Analyzing Recent Ripple Price Trends: Insights and Predictions

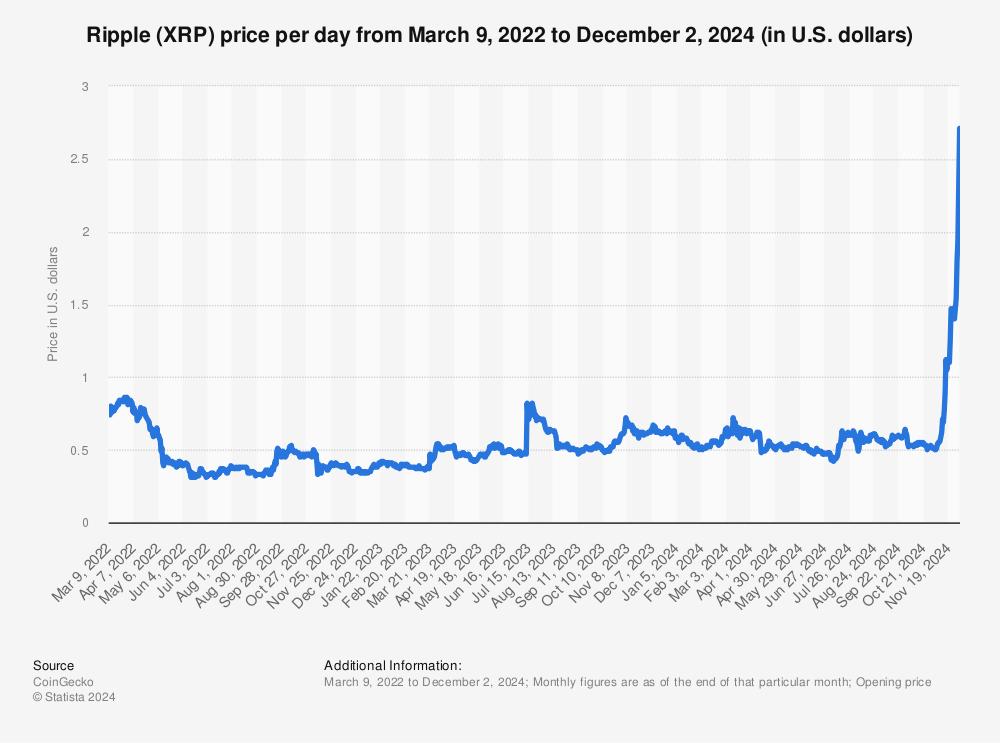

As the cryptocurrency market continues to captivate investors and analysts alike, the digital asset Ripple (XRP) has emerged as a focal point for discussions surrounding blockchain technology and financial innovation. In recent months, the price of Ripple has exhibited notable fluctuations, reflecting both external market conditions and internal developments specific to the Ripple network. This article delves into the latest price trends of Ripple, offering a comprehensive analysis of the factors influencing its valuation. Furthermore, we’ll provide insights into what these trends might mean for future performance, equipping investors with the knowledge needed to navigate the often volatile waters of cryptocurrency investment. With its unique position in the fintech landscape, understanding Ripple’s price patterns can shed light on broader market dynamics and investment opportunities ahead.

Table of Contents

- Examining Key Factors Influencing Ripples Current Market Performance

- Understanding Technical Indicators and Their Role in Price Fluctuations

- Market Sentiment Analysis: What Traders are Saying About Ripples Future

- Strategic Investment Recommendations for Navigating Ripple Price Trends

- Closing Remarks

Examining Key Factors Influencing Ripples Current Market Performance

The current market performance of Ripple (XRP) is shaped by a variety of factors that warrant close examination. Regulatory clarity remains a pivotal influence, especially following the ongoing legal proceedings with the SEC. Positive developments in this litigation could bolster investor confidence, leading to a potential surge in prices. Furthermore, market sentiment driven by macroeconomic trends, including inflation rates and central bank policies, also plays a significant role in shaping demand for cryptocurrencies like Ripple. As institutional adoption increases, particularly among financial institutions seeking faster transaction solutions, XRP’s practical utility in cross-border payments plays a critical role in its market appeal.

