Analyzing Recent Ripple Price Trends and Future Predictions

In the ever-evolving landscape of cryptocurrency, the digital asset Ripple (XRP) has captured significant attention as it grapples with market fluctuations and regulatory challenges. In recent months, Ripple has experienced notable price trends that reflect broader market dynamics and investor sentiment. This article delves into the recent price movements of Ripple, analyzing key factors that have influenced its valuation and examining the potential trajectory of the asset in the coming months. By integrating technical analysis, market commentary, and expert insights, we aim to provide a comprehensive overview that equips investors with the knowledge needed to navigate the complexities of this prominent cryptocurrency. As Ripple continues to carve its niche in the fintech space, understanding its price trends is essential for stakeholders looking to make informed decisions in this volatile market.

Table of Contents

- Understanding Current Ripple Price Dynamics

- Impact of Market Sentiment on Ripple Valuation

- Technical Analysis of Ripples Price Patterns

- Strategic Recommendations for Potential Investors

- The Conclusion

Understanding Current Ripple Price Dynamics

The recent fluctuations in Ripple’s price can be attributed to a multitude of factors, as the cryptocurrency market remains highly sensitive to both external events and internal performance metrics. Investors are currently examining key trends that have emerged in the last few weeks, notably:

- Market Sentiment: Changes in investor confidence, particularly following regulatory news and announcements from Ripple Labs.

- Technological Developments: The implementation of new features and partnerships that enhance Ripple’s utility in cross-border transactions.

- Overall Market Conditions: Broader trends within the cryptocurrency market, including Bitcoin’s price movements and shifts in investor behavior.

In addition to these factors, analyzing technical indicators reveals compelling insights. Notably, the Ripple price has experienced several support and resistance levels, suggesting a potential for upward momentum if it breaks through critical resistance points. The following table summarizes key technical levels:

| Indicator | Level |

|---|---|

| Support Level | $0.45 |

| Resistance Level | $0.55 |

| Current Price Range | $0.48 – $0.52 |

As investors keep a keen eye on these dynamics, understanding the micro and macroeconomic influences on Ripple’s price will be essential for making informed decisions in the coming weeks.

Impact of Market Sentiment on Ripple Valuation

The valuation of Ripple (XRP) has shown a strong correlation with market sentiment, often swayed by social media, news cycles, and overall investor psychology. Positive sentiment can drive short-term price rallies, while negative sentiment can lead to sharp declines. Several factors play into the fluctuations observed in market sentiment:

- Regulatory Developments: Announcements or actions taken by regulatory bodies can have immediate effects on investor confidence.

- Technological Advancements: Updates or improvements to Ripple’s technology often boost market enthusiasm.

- Partnership Announcements: New collaborations with financial institutions can enhance the perceived value of XRP.

To better understand the impact of sentiment on Ripple’s valuation, we can analyze recent price responses to market events. The following table summarizes key events alongside notable price movements:

| Event | Date | Price Movement |

|---|---|---|

| SEC Lawsuit Update | January 2023 | +20% |

| New Partnership Announcement | March 2023 | +15% |

| Market Crash | June 2023 | -30% |

As the landscape of cryptocurrency continues to evolve, understanding how market sentiment influences Ripple’s price trajectory will be crucial for investors. Anticipating emotional reactions to upcoming news can provide a strategic advantage in navigating the volatile waters of crypto trading.

