Analyzing Cryptocurrency Market Cycles: Insights and Implications

Introduction

The cryptocurrency market, characterized by its rapid fluctuations and significant volatility, presents an array of opportunities and challenges for investors, analysts, and stakeholders alike. With the evolution of digital currencies, understanding the cyclical nature of this market has become imperative for informed decision-making. This report seeks to provide a comprehensive analysis of cryptocurrency market cycles, highlighting key phases such as accumulation, bullish trends, distribution, and bearish declines. By examining historical data, market behavior, and external factors influencing cycles, we aim to uncover critical insights that not only elucidate past trends but also offer implications for future market movements. As institutional interest grows and regulatory frameworks take shape, comprehending these market cycles becomes essential for nurturing sustainable investment strategies in the dynamic landscape of cryptocurrency.

Table of Contents

- Understanding the Phases of Cryptocurrency Market Cycles

- Evaluating Historical Patterns and Behavioral Trends

- Strategic Investment Approaches Based on Market Cycle Analysis

- Risk Management Practices for Navigating Market Fluctuations

- In Conclusion

Understanding the Phases of Cryptocurrency Market Cycles

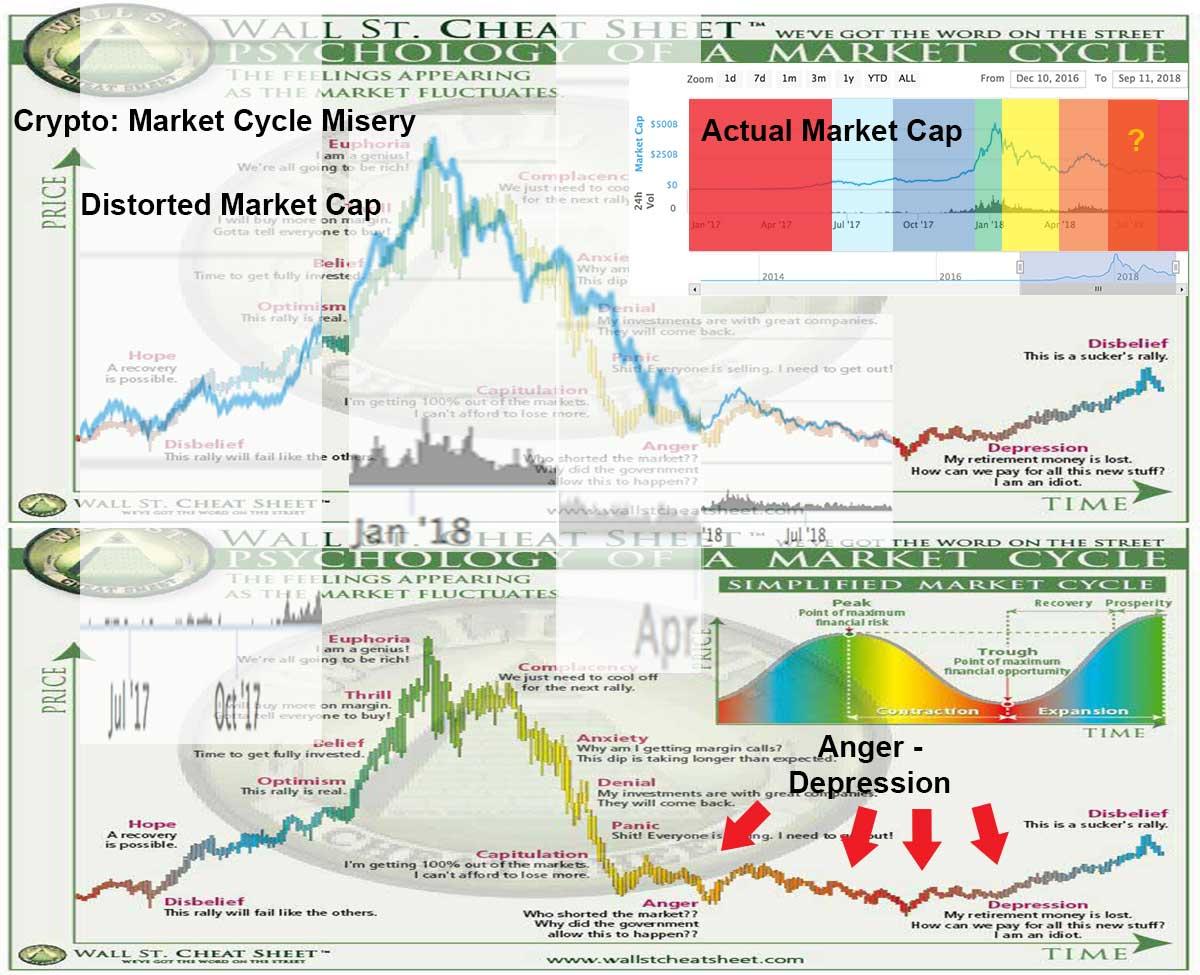

In the world of cryptocurrency, market cycles typically follow a predictable pattern, which can be categorized into several distinct phases. Each phase reflects the prevailing sentiment of investors and market dynamics that drive price movements. The primary phases include Accumulation, Markup, Distribution, and Decline. Understanding these phases is vital for investors to develop strategies that align with their risk tolerance and market outlook. During the accumulation phase, savvy investors often begin to buy assets at lower prices, anticipating the impending bullish trend.

