Analyzing Latest Bitcoin Price Trends and Future Predictions

As the world of cryptocurrency continues to evolve at a rapid pace, Bitcoin remains at the forefront of market discussions, capturing the attention of both seasoned investors and curious newcomers alike. In recent weeks, Bitcoin’s price has experienced notable fluctuations influenced by a myriad of factors, including regulatory developments, market sentiment, and macroeconomic trends. This article aims to delve into the latest price trends of Bitcoin, exploring the underlying forces driving its movements while offering insights from market analysts and experts. Additionally, we will examine future predictions for the cryptocurrency, providing readers with a comprehensive understanding of what lies ahead for this digital asset. As we navigate through this complex landscape, we will equip investors with the essential knowledge needed to make informed decisions in an ever-changing market.

Table of Contents

- Examining Recent Bitcoin Price Fluctuations and Market Sentiment

- Key Influencers Behind Current Bitcoin Valuation and Their Impacts

- Evaluating Historical Patterns to Forecast Bitcoins Future Trajectory

- Investment Strategies and Risk Management for Navigating Bitcoin Markets

- Final Thoughts

Examining Recent Bitcoin Price Fluctuations and Market Sentiment

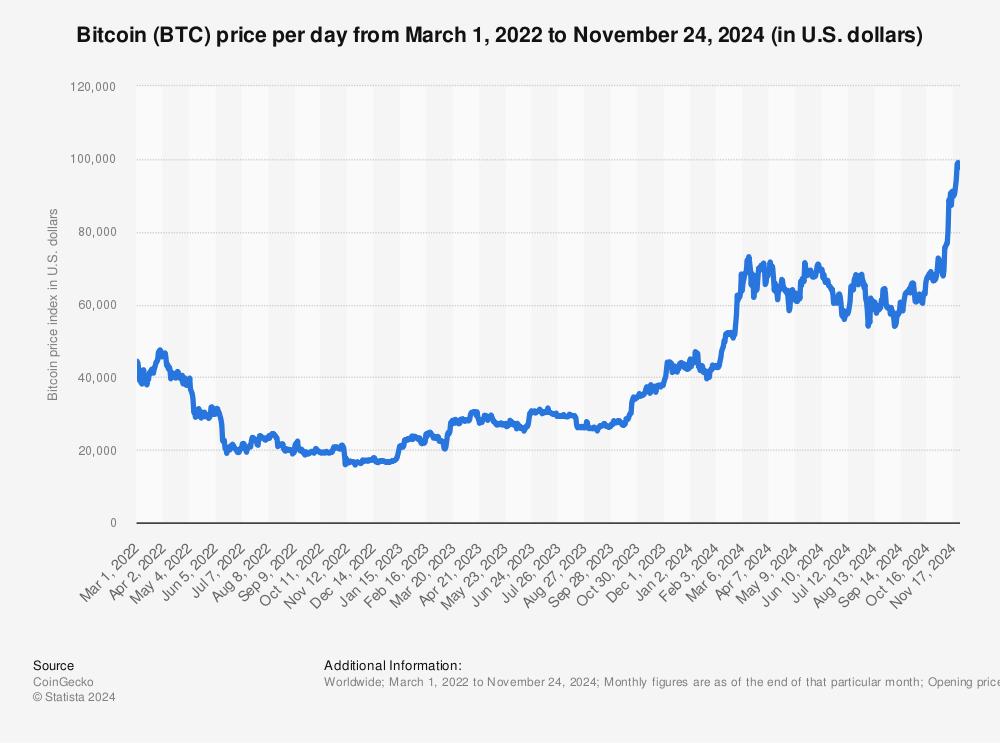

Bitcoin’s price has exhibited remarkable volatility in recent weeks, driven by a confluence of market forces and macroeconomic factors. As of late, Bitcoin surged past the $45,000 mark, only to retreat slightly as profit-taking set in among traders. Analysts point to key events, such as regulatory developments and broader economic indicators, as pivotal in shaping investor sentiment. Notable factors influencing price fluctuations include:

- Increased institutional adoption: Several high-profile companies have announced plans to integrate cryptocurrencies into their operations.

- Macroeconomic conditions: Inflation data and Federal Reserve policies continue to impact risk assets, including Bitcoin.

- Market sentiment: Investor optimism often hinges on social media trends and public endorsements from influential figures.

Current market sentiment remains cautiously optimistic, with many traders remaining hopeful about Bitcoin’s mid-term prospects. According to recent surveys, a significant percentage of retail investors still view Bitcoin as a safe-haven asset, contrasting with the opinions of more conservative market players. A recent report highlighted the following trends regarding investor outlook:

| Investor Type | Percentage Favoring Bitcoin |

|---|---|

| Retail Investors | 68% |

| Institutional Investors | 45% |

| Traditional Asset Managers | 30% |

With the regulatory landscape evolving and macroeconomic uncertainty looming, the expectation for Bitcoin’s price trajectory remains mixed but underscores a growing belief in its long-term value proposition.