Additionally, technological advancements and upgrades within the Ripple network, such as the introduction of new features aimed at enhancing scalability and transaction speed, contribute to its attractiveness in the competitive cryptocurrency landscape. In contrast, the volatility characteristic of the crypto market remains a concern, with fluctuations in trading volumes exerting pressure on price stability. Other key factors influencing market performance include the timing of new partnerships and liquidity within the market. The following table summarizes the key factors currently influencing Ripple’s market dynamics:

| Factor | Description | Impact on XRP |

|---|---|---|

| Regulatory Clarity | Outcomes of legal battles impacting market perception | High |

| Market Sentiment | Influence of global economic conditions | Moderate |

| Technological Advancements | Improvements in network efficiency | High |

| Volatility | Fluctuations in price and trading volume | Variable |

| Partnerships | New collaborations enhancing liquidity and use cases | Moderate |

Understanding Technical Indicators and Their Role in Price Fluctuations

Technical indicators serve as essential tools for traders and analysts seeking to navigate the often volatile landscape of cryptocurrency markets. By providing key insights into market trends and momentum, they play a pivotal role in understanding price fluctuations. Some of the most widely utilized indicators include:

- Moving Averages: Useful in identifying the direction of the trend by smoothing out short-term price data.

- Relative Strength Index (RSI): Helps determine if an asset is overbought or oversold, offering potential reversal signals.

- Bollinger Bands: Indicate volatility and potential price levels where reversals may occur.

These indicators generate signals that can guide traders in making informed decisions. For example, combining moving averages with RSI can provide a comprehensive view of market momentum, particularly during periods of price consolidation. Understanding the interactions between these indicators can enhance prediction accuracy for Ripple’s price movements. Furthermore, it’s crucial to consider how external factors, such as regulatory news or market sentiment, can influence these signals, leading to significant price swings.

Market Sentiment Analysis: What Traders are Saying About Ripples Future

Market sentiment surrounding Ripple has evolved significantly over the past few months, reflecting traders’ reactions to both regulatory developments and technical indicators. Many traders are currently optimistic about Ripple’s future, particularly in light of the recent court rulings that have generally favored the company in its ongoing battle with the SEC. This has led to a surge in social media discussions, with hashtags like #RippleRally trending as investors speculate on potential price targets. The prevailing sentiment has created a bullish atmosphere, with many traders reassessing their forecast models following the positive news.

On the other hand, some caution remains among traders as they weigh the potential risks associated with the volatility of cryptocurrency markets. Analysts highlight essential factors that could influence Ripple’s price trajectory, including global regulatory compliance and adoption rates among financial institutions. Amid this ambivalence, a sentiment analysis tool reveals that approximately 65% of recent Ripple-related tweets are bullish, while 25% are neutral and 10% bearish. Below is a summary of traders’ sentiments:

| Sentiment Type | Percentage |

|---|---|

| Bullish | 65% |

| Neutral | 25% |

| Bearish | 10% |

Strategic Investment Recommendations for Navigating Ripple Price Trends

Investors should adopt a proactive stance in response to the recent fluctuations in Ripple’s price. Diversification remains a key strategy; allocating investment across various cryptocurrencies can help mitigate risk. Incorporating technical analysis tools to identify support and resistance levels offers insights into potential entry and exit points. It’s beneficial to monitor Ripple’s correlation with Bitcoin trends, as movements in the latter can significantly influence the former. Keeping an eye on market sentiment, especially regarding regulatory developments, can also provide a clearer picture for making informed decisions.

Moreover, setting clear buy and sell targets is essential. Establishing stop-loss orders can protect against unforeseen downturns, while profit targets help in realizing gains at predefined levels. Investors should also stay updated on Ripple’s partnerships and technological advancements, which often catalyze price movements. Utilizing tools such as coin sentiment analysis and news aggregators can further enrich investment strategies. Below is a quick overview of potential criteria for strategic investment consideration:

| Investment Criteria | Importance Level |

|---|---|

| Market Sentiment Tracking | High |

| Regulatory Environment Updates | Medium |

| Technical Analysis Signals | High |

| Diversification of Portfolio | Essential |

Closing Remarks

the recent trends in Ripple’s price reveal a complex interplay of market dynamics, regulatory developments, and investor sentiment. As we have analyzed, fluctuations in Ripple’s valuation not only reflect broader cryptocurrency market trends but also underscore the unique challenges and opportunities facing the platform. Moving forward, the ongoing regulatory scrutiny and potential shifts in market perception will be crucial factors influencing Ripple’s trajectory. Investors and stakeholders are encouraged to stay informed and agile as they navigate this fast-evolving landscape. By keeping a close eye on key indicators and market signals, stakeholders can better position themselves to capitalize on potential opportunities in the ever-changing world of digital currencies.