As the cycle progresses into the markup phase, heightened demand and positive sentiment can drive prices significantly higher, attracting a broader base of investors. This is often followed by the distribution phase, where early adopters start to realize profits and offload their holdings. the decline phase marks the onset of market corrections and declines. Investors should be aware that while these phases can generally be identified, the duration and intensity of each phase vary, emphasizing the importance of continual analysis and market vigilance. The following table summarizes common characteristics of each market cycle phase:

| Phase | Characteristics |

|---|---|

| Accumulation | Low prices, increased buying by informed investors |

| Markup | Sharp price increases, widespread investor interest |

| Distribution | Profit-taking by early investors, slowing price momentum |

| Decline | Price corrections, negative sentiment, sell-offs |

Evaluating Historical Patterns and Behavioral Trends

Understanding the cryptocurrency market requires a keen observation of past events and prevailing behavioral patterns. Historically, several key trends have emerged, suggesting that market sentiments can influence price movements significantly. These patterns often follow cyclical trends, where periods of expansive growth are typically followed by crashing corrections. Some noted trends include:

- Market Euphoria: Characterized by rapid price surges driven by speculation.

- Fear and Uncertainty: Leading to price drops as traders panic sell.

- Seasonal Swings: Notable shifts during specific times of the year, correlating to technology cycles or regulatory news.

To illustrate these behaviors in a more structured manner, we can analyze significant price points in the history of Bitcoin, as it often serves as a bellwether for the broader market. The following table summarizes the various cycles observed:

| Cycle | Key Event | Price Change (%) |

|---|---|---|

| 2013 Bull Run | Coinbase Launch | 1,000% Increase |

| 2017 Mania | Institutional Interest | 1,500% Increase |

| 2020 Halving | Supply Reduction | 300% Increase |

These historical phases not only highlight the volatile nature of cryptocurrencies but also underscore the need for careful evaluation of market sentiment indicators. By observing how psychological factors manifest in trading behavior, investors can better position themselves to navigate future cycles with greater strategic insight. Enhanced understanding of these recurring trends may ultimately lead to more informed decision-making in the rapidly evolving landscape of digital assets.

Strategic Investment Approaches Based on Market Cycle Analysis

Understanding the stages of cryptocurrency market cycles allows investors to tailor their strategies accordingly. Each cycle phase—whether accumulation, uptrend, distribution, or downtrend—demands a different approach to maximize returns and minimize risks. For instance, during the accumulation phase, where prices are relatively low, savvy investors might consider the following strategies:

- Dollar-cost averaging to build positions gradually

- Fundamental analysis to identify undervalued assets

- Engaging with community forums to gain insights

As the market transitions to the uptrend phase, it is critical to shift towards growth-oriented tactics. Investors may focus on:

- Trend following: Utilizing technical indicators to ride bullish momentum

- Diversification to capture returns across various cryptocurrencies

- Setting stop-loss orders to protect profits

| Market Phase | Recommended Strategy |

|---|---|

| Accumulation | Dollar-Cost Averaging |

| Uptrend | Trend Following |

| Distribution | Take Profits |

| Downtime | Hedging |

Risk Management Practices for Navigating Market Fluctuations

Effective risk management is crucial for investors navigating the unpredictable waters of the cryptocurrency market. Utilizing a combination of strategies can help mitigate potential losses while maximizing opportunities for gains. Diversification remains one of the most potent tools; by spreading investments across various assets, one can minimize exposure to any single point of failure. Additionally, establishing stop-loss orders can protect against sudden downturns, allowing investors to set predetermined exit points, thus preserving capital. Employing stakeholder analysis ensures that one understands different market influences, from technological advancements to regulatory changes, which can drastically affect price dynamics.

Furthermore, adopting a long-term perspective is an essential practice in a landscape often characterized by volatility and short-term trends. Investors should consider implementing dollar-cost averaging, a strategy whereby they invest a fixed amount at regular intervals, which can help reduce the impact of market fluctuations. Keeping abreast of emerging technologies and developments within the sector is necessary for making informed decisions. By nurturing a disciplined approach through constant education and adjusting strategies based on market conditions, investors can create a resilient framework for navigating periods of uncertainty in the cryptocurrency market.

In Conclusion

understanding the intricacies of cryptocurrency market cycles is imperative for investors and stakeholders within the digital asset landscape. Our analysis reveals not only the historical patterns and key indicators that characterize these cycles but also the psychological and economic factors that influence market sentiment. As cryptocurrencies continue to evolve, recognizing the implications of these cycles can enhance decision-making strategies, mitigating risks and maximizing potential gains.

Furthermore, as regulatory frameworks develop and technological innovations emerge, the dynamics of market cycles are likely to shift. Staying informed and adaptable will be essential for navigating the complexities of this volatile market. By employing the insights gleaned from this analysis, investors can position themselves more strategically, ensuring a more informed approach to participation in the cryptocurrency ecosystem.

As the market matures, continuous research and analysis will be crucial in charting the course ahead, enabling all participants to cultivate a deeper understanding of the patterns that define the ever-evolving cryptocurrency landscape.