Key Influencers Behind Current Bitcoin Valuation and Their Impacts

The valuation of Bitcoin is influenced by a myriad of factors that continue to shape its market dynamics. A pivotal player in the current landscape is institutional investment, which has surged significantly over the past year. Major financial entities and corporations are now adopting Bitcoin as part of their asset management strategies, validating its legitimacy as a store of value. Furthermore, regulatory developments play a critical role; as governments and financial authorities around the world navigate the cryptocurrency regulatory landscape, their decisions can lead to increased investor confidence or market hesitancy. For instance, approval of Bitcoin exchange-traded funds (ETFs) has created substantial market optimism, often resulting in price rallies.

Additionally, the technological advancements within the Bitcoin ecosystem cannot be overlooked. Initiatives such as the Lightning Network are enhancing transaction efficiency, thereby influencing usage and investing sentiment. The global macroeconomic environment, particularly inflation rates and economic policies, also bears a crucial impact on Bitcoin’s valuation. Investors often turn to cryptocurrencies as a hedge against inflation, leading to spikes in demand during times of economic uncertainty. the overall sentiment in the cryptocurrency market, often swayed by social media trends and influential personalities, contributes to the volatility seen in Bitcoin pricing.

| Influencer | Impact on Bitcoin Valuation |

|---|---|

| Institutional Investors | Enhanced legitimacy and higher demand |

| Regulatory Bodies | Market confidence or retreat based on policies |

| Technological Advancements | Increased utility and transactions |

| Macroeconomic Factors | Demand as an inflation hedge |

| Market Sentiment | Volatility driven by social influences |

Evaluating Historical Patterns to Forecast Bitcoins Future Trajectory

In recent years, Bitcoin has exemplified the volatility that characterizes cryptocurrency markets, consistently creating rich data for analysis. By reviewing historical price movements, we can identify key patterns that may offer insights into Bitcoin’s future trajectory. Observing phases of rapid ascension followed by corrections, investors should consider the potential for recurring cycles, influenced by factors such as technological advancements and regulatory changes. Analyzing data reveals several critical elements that have historically impacted Bitcoin’s value:

- Market Sentiment: Changes in public perception often lead to significant price fluctuations.

- Technological Innovations: Updates to the Bitcoin protocol and advancements in blockchain technology could increase its utility.

- Regulatory Dynamics: How governments approach cryptocurrency can build or diminish confidence among investors.

To further contextualize these patterns, a comparative analysis of market trends over the last decade serves as a vital tool. In the table below, we highlight previous Bitcoin price surges and the corresponding post-peak corrections. This overview not only captures the cyclical nature of Bitcoin but also hints at potential volatility as the market matures:

| Year | Peak Price (USD) | Percentage Drop (Subsequent Year) |

|---|---|---|

| 2017 | $19,783 | -84% |

| 2020 | $41,982 | -73% |

| 2021 | $64,863 | -50% |

Future forecasts suggest that understanding these historical patterns, alongside emerging trends in decentralized finance and institutional adoption, will be critical for predicting Bitcoin’s market movements. Investors must remain vigilant and adaptable, leveraging both historical data and current events to navigate this ever-evolving landscape.

Investment Strategies and Risk Management for Navigating Bitcoin Markets

When engaging with the volatile Bitcoin market, it’s vital for investors to deploy well-thought-out strategies that mitigate risk while maximizing potential returns. One effective approach is to diversify investments across a variety of cryptocurrencies and blockchain projects. By not putting all your funds into Bitcoin alone, investors can buffer against inherent market fluctuations. Additionally, implementing dollar-cost averaging allows investors to spread out purchases over time, reducing the impact of price volatility. This method can help in capitalizing on dips in prices while minimizing the emotional impact of trading decisions.

Moreover, establishing a clear risk management framework that includes setting stop-loss orders and regularly evaluating portfolio performance is crucial. This framework should detail guidelines for when to enter or exit positions to avoid potential losses. Investors can also benefit from using a risk-reward ratio analysis to determine whether a trades’ potential profit justifies the risk taken. Below is a brief overview of essential strategies:

| Strategy | Description |

|---|---|

| Diversification | Spread investments across multiple cryptocurrencies. |

| Dollar-Cost Averaging | Invest a fixed amount periodically to reduce timing risks. |

| Stop-Loss Orders | Automate exit strategies to limit potential losses. |

| Risk-Reward Ratio | Evaluate potential profits versus risks before trading. |

Final Thoughts

the analysis of the latest Bitcoin price trends underscores the cryptocurrency’s dynamic nature and its susceptibility to a variety of influencing factors, from market sentiment to regulatory developments. As we look to the future, the potential for volatility remains high, but so too does the opportunity for growth, especially as institutional interest continues to mount and adoption becomes more mainstream. Investors are encouraged to remain vigilant, keep informed of emerging trends, and consider the long-term implications of their strategies amidst this rapidly evolving landscape. As Bitcoin navigates the complexities of the financial ecosystem, its trajectory will undoubtedly reflect broader economic changes and societal shifts, reaffirming its role as a significant asset class in the years to come.