Jim Cramer Spouts Bitcoin Sell-Off Warning Amid ETF Surge

January 19, 2024, marks another pivot in Jim Cramer’s fluctuating stance on Bitcoin. In a recent tweet, Cramer warned of a “nasty beginning to the bitcoin selloff,” questioning the sustainability of its recent rally.

This comes after Bitcoin ETFs recently outpaced silver ETFs, taking the second spot in the commodity ETF space.

Jim Cramer on Bitcoin ETFs: No One Showed Up

According to Cramer, the Bitcoin ETFs failed under the pretense that:

“You can’t have an asset double in value by hundreds of billions of dollars in anticipation of an ETF and then almost no one shows up.”

However, Ripple CEO Brad Garlinghouse contrasted Cramer’s view, expressing optimism over Bitcoin ETFs surpassing silver ETFs. He regarded it as a significant milestone, indicative of institutional validation and government recognition.

On the other hand, many investors’ bullish sentiments have been dampened due to the falling price action.

The crypto market analysis platform Santiment noted that fear of missing out (FOMO) likely fueled the local Bitcoin top:

“Many experts believed that the foregone conclusion of these approvals was already ‘baked in’ to the market’s prices at the time the [ETF approval] announcements were made.”

Read more: What Is A Bitcoin ETF?

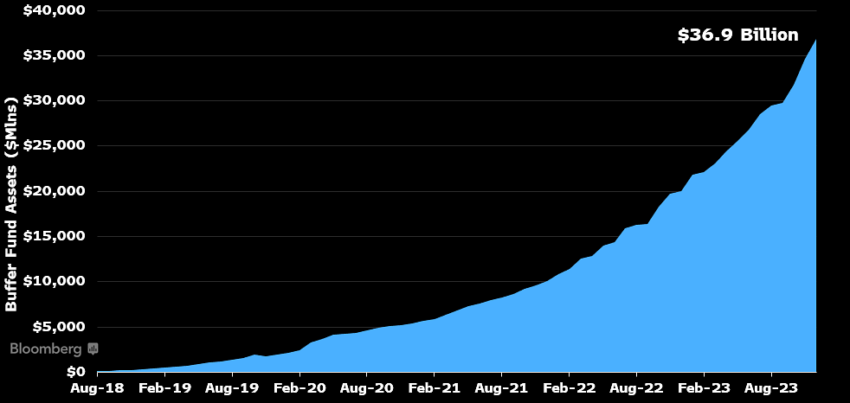

Bloomberg analyst James Seyfartt also reminded investors that most successful ETFs start out slow. He pointed to Defined Outcome ETFs as a comparison:

“For those thinking the Bitcoin ETF launches were a flop. R-E-L-A-X Give it time. Healthy ETF growth looks like this”

Flip-Flopping Bitcoin Sentiment

Cramer’s latest bearish sentiment contradicts his earlier bullish outlook from January 3, 2024, when he praised Bitcoin as a “technological marvel” and a resilient asset. His position then aligned with the bullish sentiment in the market as Bitcoin soared above $45,000.

However, Cramer’s shifting opinions on cryptocurrency have been a constant. In 2023, his advice to exit crypto markets coincided with a prime buying opportunity, and his December advice to sell at the market’s bottom was later seen as a misstep. These flip-flops have led to the so-called “reverse Cramer” effect, where his predictions are often viewed skeptically by the crypto community.

Read more: Bitcoin Halving Cycles And Investment Strategies: What To Know

Despite Cramer’s high profile, his impact on Bitcoin’s market dynamics seems negligible.

Cramer’s ever-changing views reflect the broader volatility and uncertainty in the crypto space. While influential, many view his perspectives as part of a larger market narrative, not as definitive market guidance.

With the recent advancements in Bitcoin ETFs and the asset’s persistent performance, it remains to be seen whether Cramer’s latest call for a sell-off will significantly impact Bitcoin’s trajectory.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.

Comments are closed.