Technical Analysis of Ripples Price Patterns

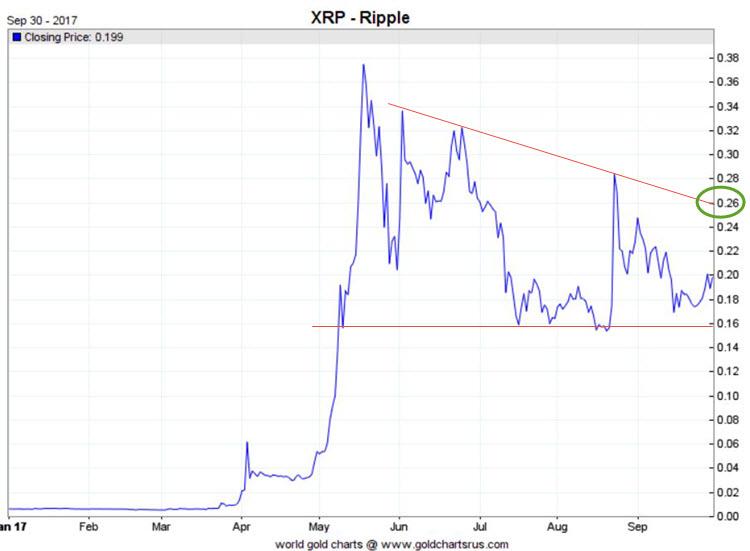

Analyzing the recent price trends of Ripple (XRP), it’s evident that the cryptocurrency has been experiencing notable fluctuations that reflect broader market sentiments and regulatory news. Over the past few weeks, XRP has displayed several key technical patterns that traders and analysts have been closely monitoring. Among the most significant patterns include:

- Support and Resistance Levels: Recent trading has seen XRP bouncing between the $0.40 support level and the $0.50 resistance level, indicating a consolidation phase.

- Moving Averages: The 50-day moving average has crossed below the 200-day moving average, a trend often seen as a signal for potential bearish momentum.

- Volume Changes: Increased trading volume during price spikes indicates heightened interest from both retail and institutional investors, suggesting potential volatility ahead.

Additionally, pattern recognition techniques highlight the formation of a descending triangle, which typically signals a bearish trend if the support level is breached. As we look forward, traders should keep an eye on these critical scenarios and consider the implications of upcoming market catalysts such as regulatory announcements or integration news. The below table summarizes the recent performance metrics for Ripple, which can provide a clearer picture for potential investors:

| Metric | Value |

|---|---|

| Current Price | $0.45 |

| 7-Day Low | $0.40 |

| 7-Day High | $0.52 |

| Market Cap | $22 Billion |

Strategic Recommendations for Potential Investors

For potential investors looking to capitalize on the evolving landscape of Ripple’s price dynamics, several strategic approaches can be advantageous. First, develop a diversified portfolio by incorporating a mix of cryptocurrencies alongside Ripple (XRP). This approach helps mitigate risks associated with market volatility while still allowing for exposure to potential high returns. Additionally, keeping a close watch on regulatory developments and partnerships within the blockchain space is essential, as these factors can significantly impact Ripple’s price trajectory.

Furthermore, adopting a long-term investment mindset may prove beneficial, given the fluctuations seen in the cryptocurrency market. Setting clear price targets and employing dollar-cost averaging strategies can help investors make more informed decisions while avoiding the pitfalls of emotional trading. To assist investors in making these decisions, tracking Ripple’s performance alongside key market indicators is crucial. Below is a simple overview of recent performance metrics that potential investors should consider:

| Metric | Current Value | Past Month Change |

|---|---|---|

| Ripple Price (XRP) | $0.55 | +10% |

| Market Capitalization | $28 Billion | +15% |

| 24-hour Trading Volume | $2 Billion | -5% |

The Conclusion

the recent trends in Ripple’s price movement reveal a complex interplay of market forces, regulatory developments, and technological advancements. As we have examined, the digital currency’s fluctuations reflect both investor sentiment and broader economic factors, making it a focal point for market analysts and enthusiasts alike. Looking ahead, predictions remain varied, with some experts optimistic about Ripple’s potential to recover from past challenges, while others urge caution amidst an ever-evolving regulatory landscape. As we continue to monitor Ripple’s trajectory, stakeholders will need to remain vigilant and informed, considering both the opportunities and risks that lie ahead in this dynamic cryptocurrency market.