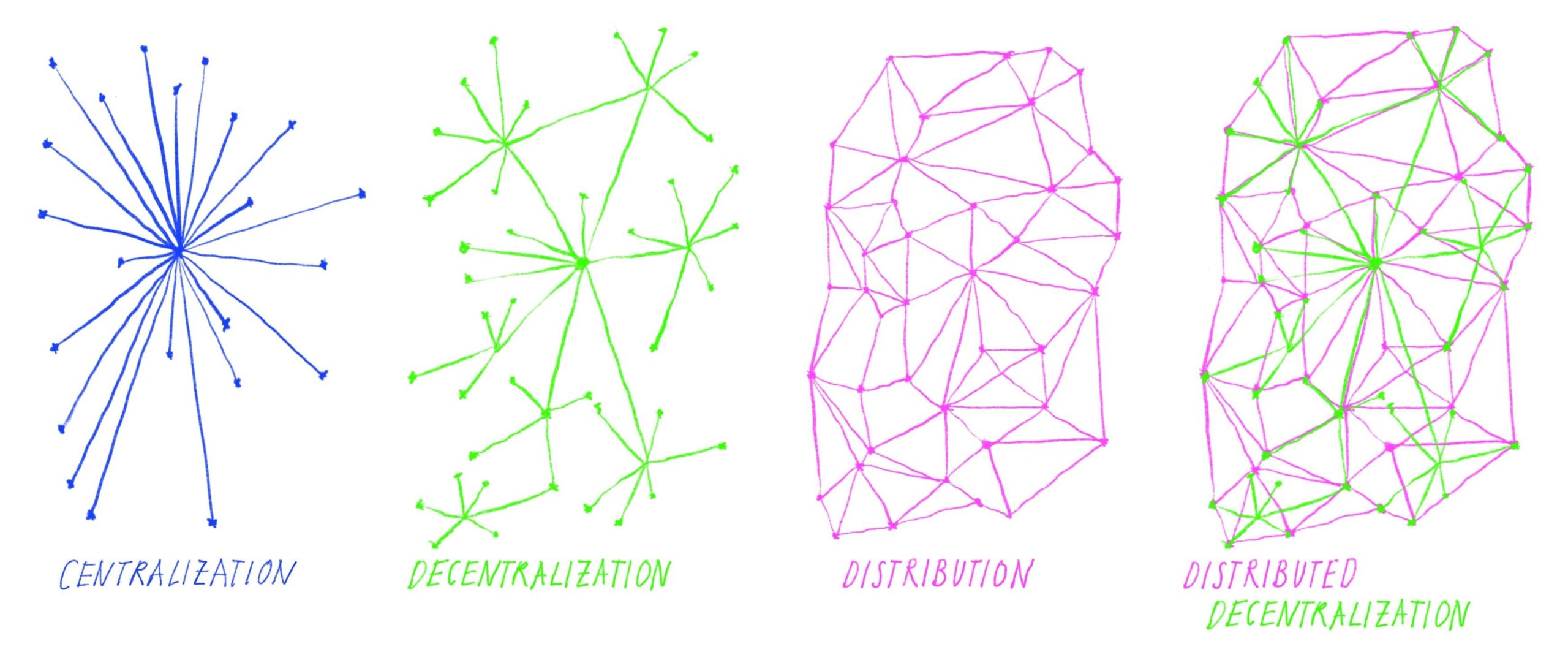

In the ever-evolving landscape of blockchain technology, the debate over centralization versus decentralization remains a pivotal theme, particularly as various platforms seek to balance efficiency with transparency. Ripple, a prominent player in the digital currency arena, has drawn significant attention for its unique approach to consensus and network governance. Unlike traditional cryptocurrencies that champion total decentralization, Ripple operates within a hybrid framework, leveraging both centralized elements and decentralized protocols to optimize transaction speeds and network reliability. This article aims to dissect the implications of Ripple’s governance structure, exploring the advantages and challenges it presents in comparison to fully decentralized models. By delving into Ripple’s architecture, its decision-making processes, and the broader impact on the cryptocurrency ecosystem, we provide a comprehensive analysis of the centralization versus decentralization debate as it pertains to this influential platform.

Table of Contents

- Evaluating the Structural Dynamics of Centralization in Ripple’s Ecosystem

- Decentralization Efforts: Ripples Approach to Enhancing Network Resilience

- The Role of Consensus Mechanisms in Ripple’s Centralized vs. Decentralized Model

- Strategic Recommendations for Balancing Centralization and Decentralization in Ripple’s Future Development

- In Summary

Evaluating the Structural Dynamics of Centralization in Ripple’s Ecosystem

The debate surrounding centralization within Ripple’s ecosystem is pivotal in understanding the overall performance and adoption of its blockchain technology. Ripple operates on a consensus algorithm that contrasts sharply with typical mining mechanisms, which inherently affects how power is distributed among participants. This centralization manifests through a handful of validators that hold a significant influence over the network. Key points to consider include:

- Validator Selection: Ripple Labs maintains a notable presence among the nodes, which raises concerns about the potential for influence over transaction validations.

- Token Distribution: The initial concentration of XRP tokens with Ripple Labs can lead to a perception of centralized control, despite efforts to distribute tokens more widely.

- Governance Dynamics: The role of Ripple Labs in governance decisions can arguably limit the decentralized nature of the platform.

In contrast, Ripple has taken steps to enhance decentralization within its network by encouraging third-party participation and establishing independent validators. The following table illustrates the current state of validator distribution:

| Validator Type | Percentage of Network | Notes |

|---|---|---|

| Ripple Labs Validators | 30% | Majority presence in the network. |

| Independent Validators | 50% | A growing base, enhancing decentralization. |

| Other Entities | 20% | Includes universities and smaller companies. |

This gradual shift towards more inclusive validator participation is essential for improving trust and accountability within Ripple’s ecosystem, reinforcing the argument for decentralization while still adhering to its foundational principles. Through ongoing adjustments in governance and the encouragement of diverse validators, Ripple aims to strike a balance that supports both efficiency and decentralization in an industry often scrutinized for its centralized tendencies.

Decentralization Efforts: Ripples Approach to Enhancing Network Resilience

In recent years, Ripple has taken significant strides towards decentralization, a move aimed at enhancing network resilience and promoting greater trust among users. By diversifying its network and incorporating community validators, Ripple is working to create a distributed system that is less susceptible to single points of failure. Some of the key initiatives include:

- Validator Diversity: Encouraging a broader range of participants in the validation process to diminish reliance on any single entity.

- Open-Source Collaborations: Engaging the developer community to contribute to the codebase, fostering transparency and innovation.

- Incentive Structures: Implementing new economic models that reward validators for their contributions while maintaining network integrity.

These efforts not only enhance the security of the Ripple network but also align with the ethos of decentralization that many blockchain enthusiasts advocate for. By focusing on a multi-faceted route to decentralization, Ripple is paving the way towards a more resilient infrastructure. The resulting benefits can be summarized as follows:

| Benefit | Description |

|---|---|

| Increased Security | Diverse validators reduce vulnerability to attacks. |

| Enhanced Trust | Community involvement fosters confidence among users. |

| Network Efficiency | Decentralization leads to faster transaction processing and scalability. |

The Role of Consensus Mechanisms in Ripple’s Centralized vs. Decentralized Model

Ripple operates on a unique consensus mechanism, primarily through the Ripple Protocol Consensus Algorithm (RPCA), which distinguishes it from traditional blockchain networks. This protocol allows transactions to be verified by a network of pre-selected validators, which has notable implications for Ripple’s structure. In a centralized model, these validators are often chosen based on their credibility within the financial sector, enhancing trust but also introducing the risk of systemic dependence on a limited number of entities. Conversely, in a more decentralized context, the potential for an expanded validator pool could diversify the network and foster greater resilience against manipulation, offering users varying degrees of control over transaction verifiability.

To illustrate the balance between Ripple’s centralized and decentralized dynamics, consider the characteristics of each validators selection method:

| Attribute | Centralized Model | Decentralized Model |

|---|---|---|

| Validator Selection | Based on established financial institutions | Open to any participant in the network |

| Trust Level | Higher trust in selected entities | Varied trust depending on validator’s reputation |

| Transaction Speed | Faster confirmations due to fewer validators | Potentially slower confirmations due to diversity |

Ultimately, this balancing act highlights a fundamental challenge in Ripple’s architecture: how to leverage the efficiency and speed of a centralized system while retaining the advantages of decentralization, such as security and autonomy. As Ripple continues to navigate this dichotomy, the ongoing evolution of its consensus mechanisms will play a critical role in shaping the future of its network dynamics, influencing not only user trust but also the potential for widespread adoption within the global financial ecosystem.

Strategic Recommendations for Balancing Centralization and Decentralization in Ripple’s Future Development

To foster an environment of innovation while maintaining regulatory compliance, Ripple should consider implementing a hybrid approach that encourages both centralization and decentralization. This can be achieved by establishing a clear framework for governance that allows for community input without sacrificing control over key decision-making processes. Regular stakeholder consultations and transparent communication channels will help ensure that the interests of diverse parties are taken into account. Additionally, the development of an open-source protocol with layered access can facilitate collaboration among developers while also allowing Ripple to maintain oversight on critical elements.

Furthermore, investing in educational initiatives to promote understanding of the benefits and challenges associated with centralization and decentralization is essential. Ripple could launch community-driven workshops aimed at demystifying its technology and engaging stakeholders in discussions about its future trajectory. Additionally, establishing a feedback loop that integrates insights from various user groups will enhance product development and strategic planning. By doing so, Ripple can cultivate a balanced ecosystem that not only promotes user trust but also positions itself as a leader in the evolving landscape of blockchain technology.

In Summary

the ongoing debate surrounding the centralization versus decentralization of Ripple continues to evoke strong opinions from various stakeholders within the blockchain community. As Ripple positions itself as a bridge between traditional finance and the innovative realm of digital assets, understanding its structural dynamics becomes crucial. While proponents laud its efficiency and partnerships with established financial institutions, critics highlight concerns regarding governance, control, and the potential for monopolistic practices.

As Ripple evolves, its unique hybrid model presents both challenges and opportunities that warrant close observation. Future developments, market acceptance, and regulatory landscapes will largely dictate its trajectory. Ultimately, the outcome of this centralization versus decentralization discussion will not only shape Ripple’s future but may also set a precedent for other blockchain projects navigating similar waters. Stakeholders should remain engaged as this narrative unfolds, ensuring a balanced perspective on the implications of such structural choices in the broader context of the cryptocurrency ecosystem.